“The greatest shortcoming of the human race is our inability to understand the exponential function.”

― Physicist Albert Bartlett

Elon Musk recently tweeted a brilliant yet straightforward investing strategy that can make you wealthy. “Since I’ve been asked a lot: Buy stock in several companies that make products & services that you believe in. Only sell if you think their products and services are trending worse. Don’t panic when the market does.”

Simple yet powerful.

Most of the supposed long-term investors are gone during this sharp market sell-off.

Growth stocks or high beta volatile companies have gotten out of favor with the “experts,” fund managers, and retail investors. Just tune in to CNBC and hear how the market will continue to go lower and high-flying stocks like Shopify and Nvidia have no bottom. Ironically, just six months ago, the same people said these were must-own stocks in an investor’s portfolio. Everything is selling off despite the quality of earnings.

Stocks go up. People say buy, and you buy;

Stocks go down. People say sell, and you sell.

Welcome to Wall Street.

Listening to the herd will lead to mediocre results. Macroeconomic headwinds have become more important than fundamental metrics, and everyone should mostly be in cash or defensive positions. Haven’t you heard? High-growth tech stocks are uninvestable for the next six years!

Although Musk offers solid value-investing advice, few people can follow it. That is because humans are, by nature, poor investors.

Why do so many people sell all their holdings during steep market drops and move into bonds, gold, and cash?

It’s easy to be a long-term investor during a bull run. It’s easy to buy and hold stocks when everything is going up.

There is only one reason to buy a stock. There are several reasons why someone sells. Fear drives most selling decisions, especially during this market downturn. Humans are good at surviving, so the justification for selling stocks when they are down big would be like our brain telling us to take our hand off the stove.

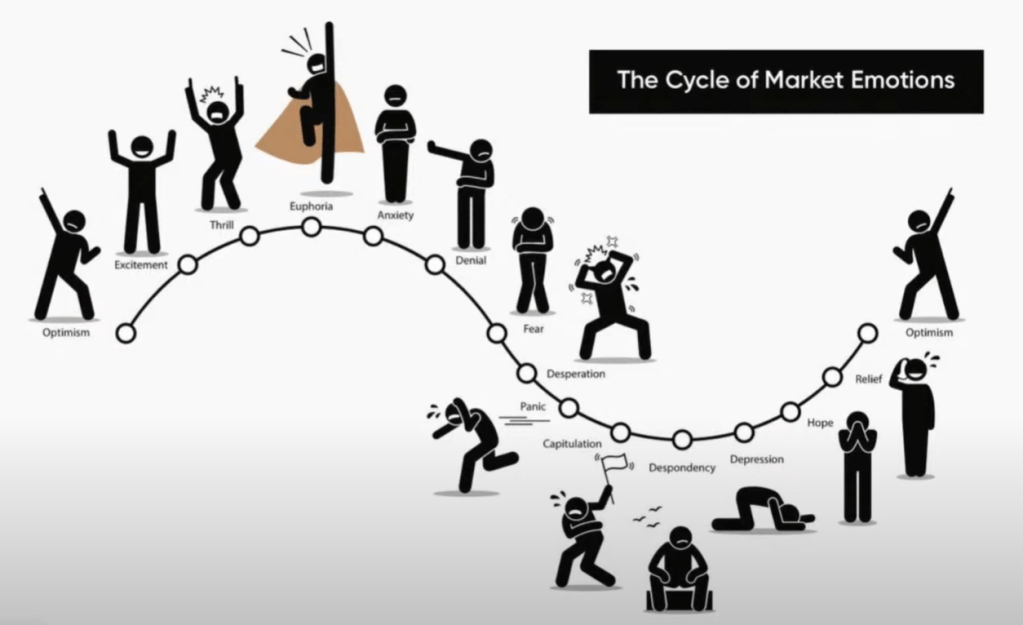

There is a cognitive dissonance that investors deal with daily. When the market goes up, people often experience euphoria. Emotions can come into play, and we become seduced by market gains. During euphoria, everything works. If stocks keep going up 5% every day, they must be doing well, and people start justifying buying stocks at ridiculously high evaluations. When the script flips and the market goes down, fear creeps in. We become obsessed with falling prices and sell stocks of companies that are fundamentally intact as a way to end the pain we are feeling. This fear can lead us to sell stocks at ridiculously low evaluations.

These cycles of market emotions are why it is crucial to have a level head if you are a long-term investor. I try to always stay in the optimistic stage of market cycles. Not too despondent to avoid all risk and not too euphoric and disregard valuation.

Think of investing as trying to maintain homeostasis. Homeostasis, from the Greek words for “same” and “steady,” refers to any process that living things use to actively maintain fairly stable conditions necessary for survival. In our everyday life, we often make the best decisions in homeostasis. Think of a time when you have gotten little sleep, didn’t eat anything for a prolonged period, or were sick. That’s not the best state to be making important life decisions.

There is constant chatter and noise from the market that moves us away from homeostasis for a prolonged amount of time. Times like these allow investors to start making irrational decisions based on emotion instead of sound logic.

People may fear selling their entire portfolio because they don’t want to see it go to zero. That’s irrational and highly unlikely. Ask someone who fears flying why they drive to work every day when the risk of getting in an automobile crash is significantly higher than being in a plane crash.

No matter how much sense it makes to fly, we wouldn’t want someone with an intense fear or phobia of flying to get on a plane because it makes more logistic sense. It could put someone in an uncontrollable downward spiral. Investing is the same way. If you cannot manage your anxiety, you should consider not investing. Long-term investing requires you to feel uncomfortable. The emotional aspect of investing is just as important, if not more than the technical aspect. In times like this, thinking critically, building conviction, and ignoring the herd mentality are necessary, making you vulnerable. We start seeing who has the temperament and those that sell out and leave the market altogether.

Regarding technology stocks like Amazon and Shopify, yes, consumer behavior is returning to where it was in 2019. Recently we have seen e-commerce slow down, but this isn’t a secular decline. It may seem like that, but I would chalk that up to significant pent-up demand for going outside due to the pandemic. Growth is going back to the trend line before the pandemic, but not below it. Do not mistake this as a secular trend as a peak for e-commerce and a significant comeback for physical stores. I question any analyst who thinks there will be a long-term decline in people shopping online, playing video games, or streaming. These activities trended upwards before the pandemic and will continue to do so in 2023 and beyond.

Today stocks are cheaper and more reasonably valued. Many of these companies are fundamentally okay, in much better shape than 2-3 years ago. Tesla and Apple reported stellar earnings and met most analysts’ expectations. In this market, that doesn’t matter. Their stock prices fell massively.

Eventually, the mood will change, and fundamentals will matter again. Expectations and comps will be so low that companies will easily beat earning expectations, likely causing their stock prices to rebound.

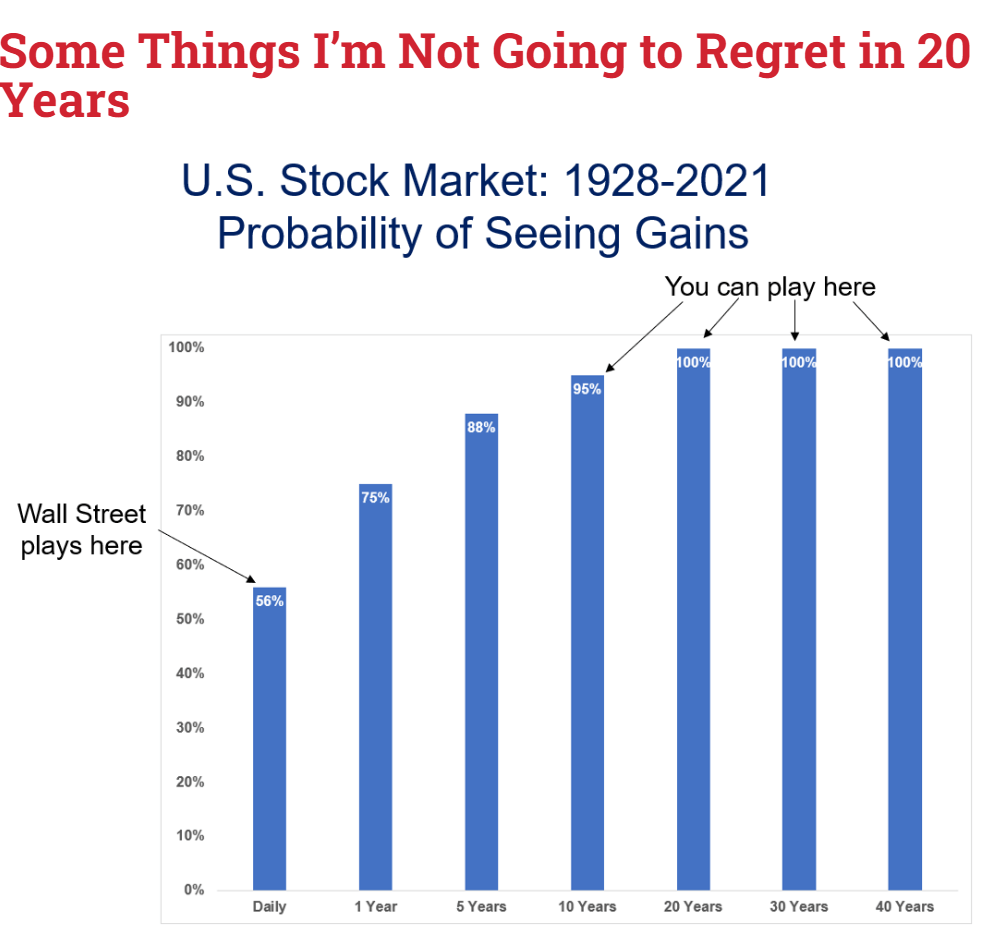

My advice? Relax. Any long-term investor will go through dark times. Bad stuff happens if you are in the game for the long term. It is unavoidable. Like in life, you get sick, lose a job, get dumped, divorced, etc. Pain is a part of life. The great thing about investing is that the probability of you “winning” is very high with time as the greatest weapon against noise and sentiment. Ultimately the market will return to its homeostasis as it always does.

The last point I want to cover is that investing in single stocks is too risky compared to a broad-based, passively managed index fund. You have to look at it from a risk-reward tradeoff like all investing. When you invest in an index, you are striving for average results. It is investing on autopilot. To strive for certainty is to doom oneself to mediocrity. There is nothing wrong with mediocrity as that can still net you six or seven figures. The risk is low-medium, with the reward being medium-high. With single stocks, the risk is medium-high, with the reward being high-exponentially high. There are no outsized returns investing in a broad U.S stock index fund. Most ambitious people do not strive for just average results in school, life, professionally, personally, etc. Why is it acceptable to be an average investor, especially when exponential gains are possible? The two greatest weapons an investor has is time and temperament. If an investor of single stocks uses those two controllable weapons in their favor, the risk profile decreases significantly.

Morgan Housel is a partner at The Collaborative Fund, an expert on behavioral finance and history. He is a wealth of sage advice during times like this. Here are some of the best quotes I have found from his blog:

The world is governed by probability, but people think in black and white, right or wrong – did it happen or did it not? – because it’s easier.

If you said something will happen and it happens, you were right. If you said it will happen and it doesn’t, you’re wrong. That’s how people think, because it requires the least amount of effort.

Every investor is making a bet on the future. It’s only called speculation when you disagree with someone else’s bet or time horizon.

When there are no recessions, people get confident. When they get confident they take risks. When they take risks, you get recessions. When markets never crash, valuations go up. When valuations go up, markets are prone to crash. When there’s a crisis, people get motivated. When they get motivated they frantically solve problems. When they solve problems crises tend to end.

Good times plant the seeds of their destruction through complacency and leverage, and bad times plant the seeds of their turnaround through opportunity and panic-driven problem-solving.

One of the Navy SEALs from the Bin Laden raid wrote a book about his life in the military. Technical skills are important to be an effective soldier, he wrote, but “one of the key lessons learned early on in a SEAL’s career was the ability to be comfortable being uncomfortable.” Same in investing.

Collaborative Fund

Best of luck to anyone reading this. Just remember, you can sell your entire portfolio to avoid further losses. You aren’t guaranteed to participate in the recovery. You would have to time the market perfectly. A long-term investor is guaranteed to suffer through steep losses but is also guaranteed to reap the rewards of an eventual recovery. Some people do not believe a recovery is coming. Stocks are in the doghouse indefinitely. If you believe this, then yes, you should sell your portfolio. However, you are betting against America’s prosperity, which Warren Buffet has recommended not to do. Do you want to bet against America in the long term? That seems like a losing bet.