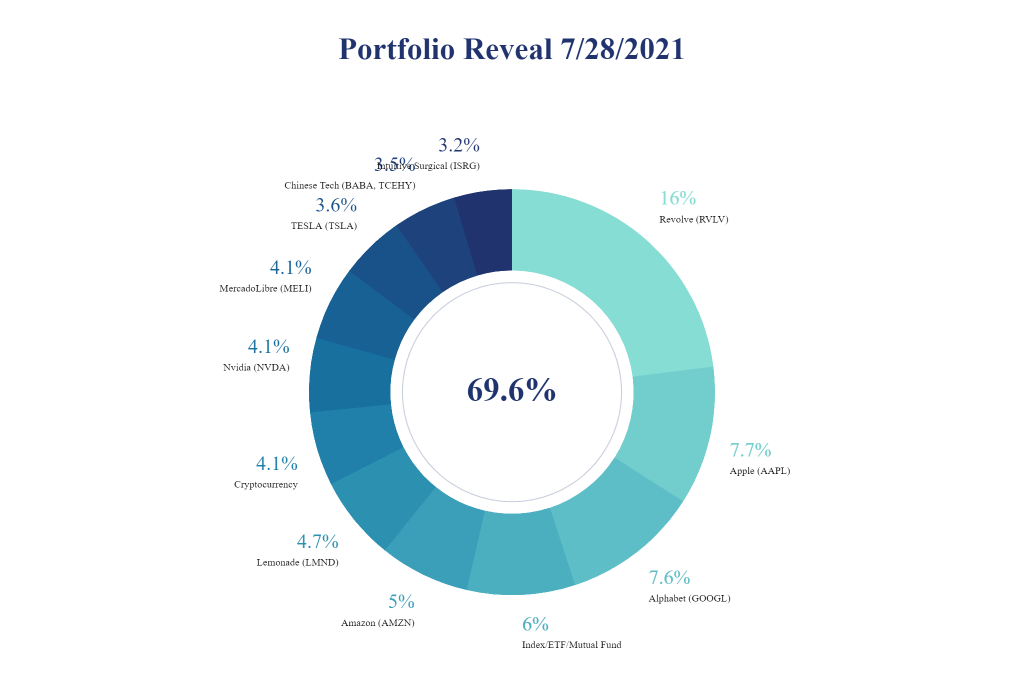

This is a partial reveal of my entire investing portfolio showing how weighted I am in certain stocks. Just some quick random thoughts.

- RVLV is my highest position obviously but I am comfortable with it. Remember, it didn’t start out at 16%. During the beginning of the pandemic it was barely 5%. I will hold onto this company for a long time. I have so much conviction in this company I wouldn’t start trimming my position until it made up 25% of my portfolio.

- I have been contemplating trimming some of my initial position on GOOGL. I already have done so for AAPL, AMZN, TSLA and NVDA. I probably could never sell the majority of my position though. The company still has a lot of growth left.

- I will view my holdings in Index/ETF/Mutual Funds as a safety position. It is tempting to sell them and invest in individual stocks, however I view this as my original floor of when I started as an investor.

- I am quite happy regarding my Cryptocurrency position. Many “fund experts” are saying you should only invest 3-5% in Cryptocurrency. The majority of my cryptocurrency is in BlockFi gaining monthly interest just for holding it. I kind of view it like a high-growth dividend stock.

- If I had to predict, I could see Crypto, NVDA, LMND and Chinese Stocks being a larger part of my portfolio in the future. LMND is in its early growth stages as a company. Chinese stocks like BABA and Tencent are highly discounted right now.

- The rest of my holdings consists of other companies that I do not have a big enough position too list. I am obviously trying to find the right mix of diversification/concentration.