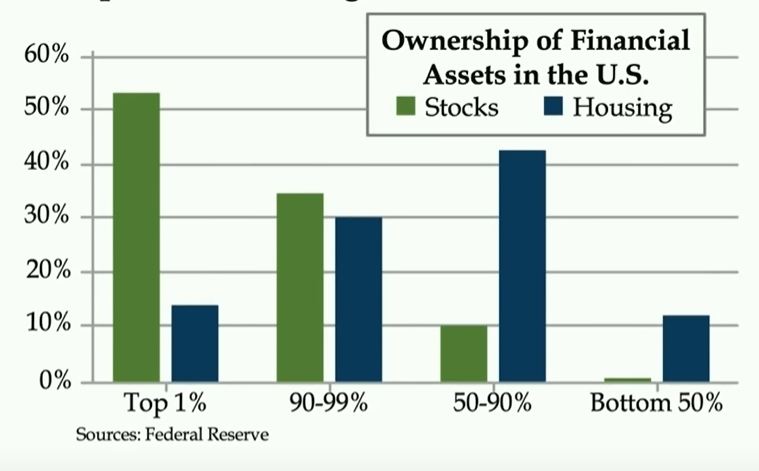

Why are the majority of Americans so poor? This chart shows they have too much exposure tied up in housing and not enough in stocks. The wealthiest Americans show much higher ownership of stocks and significantly less in housing.

The irony is that when you ask most Americans why they don’t any stocks, the most common answer besides not having enough money is that they are too risky! Unfortunately for the majority of Americans, not having exposure to “risky” stocks makes them vulnerable to being wiped out.

Two solid investing rules I learned and follow are;

- Reduce or eliminate debt: Avoid leverage, and beware of excessive expenses.

- Requires a safety of margin: Be an informed realist but do not allow your awareness of risk to become too fearful, paranoid, or pessimistic.

Sound/simple advice, yet it is something a lot of people do not follow. There are some common reasons why having most of your wealth tied up in housing is a bad idea. I will go over a few key bullet points:

- Expenses: Property taxes, homeowner’s insurance, mortgage insurance, flood insurance, earthquake insurance, maintenance, repairs, renovations, acquisition costs, realtor commissions, etc. With stocks, you generally have none of this. Also, property taxes and insurance are not fixed prices and are likely to rise over time.

- Debt: Although you have many pros with getting a low-interest mortgage, it is still debt.

- Time: The time spent on buying and selling homes is much longer than buying and selling stocks. Even if you are flipping houses, it’s a much longer process than going online in your brokerage account and buying a stock. More sweat equity is involved with housing that requires your time and physical presence.

- Mobility: If you own a home, you cannot just move and bring that house with you. Of course, you could rent out your home, which can provide a monthly income, but this can take up more of your time and expose you to landlord-tenant risks. Many cities have passed fair housing laws that make owning a house much less lucrative for a landlord.

- Lack of education/preparedness. 64% of millennials have regrets about buying their current home. When you hear people say they don’t invest enough because they do not know enough about stocks, that somehow doesn’t apply to housing as so many millennials have buyer’s remorse yet still feel an obligation to buy a home. Just because something is tangible doesn’t make the process easier.

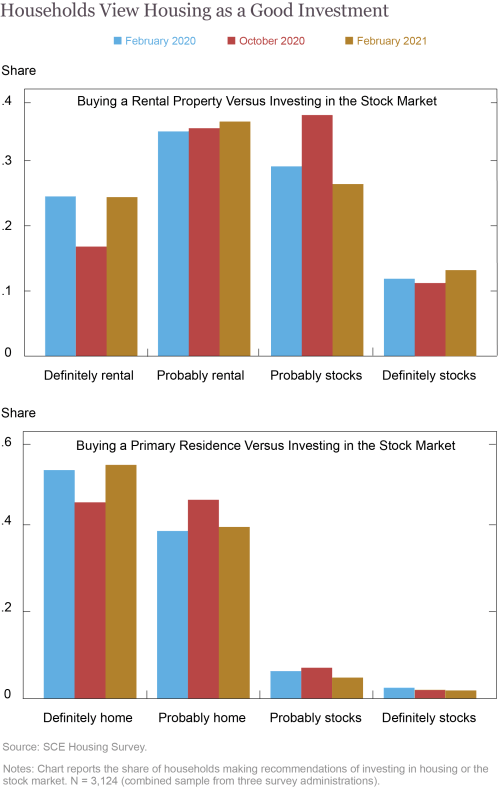

Per a study from the Federal Reserve, 90% of respondents preferred owning their primary residence rather than investing in the stock market.

Yikes.

I hate to say it, but the majority of Americans have it wrong. This keeping up with the Joneses’ mentality definitely explains why a wealth gap exists. Based on statistics and charts, the bottom 50% owns about the same amount in housing as the top 1%. Flipping it the other way, the majority of Americans own such few stocks.

It seems like I am completely railing against homeownership, but I am not. Like with stocks, if you can buy a home at a fairly-priced entry point, I am all for that. That being said, the amount of sweat equity involved in housing can mute the actual benefits. I also have trouble seeing any property that can net the same return as Tesla, which earned a 2,719.81% gain five years ago, or Apple, which has a 403,425.00% all-time return.

The reason many people buy homes has nothing to do with it being a good investment, as many other external/internal factors exist. For some, buying a house is an aspirational purchase. Buying a home can be seen as a sign of financial success but not actual wealth. The question you have to ask yourself is, would you rather appear wealthy or actually be wealthy?

I also believe many people have a cognitive bias against non-hard assets. This person’s profile typically finds tremendous value in housing or gold (It has value because I can feel it). If that person does own any stocks, it is in companies like Boeing or Caterpillar. They see the value in manufacturing, semiconductors, and commercial aircraft carriers, not so much in social media or e-commerce. Since they did not grow up or live on the internet, they have trouble finding the true worth of a company like Amazon or Facebook. They most likely have determined cryptocurrencies to be a scam. I would say this type of mindset is outdated, and as technology advances, it could leave millions of Americans desperately in the dust.

People need to invest more in stocks or invest anything at all as many people have zero invested in the market. Housing can be a valuable tool in growing your wealth, but I would caution anyone that concentrates their entire portfolio into it. As Zillow learned the hard way, flipping homes successfully depends on what local market you are in. Unless you are committed to getting into real estate/owning multiple properties as a career pathway, most people are better off investing.