I would like to go in-depth on why so many people don’t invest anything at all. I think the best way to analyze this is to break down the main reason why. I definitely would like to re-visit this topic in the future as I will only go over the main reason cited for people not investing. It is assumed by numerous surveys/studies, that around 40-60% of Americans have absolutely nothing invested in the stock market. The #1 reason provided is not having enough money. Studies have shown 70% of millennials are living paycheck to paycheck. An even more shocking finding can be found here. 60% of millennials earning over $100,000 a year are living paycheck to paycheck.

Here is what I take from these findings:

- You can’t invest if you don’t have savings – The next logical question is why don’t Americans have enough savings? One thing I have learned is to master savings and investment, you need to get in the correct mindset. Savings and investing are more mastery of psychology and behavior rather than financial knowledge. 60-70% psychology, 30-40% knowledge of numbers, formulas, statistics, charts, or what I call head knowledge. The best analogy I can make is living healthy. Why do people continue to eat so much junk food if they know it is bad for them and they can easily find healthier options elsewhere? Why do people not exercise enough, even just walking 30 minutes a day? A big component of this is behavioral psychology. There are deeper reasons why people do not save enough money but this is just a very brief summary. Saving money is the gap between your self-worth and your income. Wealth is created by suppressing what you can buy right now to increase the value of your money in the future.

- High income does not equate to wealth – As evident to the numerous millennials making six figures but living paycheck to paycheck. The best example I can think of a wealthy person with a modest income is Ronald Read, a career janitor, gas attendant, and mechanic who never earned over $100,00 in a year. When he passed away at age 92, he was worth over $8 million, mostly in stocks. How was this possible? Investing, even a small amount, can create massive wealth. A high income simply provides one with the ability to invest. Whether you invest is dependent on many other factors.

- Relying solely on your income in the long-term is a suckers bet – Unfortunately, I see a lot of people relying on their income to create wealth, and that is a likely pathway towards mediocrity. There are too many negative variables with your employer that can change – losing your job, the company becoming unprofitable, office politics, nepotism, the economy, COVID-19, family situation changing, age discrimination, etc… The fact is, the few that do climb the corporate ladder and become executives in their company do not build wealth through their salary! The reason why these people do become millionaires is most likely through equity sharing plans or stock options. For the majority of us, this pathway is not realistic even though many of us cling to this internal belief that if they work hard enough, they will be eventually promoted or given a raise. Consider that on average, a millionaire’s income makes up only 8.2% of their net worth. Someone with one million in net worth is not making anywhere close to a million a year from an employer. My thoughts: consider other ways to make money or as a supplement to your current job. Dwayne Johnson couldn’t make it as a professional athlete, so he pursued a career as a professional wrestler and became Dwayne “The Rock” Johnson. He then left wrestling and became one of the highest-paying actors in Hollywood.

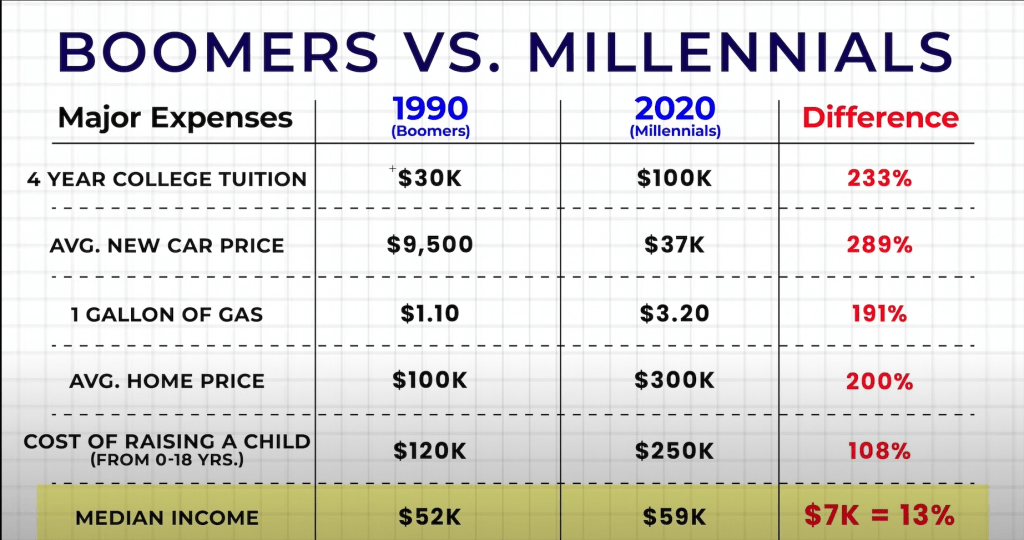

- Saving a small amount and investing it long-term could turn into a big thing: A small contribution today could double, and then double after that, and so on. It is like putting Kerosene on a fire that’s already burning. As seen from the chart above, the average American spending on things like tuition, gas, home prices, raising children has skyrocketed over time whereas their income has not. Investing is such a powerful force with compound interest in force, the growth from your investments will likely exceed your annual income by a lot. This statement may seem shocking but it isn’t. Think about this: if you have one million invested, you probably will see more than $82,000 in a combination of dividends or gains from your investments annually. That’s 8.2% growth, not unrealistic at all and below the average rate of return from the stock market. How many hours will that person research stocks? Maybe 1 hour a day or 52 hours in a year. If that same person works 40 hours a week, that’s 2,080 hours in a year to make an annual salary of $82,000. Ask yourself, would you rather have your investments earn you $82,000 annually with nearly zero physical labor, or work for it, not taking account for the time you sit in traffic, get ready for work, and all that extra inconvenience that comes with working. Over time, a $1 million portfolio will grow thus, likely increasing your annual gains at a much higher rate than your salary increasing.

- If more people understood the power of compounding, they might invest more: Investing is a powerful force due to compound rates of return. Doubling one’s money throughout one’s life, multiple times, is quite honestly the best chance people have of getting rich. It is possible but many people quite cannot understand it. The majority of us have an incremental mindset, looking at change gradually or step-by-step. An exponential mindset is something harder to understand. Incremental mindset: Average annual return for the U.S stock market since the end of World War II: 11.2%. Exponential mindset: Total return for the U.S stock market since the end of World War II: 270,000%. Incremental mindset: If you had invested $1,000 in Apple stock in 2020, it would be worth roughly double that, around $2,000 today. Exponential mindset: If you had invested $1,000 in Apple stock at IPO, 1980, it would be worth $1 million today.

- Not having a defined purpose: People invest to make money, but what is the purpose to have that money? If you haven’t thought about that question, you may not have the motivation to invest. Do you want to buy a lot of stuff? That may not provide what you want. I invest to have more control over my time. It will provide me the ability to do what I want, when I want, as long as I want, with the people that I want. This provides me with the most independence and freedom, which is quite different than wanting more material possessions. And even if you don’t have a specific purpose, there is nothing wrong with wanting more money to protect yourself from the unknown. As Murphy’s law states: “Anything that can go wrong will go wrong.” We never know what the future brings. We all try to have a plan, but we should consider that plan not going to plan. Wealth can be viewed then as a combination of insurance, a get out of jail free card, and Wild Draw Four Uno card all in one.