The market has been painful to watch for the past couple of months.

REALLY PAINFUL the past couple of weeks.

70% of Nasdaq stocks have fallen at least 20% from their recent high, 50% of Nasdaq stocks are down 40% or more!

This isn’t the first time the market has gone down and it certainly won’t be the last time. The truth is this is the cost of becoming wealthy. To go through times like this when you see your portfolio value eviscerated in weeks.

Imagine holding bitcoin when it was $1.

Imagine holding Amazon when the idea of selling items online was considered a novelty.

There was no consensus among experts, analysts, even internet trolls to buy bitcoin in 2011.

There were no waves of screaming buys when Amazon was trading below 100.

Those that got rich went against the market. They went against the crowd.

Times like this are the best time to buy stocks when all the “experts” start telling you to sell. Netflix for example had a great earnings report in October. It had a positive earnings report Thursday, but the stock price fell over 20% in one day!

Now you hear a lot of analysts/experts downgrading/selling the stock, the same people who were increasing the price target to above 700. They are all running towards the exit at the same time! Call me crazy, but I do not think much has changed with Netflix since October. The fundamental story for solid companies like Netflix, Amazon, Google, etc.… remains the same.

The only way to buy solid companies at a fair price is during times like this. The risk level seems higher but that is only on a surface level. For example, if you have a high conviction that Lemonade will do well 3-10 years from now and believe the stock price will be 600-700, it doesn’t matter if you buy the stock at 60, 50, 40, 30, or 20. You will still make a lot of money if you buy and, this is the hard part, hold. If you wait until there is less “risk,” and buy the stock after it has a consensus buy rating, you will likely end up buying the stock when it is between 200-600.

In the above example, one investor might or might not get rich and might or might not make a decent-sized profit, the other investor will build serious wealth.

Long-term wealth building is a psychological exercise of patience and controlling your emotions. If you can master the psychology of investing, as a long-term investor, you can build wealth. This is very easy to say but extremely difficult to follow. Even after Netflix fell 20% it can still fall a lot further from here. Nobody wants to hear that there is more pain on the horizon but a sound investing strategy requires logic and common sense, not emotional selling or buying.

Making a scientific analogy, the market is in a constant state of disorder, randomness, and uncertainty. Entropy is the measure of the disorder of a system. It is an extensive property of a thermodynamic system, which means its value changes depending on the amount of matter that is present.

It is impossible to predict the stock market because there are so many variable factors beyond our control and constantly changing. In general, if you have an optimistic view of the U.S economy in the long-term, you probably will have a favorable view of stocks, meaning stocks on a broad basis will go up, as it has always been doing. If you have an unfavorable view of the economy, you are likely predicting market crashes and hoarding lots of gold.

As of this present moment, based on sentiment we are headed towards a recession and stocks will fall off a cliff. No matter how good the economy is doing, a recession is not extremely improbable. Every year there is a 10-15% chance of it happening. That sounds horrible however I do not believe the Federal Reserve, the legislative or executive branch of our government has any incentive to allow this to happen, meaning they eventually enact policies that will prevent stocks from crashing. And even if a recession does happen, in the long run, we should be fine.

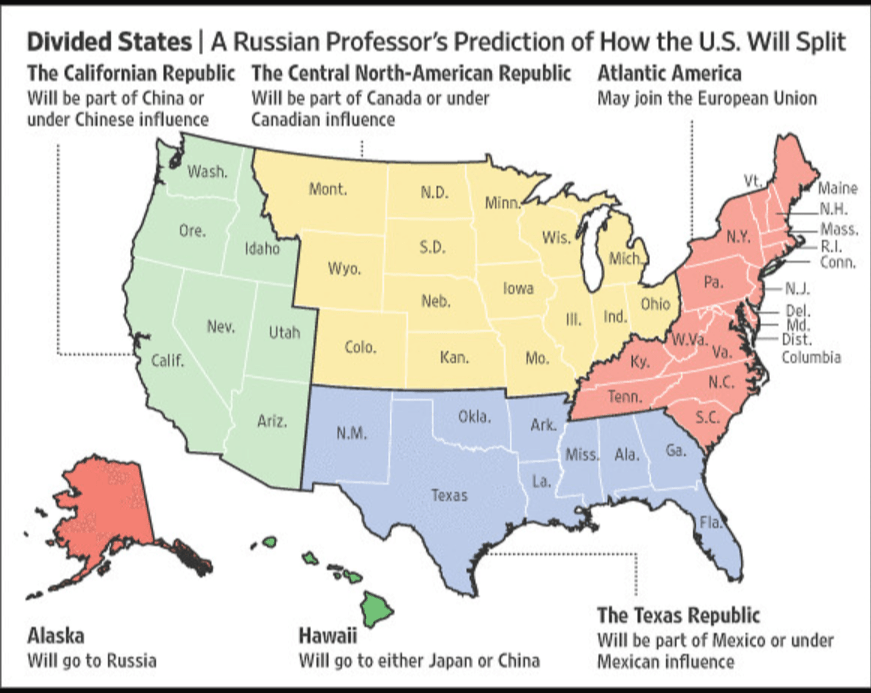

Most predictions of a stock crash and doomsday scenarios are proven to be wrong. Remember Y2K or the 2012 Maya Apocalypse? Igor Panarin once predicted the U.S would disintegrate, he even created a map about the new global order.

The 2020 Pandemic was indeed a black swan event however the global infrastructure is stable enough for us to overcome it. That doesn’t mean stocks will stop falling. They could have much further to go down, which means more pain ahead.

So why do I keep holding?

Two main reasons: In the long run I believe the stock market will go up and the U.S. economy will grow. Why overcomplicate things? Secondly, from everything I have learned and been taught, it is impossible to time the market accurately. If you do time the market correctly, a lot of luck was involved. Not only do you have to sell at the right time, but you also have to buy back in at the right time as well making it even more improbable and risky you get it right twice.

From most economic models, our economy is in a healthy state. I will weather the storm, continue to buy high-quality companies at discounted prices, sit on my hands and do nothing – Even if the stock market falls further. This is what I believe is the ultimate challenge of investing. Holding during times like these. I don’t blame anyone for selling, but my goal is to build wealth. Jeff Bezos once asked Warren Buffett: “You’re the second richest guy in the world. Your investment thesis is so simple. Why don’t more people just copy you?” Buffett replied, “Because nobody wants to get rich slow.”

I wish everyone a calm state of mind during these times of intense market fluctuation. We need less judgment and more caring. The best thing to happen to the stock market was this weekend. It provides everyone time to reflect and think. Do I sell? Do I hold? Do I buy? Things aren’t always as bad as they may seem. It is important to take a deep breath and not panic. Best of luck on your investing journey.