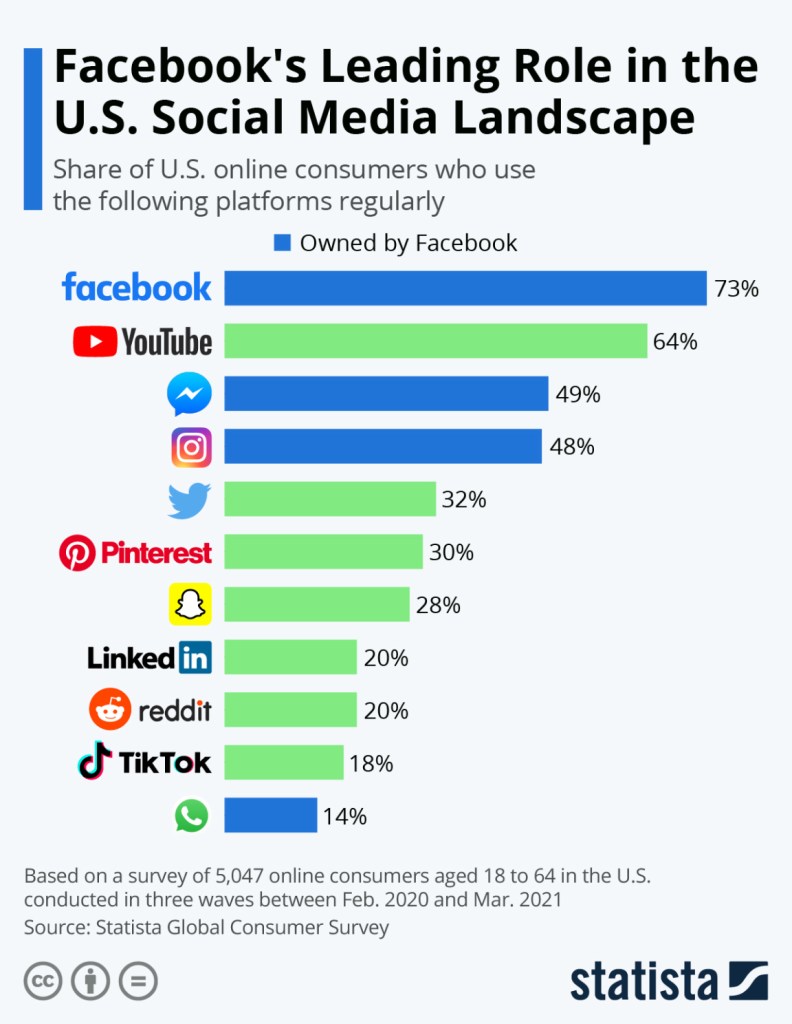

For Social Media sites, there’s Facebook, and everyone else. Facebook has the most active users and cash on hand. If you take out Youtube, which is more of an online video platform, they have nearly lapped all their competitors.

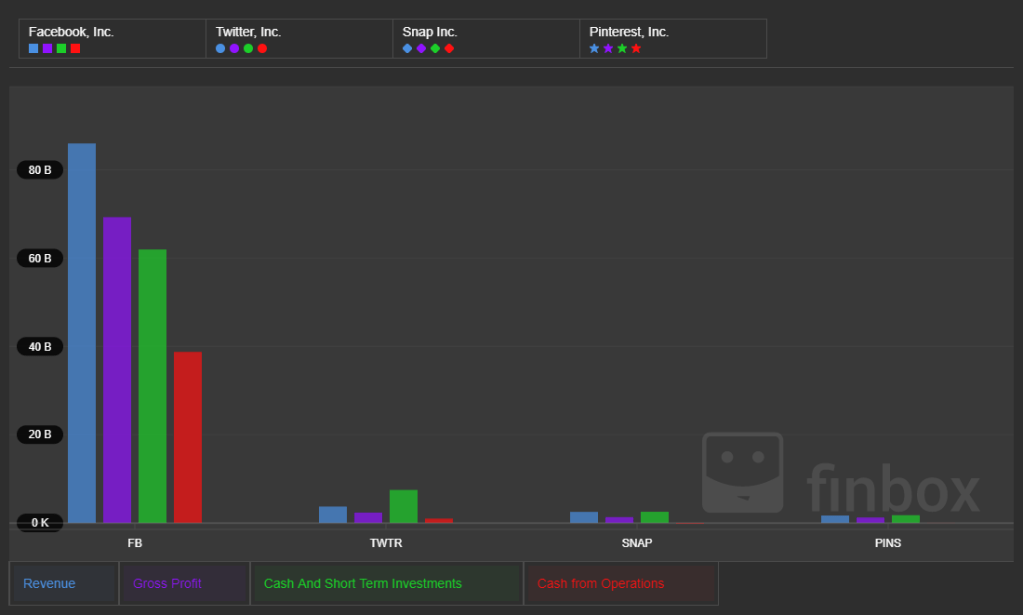

Facebook will remain relevant and on the king’s throne for social media networks this next decade. As for the stock, they are still the best show on the road. You can make the argument that Facebook (the platform) is declining, and maybe it is in terms of popularity, but at this point, it doesn’t matter. Facebook owns Instagram, WhatsApp, Facebook Messenger, and Oculus Rift. They have more cash than their competitors by… a lot. Cash on hand for a company means being able to snatch/pouch the best employees, acquire competitors, buy back shares, expansion, and gain political influence.

“Oh Well Guess You Win Some And Lose Some, As Long As The Outcome Is Income” – Drake, Over My Dead Body

It is important to remember, in regards to stocks, this isn’t a popularity contest, it’s about money and power. The FB may have the most powerful leadership duo in Mark Zuckerberg and Sheryl Sandberg. Sandberg may be the most powerful woman in corporate America. She has been in important meetings with President Obama and Trump. She is a resource smaller companies do not have and cannot afford to bring in.

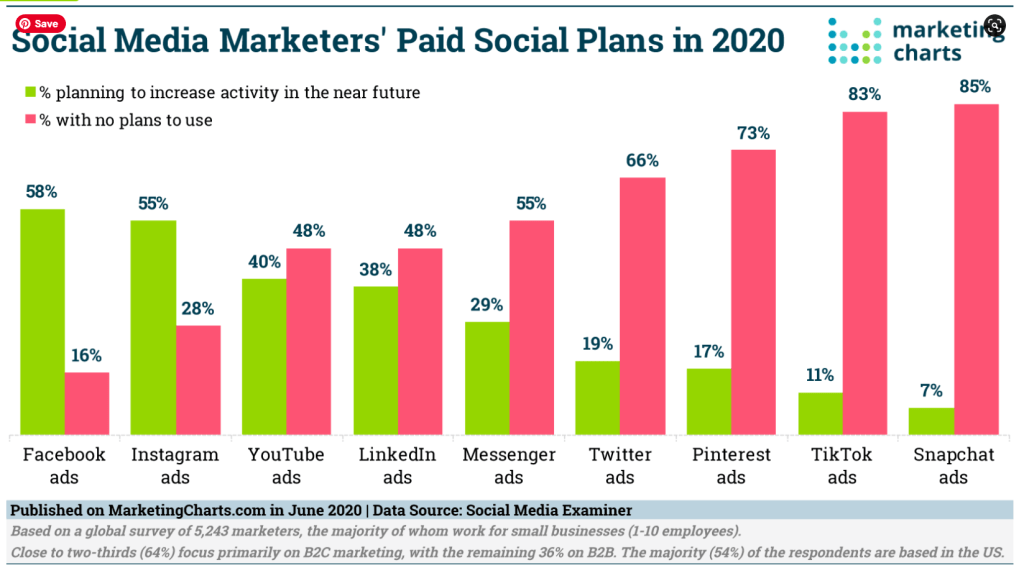

You can make a really good argument that Snapchat and TikTok are more engaging platforms for Gen Z, however, The FB is still the king of monetization. Popularity, user growth, engagement, user experience are all nice however as an investor, the most important thing is free cash flow and utilizing it.

As a consumer, you may use and like other platforms more, however, answer one simple question, where are you spending your money online? Based on the numbers it is Facebook or Instagram. That’s monetizing on daily active users and advertisers know that.

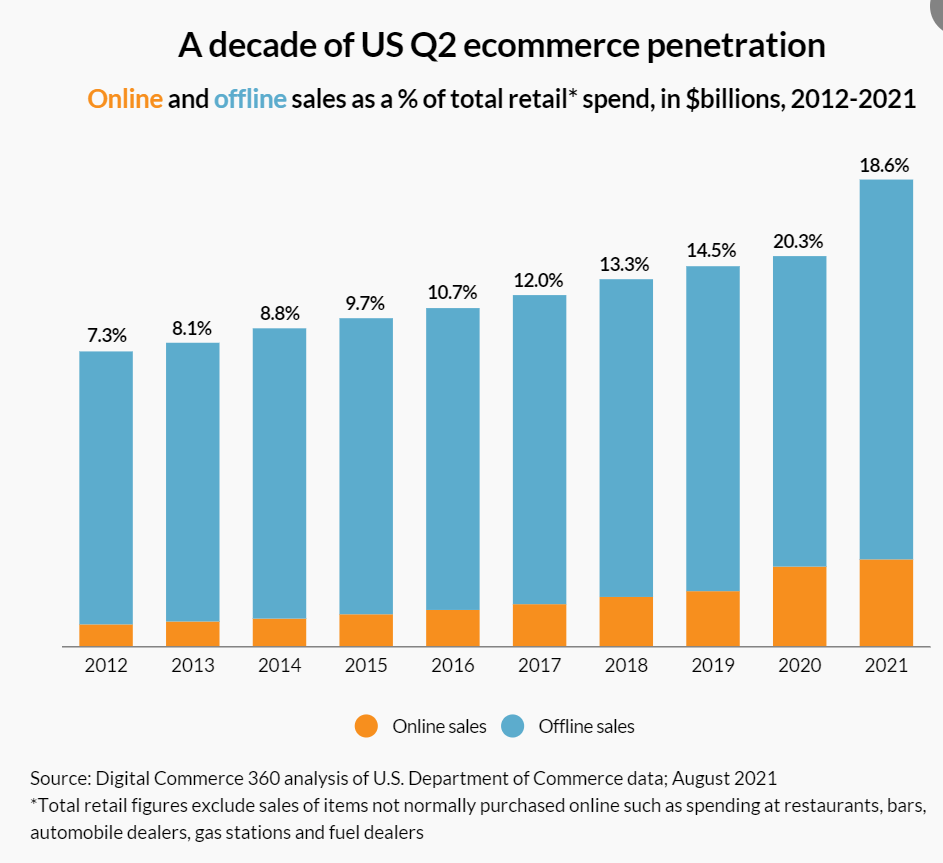

Brief conceptual summary. E-commerce is the selling and buying of products online. E-commerce in 2021 made up 18.6% of all U.S retail sales. If you estimate conservatively, that number should be 25-30% by 2030. If E-commerce is trending up globally (many people don’t have internet service or smartphones yet) it makes sense that more money will be poured into social media influence marketing/advertisements. The number one platform for advertisers to flock towards is Facebook or a platform owned by Facebook.

That’s what makes Facebook so special. They are not niche. Everyone else is trying to establish their lane in regards to demographics and target audience. Facebook attracts all demographics and businesses – young, old, men, women, white, black, restaurants, small businesses, corporations, etc…..

Twitter recently launched Super Follows, a way to generate more revenue for the company. This however should have been done 3-5 years ago. Now their daily active user growth has slowed down. Twitter is not even close to being in the top ten for most overall downloads, App Store downloads, or Google Play downloads. They couldn’t monetize the President of the United States tweeting over 25,000 times, which was a major disappointment as a former TWTR shareholder. I seriously question if their leadership can properly monetize their platform efficiently.

Snapchat & TikTok are relevant for anyone under 35. These are more entertainment platforms. It is questionable if these are effective platforms for monetization and ad money. I like Pinterest most for the secondary players however they are concentrated towards women and niche categories. The average revenue per user for Pinterest is around $5 whereas Facebook’s average revenue per user is closer to $50.

I just don’t see tremendous upside in owning shares of Twitter, Snapchat, Pinterest, or Etsy unless their share prices dropped significantly. I am also not interested in a future IPO for TikTok or Reddit. Why worry about owning shares of a company that can barely squeeze money out of their users when The FB does it so effortlessly? I don’t see any immediate existential threats either, and when that does happen, they will have a much bigger cash empire. Like it or not they are here to stay. One of the biggest reasons why I own shares of Bilibili is because Facebook is banned in China. That’s the only way you can stop them, albeit in one country.

Even if Facebook just makes minor tweaks to their platform, it doesn’t matter if their user growth declines. There is nothing illegal about copying your competitors – Instagram Reels/TikTok, Instagram Stories/Snapchat Stories. They have such an amazing balance sheet, they can essentially buy growth. It doesn’t matter if you only log onto Facebook a few times a year. You are still in their ecosystem and most likely in the future, their metaverse. They also don’t need to issue more shares outstanding to raise cash, meaning they do not dilute current individual shareholders. The king still resides in Menlo Park California. I will still hold onto my shares of Facebook because quite honestly, it’s one of the surest things to grow this decade. Their competitors may think they are catching up to with them, but I will finish with a lyric from Jay Z:

Y’all on the ‘Gram holdin’ money to your ear

There’s a disconnect, we don’t call that money over here

The Story O.J.