Over 1 million COVID cases were reported in the United States in a day…

The Fed expected to hike rates over four times…

Worst inflation in nearly 40 years…

Major Supple-Chain issues…

Oh, Ya… I am buying stocks!

Jamie Dimon, the CEO of Chase Bank is super bullish on the economy as well. “We’re going to have the best growth we’ve ever had this year, I think since maybe sometime after the Great Depression.” Dimon and many other analysts however see the market having a volatile year ahead due to expected higher rates from the fed.

As a long-term investor, I ignore the noise, keep patient, and disciplined. Macro headwinds aside, I am bullish on the market, really bullish on certain sectors and stocks for the long term. I exercise delayed gratification, which is a key practice for any long-term fundamental investor. Long-term investing is easy, as you are committing to hold a stock for years, but at the same time very difficult as you have to endure rough stretches, scary headlines, and listen to the sky-is-falling crowd.

What I do is build out a balanced portfolio of high-quality dividend, value, and growth stocks.

Dividend: Focus on the long-term. For every dividend stock, I utilize a dividend reinvestment plan (DRIP). These are companies I plan on holding for 10+ years. I probably hope the stock price remains sideways so I can collect as many dividends as possible at a discounted price.

Value: The key with value is obvious. Value can be dividend or growth stocks. As I learn more about valuation metrics, the better an investor I become. I believe most of your portfolio should be made of high-quality value stocks. Just like in golf, the best golfers are the ones that play high percentage shots. They try to hit par most of the time instead of birdies. Golfers that try to play birdies or eagles are playing with fire and often end up getting double and triple bogeys. Too many times I see investors with a portfolio made up of mostly overvalued, unprofitable, speculative companies. There is a place for these types of stocks in your portfolio however a portfolio mostly made up of profitless tech is a bad risk-management strategy that the average investor probably cannot stomach.

Growth: I put growth in three categories, a. Potentially great growth stocks, b. Great growth stocks, and c. Generational growth stocks. The market is littered with potentially great growth stocks, your job is to find the ones that will turn into great growth stocks. The difference between great growth stocks and generational stocks is that generational stocks are the companies that have a mixture of continuous/growing revenue, large TAMs, and stellar management teams. These companies often cannot be valued by book value alone. For example, how do you value a company like Alphabet (Google)? If its market cap is 1.85 trillion, how do you put a number on all that it encompasses and every business and person it reaches?

The one misguided fear happening in the market today is the notion that stay-at-home stocks are in bubble territory with that bubble popping as things open back up. Cathie Wood, in a monthly market update, said inflation fears are overblown and will l subside as supply-chain issues resolve. She argues that many early-stage innovative companies like Zoom and Teledoc are currently undervalued:

We will not let benchmarks and tracking errors hold our strategies hostage to the existing world order. The coronavirus crisis permanently changed the way the world works, catapulting consumers and businesses into the digital age much faster and deeper than otherwise would have been the case. Dismissing innovation strategies as “stay at home” glosses over a crucial point: innovation solves problems in a way that consumers and businesses adopt with relief, enthusiasm, and delight. Critical to investment success will be moving to the right side of change, avoiding industries and companies caught in the crosshairs of “creative destruction” and embracing those on the leading edge of “disruptive innovation.”

Innovation Stocks Are Not in A Bubble: We Believe They Are in Deep Value Territory

I agree with many of Cathie’s points. The pandemic has accelerated us towards a more global digitalized age faster. Current valuations on areas involving artificial intelligence, cryptocurrencies, augmented reality, autonomous vehicles, etc… are misplaced today and in 2025, 2035, 2045, will be very dramatically different. This permanent acceleration into digital services and applications will also likely mean a downward acceleration toward safe value – companies that lack innovation and technology. In 1998 the top Internet companies were AOL, Yahoo, Geocities, MSN, and Netscape. Back then, Amazon was a high-risk company, Google was just starting up, and Facebook didn’t even exist.

Innovation and technology will continue to have a largely deflationary force on our economy. Amazon has made things cheaper and more convenient for consumers to shop. Netflix has reduced the cost of entertainment. I will argue that quality/disruptive tech companies will trump the movement of interest rates.

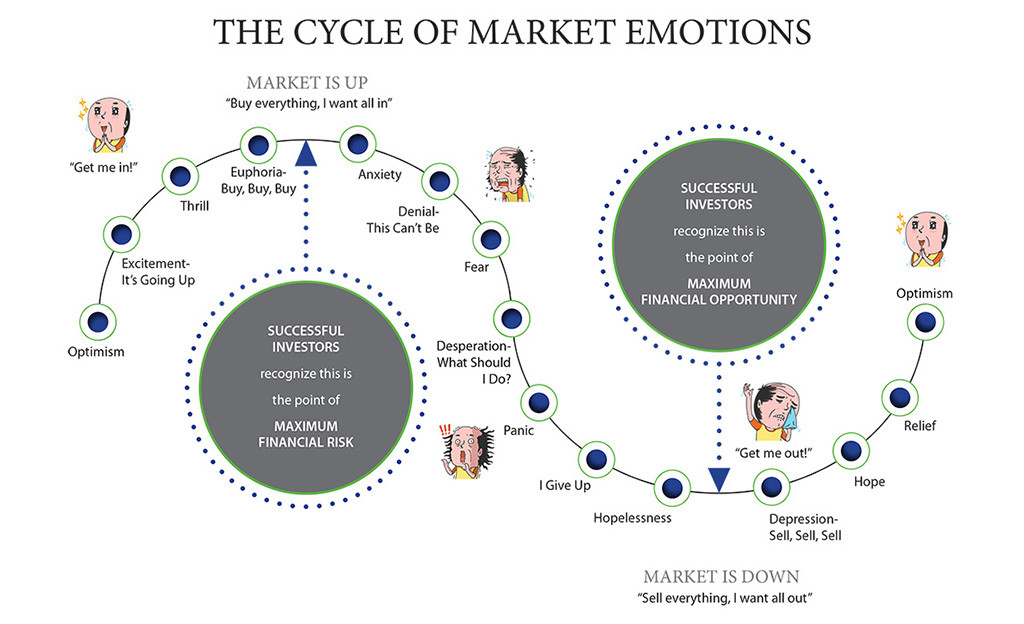

For a long-term fundamental investor, if you bought companies like Zoom, Teladoc, Mercadolibre, PayPal, or Square a year ago you should be enthusiastic about price today. They are trading at 30, 40, even 50% lower! These companies can be bought cheaper today with the fundamentals about the same today, if not better. It is important to understand the cycles of market emotions. We are closer to maximum financial opportunity than maximum financial risk. At this time last year market sentiment was about euphoria. You sell during those cycles to build your cash position, which is then best deployed in times like today.

Long-term investors should always try to ignore major macro events because they will always exist. There will be those that try and sell everything and get back in the market when things “calm” down. It is proven for the average investor, timing the market is nearly impossible and they often miss the boat. They end up leaving the market entirely or buying back in at a much higher cost average. The road might be bumpy in the near term but I think we will look back at this time as a great buying opportunity. I will take any short-term pain to receive long-term prosperity. As the great Charlie Munger once said, “If You Can’t Stomach 50% Declines in Your Investment You Will Get the Mediocre Returns You Deserve.”