As the overall stock market is holding up quite well right now, smaller Nasdaq stocks are getting crushed! 36% of the stocks in the Nasdaq are down at least 50% from their 52-week high! This seems like a bloodbath for most investors. I understand why many investors would be fearful to invest right now or in the next few months. Why invest in such a risky environment? Is it time to sell all my stocks?

My investing philosophy is to scoop up high-quality, or potential high-quality stocks and hold them for a long time. This seems like the perfect time to buy stocks, as I would rather buy stocks near their 52-week low than their 52-week high. I want to warn anyone reading this: stocks can continue to fall. Amazon at one point in its history lost 90% of its value in two years. For those that are patient, great things can happen to those that wait. When you invest in high-quality companies that you are willing to hold for 5-10 years or longer, you will get wealthy. Investors that bought Amazon at the peak and lost 90% of their investment are up now (if they still hold the stock) at least 1,400% of their investment.

I want to make clear, these are investments in companies that I think will thrive 5-10 years from now. These are not trades. I have to fundamentally be excited by the story of the company and its financial outlook in the future. I could never justify investing in AMC because they have $5.4 billion in long-term debt and in an industry that is drastically shrinking. If you were an entrepreneur, would you invest in a start-up company wanting to build movie theaters? I would be highly skeptical and thus could never justify investing any significant amount in the stock.

A lot of traders made a killing when AMC spiked last year. I missed out however, I have a long-term horizon. If you were lucky to get in on ACM I would guess you made a significant short-term capital gain, the keyword being “short.” Short-term capital gains are taxed as ordinary income, which is much higher than long-term capital gains. Investors have to remember fees and taxes are silent killers in wealth-building. With AMC, many traders simply get lucky. Do they have an investment philosophy or process that can be replicated to find the next AMC and get in and out at the right time? For the majority of traders, I would not think so as that explains why so many of them lose money.

One of my favorite Warren Buffett quotes is “if you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.” Another is, “our favorite holding period is forever.” The best advice from what I have learned from greats like Buffett is that if you want to get rich, you can sell, if you want to get wealthy, you have no reason to sell. You hold on. These are 10 stocks which I feel are a. high quality and b. beaten up creating a potentially attractive buying price.

MercadoLibre – Investing in MercadoLibre is the equivalent of buying shares of Amazon 5-10 years ago. Imagine if you had a time machine and you could do that? With MercadoLibre you have more geopolitical risk than American businesses but there are so many similarities with Amazon, it is difficult to ignore. The total addressable market is gigantic and both have profit-generating businesses outside of their marketplace. With MELI, I ignore its insane P/E Ratio, just like I did with Amazon, and look at its Price to Sales Ratio, which is a lot more reasonable. I would be shocked in 3-5 years if MELI is not trading where Amazon’s stock price sits at right now – about 3,000-3,500.

Alibaba – Alibaba and many of the high-growth Chinese tech names are at buy-levels. If you can stomach the geopolitical risk, they are worth a look into. My thesis with baba and a lot of these companies on the list are similar. If you liked BABA at 200, you should LOVE it at 130, even more at 120! With how large of a presence Alibaba has in China I do not believe the stock is priced to go down to zero. The business is fundamentally strong and I believe the Chinese government has no incentive to tear it down.

Sea Limited – If you haven’t noticed, I am bullish on the e-commerce sector for the next decade. E-commerce is not a trend, it is a fundamental change in consumer behavior. So it should be no surprise I picked another e-commerce company.

The Honest Company – Perhaps the least upside out of all these stocks, but maybe the safest. This is a recession-proof business. You cannot go wrong with diapers, skincare, cleaning products, and makeup. This is the Procter & Gamble for millennials. While this isn’t necessarily the next Tesla, I would be surprised if this stock isn’t well above its 52-week high of 23.88 once they start eeking out a profit, projected by late 2022 or early 2023. From my observation the business model is sound. A lot of the scaling and growth issues happened before this company become public.

Block/Paypal – These are two separate companies however they are in the same space and the two stalwarts in the fintech sector. Top Financial Apps: 1. Cash App, 2. PayPal 3. Venmo. For diversification purposes, I endorse splitting 50% of an equity position on both Block and Paypal. If I had to guess both companies will be significantly worth more in the future but by diversifying, you protect yourself from single-stock risk. These are two well-known companies so there is no need to go in-depth in each of them. Jack Dorsey has stepped down from Twitter so he should be able to devout more of his time with Block. PayPal is a high-quality company that has been around since 1998. They aren’t going anywhere.

Mind Medicine/COMPASS Pathway/ATAI Life Sciences – The biotech sector is a bit like the Amazon Rainforest. Unpredictable and extreme volatility. This isn’t for the faint of heart and will test you as a long-term investor. The psychedelic sector is down significantly based on no real material news. Clinical-stage biotech moves towards a different beat at times, especially when there are no trial results or FDA rulings. For long-term investors in this sector, massive swings based on non-fundamental news are just noise in the background.

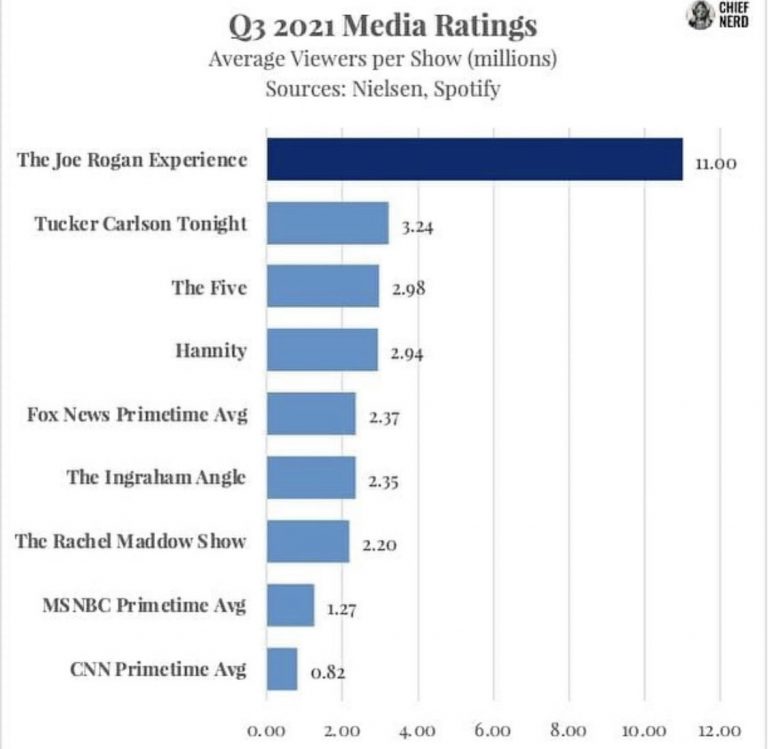

Spotify – I do not own this stock but it has reached a price where it has become intriguing. If Netflix and Google are the kings of video streaming, Spotify is the king of audio streaming. They leapfrogged Pandora and haven’t looked back. With Spotify, you just have to follow the money. It is an ad-revenue play. Follow the money by following the eyeballs, or this case the ears. In terms of high-growth stocks in their early stages, Spotify may be one of the best. They have Joe Rogan, paid $60 million to Alex Cooper and her podcast “Call Her Daddy.” I see Spotify on a similar course to the next stock I will mention.

NetFlix – I have always thought NetFlix was the weakest among the FANG stocks but I underestimated how well the company is managed. Subscribers follow good content and Netflix has proven they can consistently produce a lot of good and varied content for different audiences. Once you think Netflix is on the decline they shell out the Squid Game, which became a global phenomenon. At some point, you cannot credit this to luck when they consistently produce popular original content. Of course, there is a ton of competition in this space however I don’t see Disney+ or any other video streaming service being able to churn as quickly hit show after hit show as Netflix has done.

Lemonade – Timely advice for investors of this company: Scaling growth is not a linear process. It will take time. There will be road bumps on the way. Lemonade offers pet insurance in 34 states, renters insurance in 28 states, condo insurance in 25 states, homeowners insurance in 23 states, and car insurance in 1 state. What does that mean? They have a lot of markets to enter into, and I am not even talking about other countries yet! While pet and renters insurance has been growing at a quick yet steady pace, they are just getting into car insurance. That all changed when they acquired Metromile in November 2021. Metromile is already in 8 states, so Lemonade has now acquired its state certifications in those states. For Lemonade to operate, they need certification in each state they operate in. To do this organically would take a lot of time although, by acquiring Metromile, they sped up that process. The future outlook of this company has never been brighter and is certainly something to get excited about.

Coinbase – If you do not believe in cryptocurrencies, Bitcoin, Ethereum, and NFTs having much value you can stop reading. If you think they have staying power, Coinbase may be the best stock to invest in without actually buying cryptocurrencies. Think of Coinbase as the Goldman Sachs of crypto. Coinbase makes money when there is more trading activity. If you believe interest in cryptocurrencies will permanently die down, you shouldn’t buy this stock. I believe in the bull-thesis for Coinbase, especially more so since they are launching an NFT marketplace soon. If their marketplace can provide a better user experience than OpenSea it will see its revenue soar to record-highs. With Coinbase it is not so much if you find value in NFTS, it is if the market as a whole will. Pokémon cards for example are a decade older than bitcoin, and the value for certain rare cards has skyrocketed. The estimated value of a PSA 10 Base Set Holo Shadowless Charizard is over $300,000.