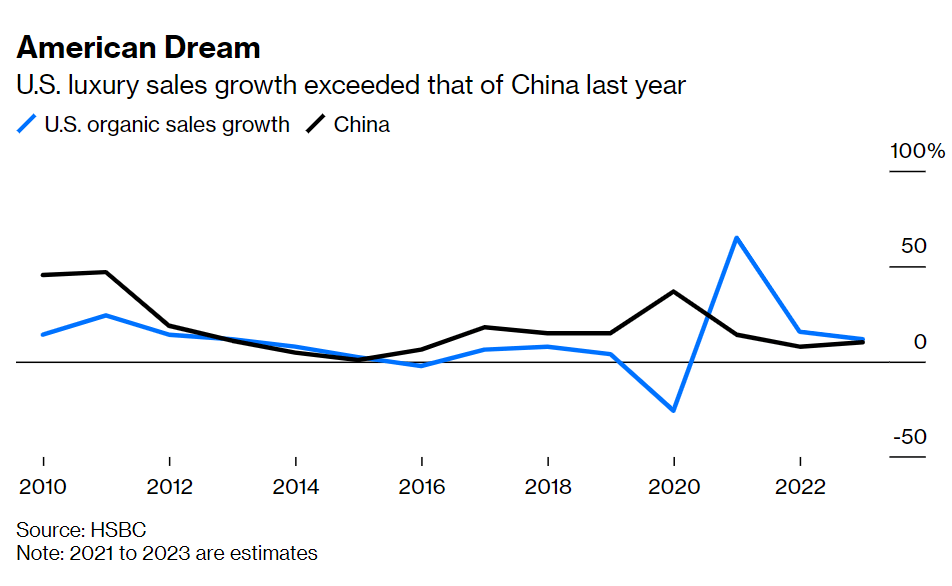

Consumers are spending like there is no tomorrow. One of the biggest beneficiaries is luxury fashion. That shouldn’t be surprising. If people were still buying designer clothes and handbags when everything was shut down, it seemed inevitable spending would increase as things open up. There are obvious reasons why luxury fashion benefits:

- People want to buy expensive clothing for special events and gatherings.

- People want to look good on their preferred social media platform.

- Even with supply chain issues, getting your hands on a designer dress or handbag is much easier than a Tesla, refrigerator, heater, etc.

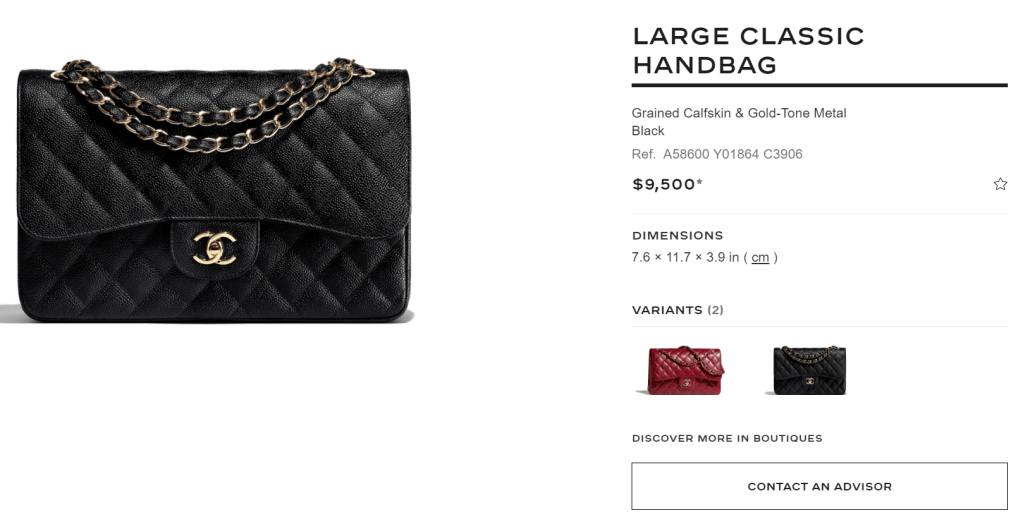

- High-quality luxury brands have pricing power and can/will raise prices because consumers will pay for those prices.

A Chanel Handbag was going for $3,000-$4,000 in 2019. In 2022 it is now going for over $8,000.

“All the luxury industry is raising prices,” John Idol, the CEO of Capri Holdings (NYSE: CPRI), the parent company of Michael Kors, Jimmy Choo, and Versace. “We’ve seen absolutely no consumer resistance to any of the price increases that we have taken, and there will be more.”

This may disgust the average, middle-class consumer however there isn’t much they can do about it. There are still long lines outside stores like Louis Vuitton and Chanel. Certain consumers may become priced out however the core consumer for these products will still buy. Those consumers that are priced out usually will end up buying from a lesser-tier luxury brand, which is raising their prices as well.

Tapestry, Ralph Lauren and Capri Holdings have all recently raised sales outlook as 2022 and 2023 look like a good time for higher-end apparel companies. Demand will remain high as pandemic lockdowns get lifted. More social outings = Increased Demand.

My biggest holding is Revolve Group Inc, (NYSE: RVLV). If the price falls further due to weak earnings or the fear-driven market we are in currently, I may consider buying more shares, the first time in nearly two years.

Revolve Group has no physical retail presence. Having no stores lets them allocate their funds into advertising, inventory optimization, and operational efficiency. This gives them a leg up over their competitors with physical retail, which requires hiring employees and paying rent to lease commercial stores. In the future I think Revolve will actually need some sort of physical retail presence to help raise brand awareness and boost profits however, that is not the priority at this time.

The Revolve story is about social media and AI machine learning to better engage with their audience. Physical stores do not make much sense now since their brand is being built through influencers, special events, and festivals. This strategy is different from most other apparel companies but one that I think will be a winner and eventually be copied by other apparel companies.

The ultra bull-case thesis is that they become the first American Luxury Fashion company, being able to rival Louis Vuitton. Luxury fashion has been a European concept, it really hasn’t existed in the United States. Bernard Arnault once said, “if you control your distribution, you control your image.” A true luxury brand needs to aspire their audience to reach the top. This cannot be done when a product is discounted in outlet malls. It cheapens the brand. There is a reason why Rolex doesn’t sell “cheap” watches or why fancy restaurants have a dress code.

Since Revolve has no retail presence, its brand hasn’t suffered from massive discounting. It has an aspirational Los Angeles aesthetic feel with the cool factor. While the majority of other aspiring higher-end apparel companies operate in New York, their roots are in Los Angeles. They target a specific niche audience and operate more like a European fashion company than an American fashion company.

The question all high-end apparel companies have to ask themselves is how do you reach a mass audience without diminishing your brand value? Revolve is the only American company in their space doing this effectively. They do not just sell clothing, they are selling a cultural brand. Communication in how you reach your audience is just as important as the product itself.

The other catalyst for Revolve Group is that they appointed Oana Ruxandra to its board of directors. Here is a snippet from her biography:

Ruxandra is Chief Digital Officer & EVP, Business Development at Warner Music Group, where she oversees global digital partnerships and negotiations with a focus on exploring new forms of commercial innovation and creating new digital revenue opportunities. In recent years, Ruxandra’s team has led successful growth in emerging streaming platforms that have become Warner Music Group’s fastest-growing source of revenue by partnering with leading social media, gaming and connected fitness brands. She is also guiding the company’s expansion into other emerging digital market opportunities as the world of web3 evolves and more time is spent in the metaverse and with digital goods (e.g., NFTs).

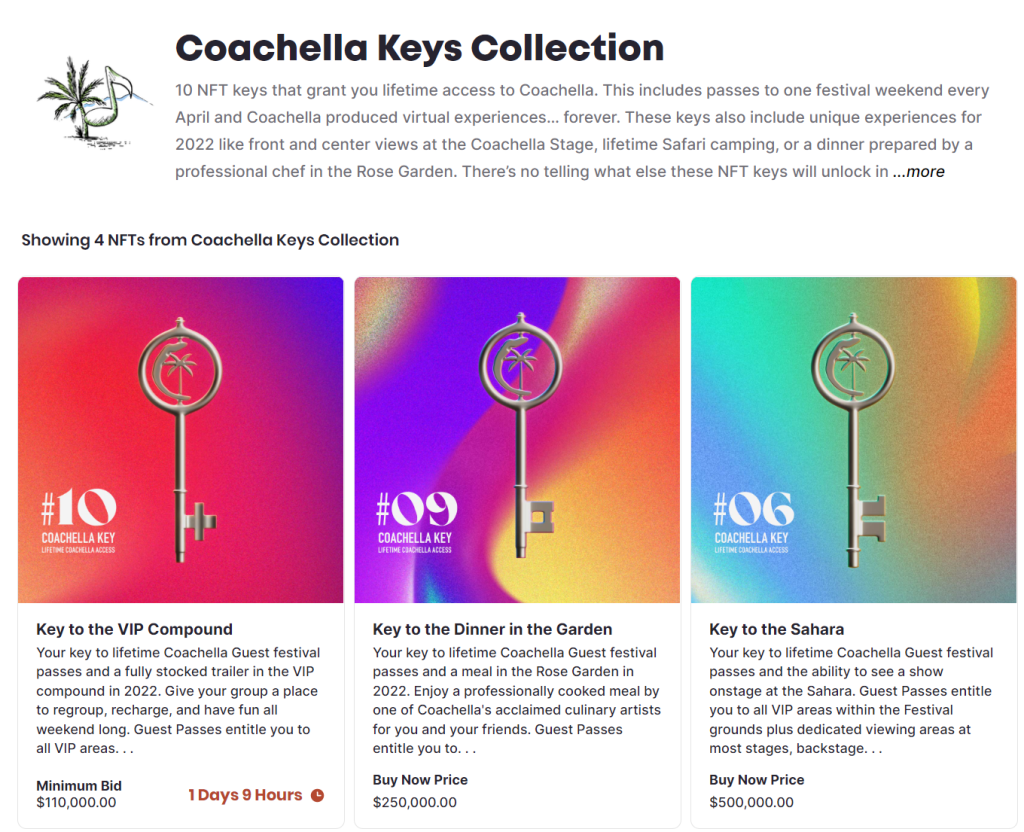

I see this as a potential sign that Revolve may get into NFTs and or the Metaverse. Ralph Lauren already got into the Metaverse last year and I could see Revolve proceeding soon. I see this being relevant for two main reasons. 1. Better able to connect and reach a Gen Z audience and 2. Premium luxury fashion needs to be more than just about selling products. They need to be able to create and sell experiences.

The Metaverse itself is about a digital experience. Revolve already has its own festival, the exclusive party inside Coachella. The Metaverse is another innovative way to connect to a younger audience. NFTs have value depending on who the creator is and what use case they have. Coachella recently launched an NFT marketplace which shows how they can be valued in a utilitarian way. They have an auction selling NFT keys that grant you lifetime access to Coachella. These keys show how they have value more than just aesthetically. The key provides an actual tangible real-life experience, which goes against the idea that NFTs are completely useless.

If the fundamental story remains, I will still hold my RVLV shares. If the stock price falls after earnings, I will strongly consider adding more shares. At this moment I have no plans to sell.