Buy Now, Pay Later services have gained massive popularity recently. Three of the biggest BNPL companies are Klarna, Affirm, and Afterpay. Klarna is headquartered in Sweden and will likely IPO eventually. Affirm (NASDAQ: AFRM) partners with companies like Peloton and Amazon. Afterpay, which is headquartered in Australia was acquired by Square (NYSE: SQ) in August. BNPL is point-of-sale, or POS loans, which allow consumers to make monthly installments – often in four months. Klarna and Afterpay require 25% due at purchase. Both do not charge any interest but do charge late fees. Affirm could charge 0 due at purchase and does not charge any late fees. Affirm does charge interest as low as 0% and as high as 30%. Klarna and Affirm may do credit checks and report missed payments to credit bureaus. Afterpay does not perform credit checks.

For these companies to become profitable, they will need the majority of their customers to consistently make their payments on time. Unfortunately about a third of users in the U.S. who have used BNPL have fallen behind on one or more payments. The typical item being purchased is under $500. There appears to be a lack of consistency or reporting to credit bureaus but it is safe to assume that many that do miss payments will see their credit score decline, although the exact number is not clear. These companies do not have consistent data as underwriting standards seem minimal.

The delinquency rate for all consumer loans runs between 2-3%. The highest it has ever gotten is 6.7% in 2009. The Australian Securities and Investment Commission (ASIC) found that 21% of BNPL users in Australia had missed a payment. As of right now, there is no real incentive for someone that can make a full payment to utilize BNPL. If they offered some type of reward program, like credit card rewards, it would entice a lot of consumers that are consistent payers to utilize this payment feature.

I have 18 active credit cards in my portfolio. I obtain credit card reward points on everyday purchases. A lot of the cards I applied for, like the American Express Platinum, require a credit score of over 700 to be approved. A lot of people who are getting these reward points are not lower-income households. You could argue that lower-income households are subsidizing those reward credit cards from their purchases. At this point, I am wondering who is subsidizing consumers utilizing BNPL. For these companies to become profitable, they will need to keep increasing their footprint but have to decide if they are a true alternative to credit cards or a modern-day version of a payday loan.

BNPL companies could be good investments however regulations are likely so there could be better buying opportunities in the future. Right now BNPL is a very niche space in the financial market. As it currently stands, companies like Affirm are more like Moneytree rather than a go-to financial services company. The upside and opportunity are there however I would rather stay in companies like Square and PayPal which in my opinion have less risk.

I am a big fan of the fintech sector. I believe this space is growing and profits will keep steadily increasing. Now is BNPL good for the average consumer, and will it increase consumer debt and misery? I do not believe loans are inherently good or bad. People can obtain student loans and credit card debt and pay them off responsibly. I am not the arbiter of morality. If someone without the money wants to make payments on a sweater or shoes, it is on each individual to pay off those items. I believe the government has some sort of obligation in protecting consumers however regulation won’t prevent people from making poor financial decisions.

* On a side note, I hate talking about politics and I hope this is not perceived as a political statement. Our country will be at its best when we focus on lifting people out of poverty. There shouldn’t be dramatically different class systems. Lifestyles should be more equal all around. When we focus on that, and not so much on promoting individuals and corporations to gain massive wealth, our economy will truly stabilize. It took a Great Depression for the government to create a response (The New Deal) to help millions of families out of despair. We should always prioritize lifting those in poverty and preventing them from falling through the cracks. By increasing the wealth gap further and further, we risk a higher likelihood of economic cratering. When more and more people go into extreme poverty and fewer individuals reach extreme affluence (shrinking the middle class) our entire system becomes less fair and more dangerous.

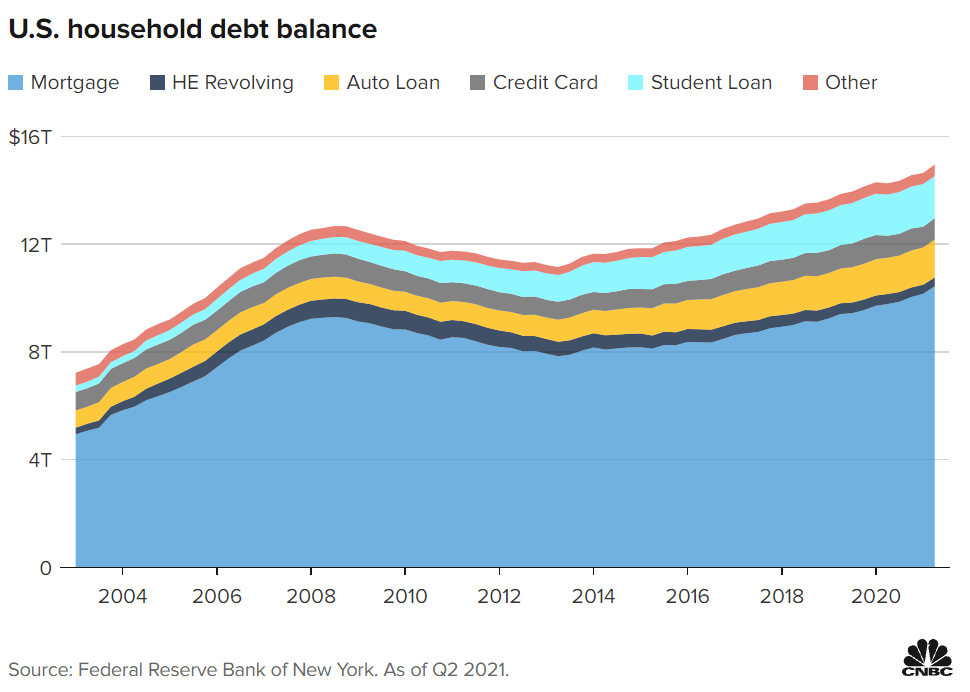

The United States made it a priority to normalize debt after World War II to prevent another great depression. The government has promoted the mantra that having debt is okay and an acceptable way to finance your lifestyle. Student loans and credit cards began in 1958. Our government has equated owning a house, to the American Dream, even if that means you cannot afford your mortgage payments in the long term. If you ever wonder why personal finance is never taught in public school, you should know why. Increased consumer spending helps prop up the economy and is favorable for businesses.

I want to be financially frugal and responsible. I want others to do the same as well. The sad irony is that I benefit personally from increased consumer debt even though I don’t have any myself. If consumer behavior dramatically changed overnight and a large segment of the population became financially responsible, that would not be good for the economy overall. A lot of the companies I invest in would lose revenue, and may even become unprofitable. The economy would likely suffer and go into a deep recession. What would become of American Express and other banks? Who would financial advisors help if no one had debt? That’s why I believe things will not change anytime soon. Based on studies, 60-70% of people would rather talk about sex, politics, religion, or their mental health before finances. It is just a very taboo subject people do not want to discuss openly. Not enough people talk about personal finances, and there are too many debt instruments that create negative compounding interest, which destroys an individual’s wealth. This may not be the brightest outlook but that doesn’t mean you will become a victim to this instant gratification culture. You (and only you) are responsible for the financial decisions that you make.