As we head into the new year, I will look at the top investing trends for 2022. Currently, we are still dealing with the Covid-19 pandemic, but I predict by the middle or end of 2022, we should be shifting towards the end of the pandemic and transitioning towards an endemic. Gradually we will see fewer restrictions and more people will feel comfortable traveling and attending large gatherings again. This does not mean Covid-19 will go away, it will stay with us for a very long time. The virus will mutate and require annual booster shots. The virus will go through a stage called attenuation which means weakened, diluted, thinned, reduced, diminished. The pandemic may end, but we will never return to the old normal. International travel will take several years to recover. Some form of work-from-home will continue. Most importantly, most problems before the pandemic still exist, and a lot of them are getting worse.

The Good:

Demand for cruises has been unprecedented for 2022.

Demand for concerts and live events? Same thing. Concert tickets for Olivia Rodrigo’s SOUR tour sold out due to overwhelming demand. Tickets in San Francisco are being resold as high as $9,000.

The people who have money, are spending it, even with higher prices caused by a combination of inflation, low supply, and pent-up demand. In summary, consumer spending should be strong in 2022. I am optimistic about the U.S economy in 2022, more so than last year.

The Bad:

Inflation, supply chain disruption, and the labor shortage are still problems. These issues should not prevent you from investing, as there will always be some headwinds even during the best of times, but these are worth paying attention to. The labor shortage problem deserves a much greater deep-dive however I predict more people will return to work on the basis that they need money. Pandemic assistance will dry up, people will need an income to support themselves. Many people have found funds through being a content creator through onlyfans, youtube, TikTok, etc. But realistically for the average person, can they maintain that steady income stream in a non-pandemic setting? Social media is always evolving, you must be quick to adapt otherwise you become an afterthought.

When federal stimulus support ends, bankruptcies could pick up. The big lingering question is how much has pandemic assistance propped up families and businesses from disaster? We could soon find out. This reminds me of a famous Warren Buffett quote, “only when the tide goes out do you discover who’s been swimming naked.”

Economic inequality will get worse – If you are in cash, due to inflation, your money is eroding around 5% each year. If you do not own real estate and stocks, you will fall further behind. If you are not in a high-demand field like tech, the purchasing power from your wages will decrease. If you are in deep poverty or homelessness, the chances of recovering are not better. The poorest individuals will continue to fall further behind.

Mental health issues will reach a crescendo – This will affect everyone no matter what economic class, race, national origin, sex, religion, or age bracket you are in. The pandemic has left millions of people with PTSD and exacerbated preexisting conditions like depression. Even if you got a raise or in an industry where the demand for your services has increased, the work culture has become far more oppressive and stressful. There is no work-from-home for nurses, flight attendants, pilots, etc. This will take a toll on everyone’s mental health. We see it in stories with the record number of unruly passengers or doctors and nurses being assaulted by patients. What do you get with short-staffed employers dealing with packed concerts, restaurants, and mass gatherings? That is several bad headlines waiting to happen. Everyone already knows mental health issues are a problem and going to get worse, but I believe 2022 it will get to a point where it will start grabbing the spotlight from news media outlets as covid starts dying down.

And as predicted, hot-button partisan issues like gun violence, abortion, immigration, and health care will still be divisive.

Without further ado, here are my top investing themes for 2022:

E-Commerce

E-Commerce is growing fast and expanding everywhere. Every year we will be more tech-driven and E-Commerce will play a bigger part in our everyday lives. In no way is this a fad. The pandemic just sped up the growth cycle with increased online payment activity. We are seeing the acceleration of the trust and adoption of digital platforms globally. We will not be going backward.

Who do I like the most? Choose from the buffet list! I like the big players like Amazon, Alibaba, MercadoLibre, and Sea Limited the most. Even smaller players like Coupang and Jumia are intriguing.

The two companies I like the most are Amazon and MercadoLibre. With Amazon, you have its marketplace/retail business, which we know is still growing globally. Evercore ISI analyst Mark Mahaney, whose book I’ve just finished reading, called Amazon, “arguably the single best fundamental asset in Net-land.”

With Amazon you also get its cloud computing business Amazon Web Services (AWS), which is growing faster than its retail business. And then I am banking that they will find their next AWS. With Amazon, they always have their hands in different cookie jars. These are high-reward pet projects that can change the entire trajectory of the company. It could be AI-powered robots, a cloud gaming service, telehealth, who knows! And even if they do not find the next big growth segment of their business (which I predict they will), the company is still growing at a fast rate, the stock will likely do just fine. Picking Amazon is like picking Stephen Curry on your basketball team and getting his brother, Seth Curry for free.

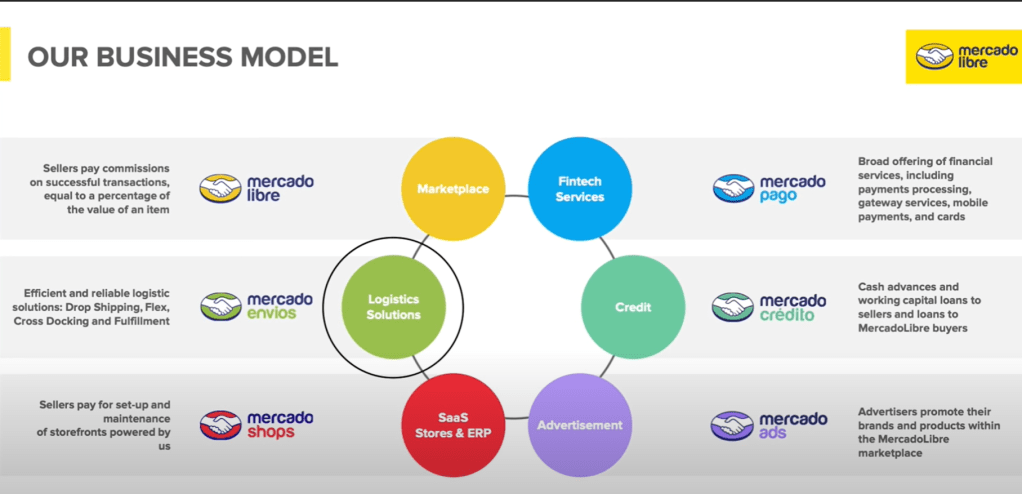

MercadoLibre is considered the Amazon of Latin America. They are in 18 different countries and expanding quickly. To understand why MercadoLibre is growing so quickly you must be able to differentiate the United States from Latin America. Many people in Latin America are unbanked. The postal system in Latin American countries is not as reliable as the U.S Postal system. Amazon, for example, can’t just open shop in Argentina and expect the same results in Texas. It takes several years to build a strong infrastructure. MercardoLibe has solved this by expanding from just its marketplace business and now has a fintech platform, credit service, advertising agency, and logistics division. They are building such a strong ecosystem they are becoming the PayPal (MercadoPago) and FedEx (Mercado Envíos) of Latin America.

More competitors will enter this space as it grows however this isn’t a winner-take-all battle. In the United States, you have PayPal, Square, Visa, Mastercard, Amex, Sofi, etc. There isn’t one dominant player. The total addressable market is massive. MercadoLibre right now is a big fish in a big pond. In the future, they will still be a big fish but in an even bigger pond. There are 33 countries in Latin America, the space is big enough for multiple winners.

Biotech

Biotech had a terrible year in 2021 unless you were involved with the COVID-19 vaccine, like Phizer, Moderna, or Novavax. A lot of biotech stocks ended the year negative however I would expect that to change in 2022 as many of these companies can be bought at bargain prices. Companies like Gilead Sciences and Bristol-Myers Squibb are undervalued. Johnson & Johnson is one of the safest dividend stocks to invest in, and that stock has a 10-25% upside. These stocks won’t 10x, but they provide lots of safety and easy money. These are companies you can own for over a decade and not lose any sleep.

In regard to riskier long term plays, I really like Field Trip Health Ltd, a company that specializes in psychedelic-assisted therapy. So far, the results are extremely promising:

In the past three years, at least a dozen such facilities have popped up around the Puget Sound region.

“When we started seeing patients a little more than a year ago, I wasn’t sure what to expect in terms of volumes,” said Liana Ren, a nurse anesthetist who runs Lighthouse Infusions, a ketamine clinic in Kenmore. “The last couple of months … our schedule has been full.”

Field Trip Health is a similar clinic with locations in Toronto, New York, Chicago, Los Angeles, and Atlanta. Unlike Mindbloom, which went completely virtual in September of 2019, Field Trip offers an in-person ketamine experience at their spa-like facilities. Put The Wing, a Manhattan therapy office, and a yoga studio in a blender, and you’ll get the vibe.

Is tripping with a therapist the next big thing In mental health?

I envision these ketamine-assisted psychotherapy clinics as the next massage therapy for your mind. These clinics won’t be mainstream anytime soon, but I see this as a brand-new emerging market. Field Trip plans on opening 75 clinics by 2024. I see this as the newest innovation in mental health, and as mental health becomes more mainstream, the better for the psychedelic sector.

Consider in 2003, there were 9,870 Spa locations in the United States, now over 21,500. exist. The number of Americans practicing yoga grew by 50% in four years. I see too much positive news every day regarding Psychedelic therapy/treatment. More and more cities are decriminalizing psychedelics and psychoactive drugs.

Investing in psychedelics is still early in 2022, but I have dipped my toes in the water. I understand the skeptics and unfortunately, unless you have used these drugs, it can be hard to conceptualize the net benefits but ask yourself the first time you got a professional massage. I would guess most people liked it (I did) and will likely get another one in the future. I recently went to Mexico and got a synchronicity massage, which included amplified vibrations, pressures, and patterns. Bass vibrations rippled through the massage table. The experience I would say was quite an enjoyable experience. I view psychedelics in the same manner. It is not for everyone, but there is a high demand for these types of treatments and the market currently has very few solutions that work.

E-Fashion Retail

I am bullish on the evolution of online fashion retail. Large retail chains like Macy’s, Nordstrom, Kohl’s were struggling before the pandemic and that is not going to change in the future. I would guess they will receive a boost when things open however, in the long-term I wouldn’t want to hold any of these companies. I am not saying all these companies will file for bankruptcy, however, online specialty retailers like Stitch Fitch, Revolve, and Everlane are growing in numbers. For traditional retailers to survive, they need to double down on digital transformation and social media, which means they will be playing catch up to companies like Revolve. They need to merry a high-touch customer experience, content curation, and personalization. If they cannot do that they will struggle as traditional retailers are carrying an anchor, empty stores, which online retailers do not have to deal with.

Retailers are in a very tough spot. Those that sell discounted brands have Amazon and Walmart hovering around them like a dark cloud. Luxury brands are very exclusive. It is nearly impossible to compete with brands like Louis Vuitton. Even Amazon, as powerful as they are, would have trouble selling luxury watches and competing with Rolex. That leaves many retailers needing to find their specialized niche and audience. Lululemon is the best example of a thriving retail store because their E-Commerce drives their company, not the stores. They also have excellent branding, reaching more customers yet still maintaining a luxury brand image. I could be wrong however companies like Nordstrom are operating on an outdated business model and unless they can pivot, very fast, they could go bankrupt or go through another decade of stagnating growth.