Alibaba (BABA) is still a screaming buy. It is an undervalued growth stock that will likely 3x in price in the next 5 years or less.

- Big profits and gains are made during intense fear and uncertainty. This is usually the best time to buy, not sell.

- Baba’s income statement/growth/balance sheet remains pristine. The headlines have nothing to do with Baba’s business. Jack Ma hasn’t been chairman of the company for nearly two years.

- Macro headwinds like China Regulations will always exist. They exist in every country/continent. They will never go away.

- If you fear China that much, you should probably not own great stocks like Tesla, Starbucks, Apple, Nike, etc… you may want to avoid investing altogether since almost every company touches China.

- China makes up 17% of the entire global economy. One day it could overtake the United States. They are too big to fail. Why do you think John Cena or Mark Zuckerberg can speak Mandarin? Like it or not, China is here to stay now and in the future. They will be a major player in digital innovation and growth.

- Although the majority of my investments are in U.S companies, ignoring China Tech entirely is too risky.

- What is more likely, Alibaba reaching a stock price of 592.14 or Amazon reaching 10,098.72? The answer seems obvious. What’s holding BABA down is regulatory scrutiny which goes in cycles. Amazon, Google, Facebook, Twitter will also go through regulatory scrutiny in the near and mid-term future. Remember, there are multiple elected officials from both parties that support breaking up U.S big tech and bringing on federal lawsuits against these companies.

- Two key traits of any long-term investor are patience and calmness.

This is Alibaba’s Cambridge Analytica moment.

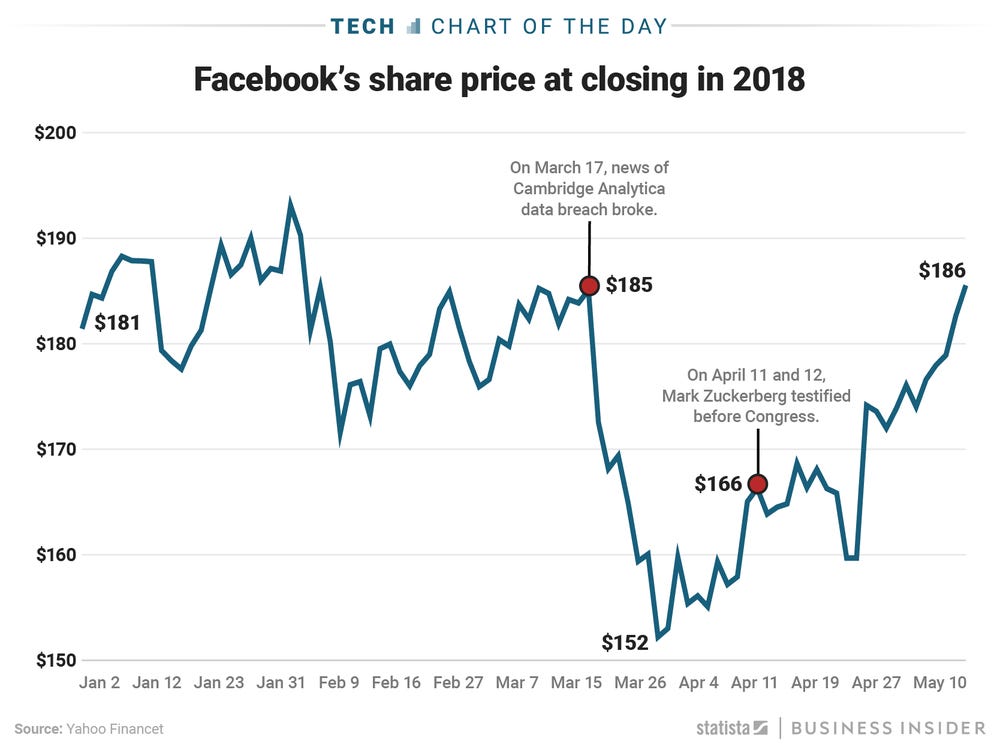

If you forgot what happened to Facebook, I’ll provide a brief refresher. Cambridge Analytica was a British political consulting firm that took information from more than 50 million Facebook users without their consent. It has used Facebook to collect data that was used by the Trump campaign in 2016 to target voters. The result:

- Numerous top executives left the company. Former executives trashed the company on media.

- Shares fell more than 24% on March 26th

- The company lost $134 billion in value

- Facebook’s favorability rating fell significantly. Numerous celebrities, politicians, and important people in the tech community supported the #DeleteFacebook movement.

The reason why Facebook didn’t die, is because their ecosystem is too vast. Cambridge Analytica was a small bump in the road. They have become so embedded in our culture, it is essentially impossible to delete them. Buying FB stock during the scandal and holding today would have been a great investment opportunity. Many investors however were being prisoners of the moment.

I see China’s regulation as Alibaba’s Cambridge Analytica moment. Many smart people looking at BABA today, are only looking at a page in a long book still being written. Alibaba in 2021 is a much stronger company than Facebook was in 2018. Their financial and cultural reach in China is larger than Facebook’s reach is in the United States.

The Chinese Communist Party couldn’t delete Alibaba, even if they tried. The genie is out of the bottle, it is simply too late. Unless the CCP’s goal is to cause irreparable harm to their economy, coolers heads will eventually prevail. BABA is still growing in China and expanding its reach outside of the country as well. They will kiss the ring and oblige with The China Securities Regulatory Commission (CSRC). They will do the same political lobbying/dance that mega-corporations do in the U.S. The players are different but the game being played here is essentially the same.