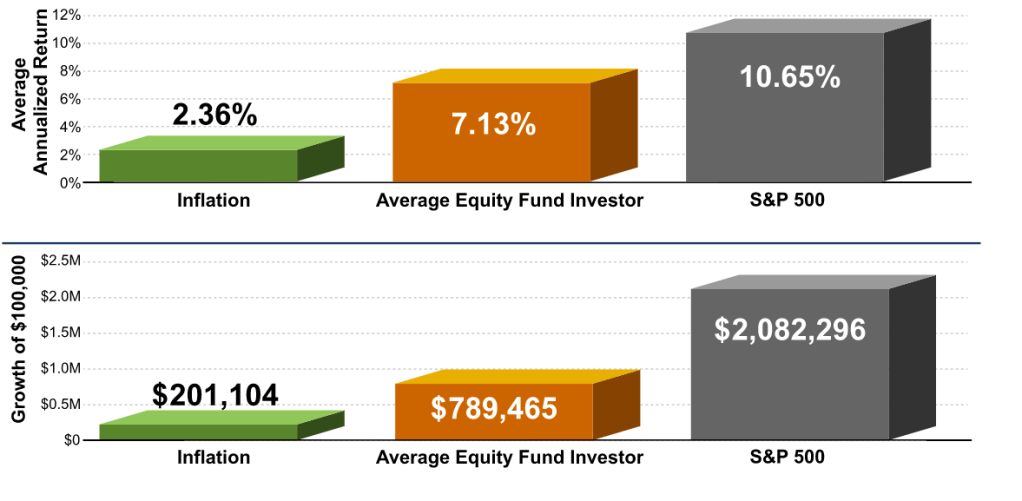

The chart above shows the growth of $100,000 invested between the average equity investor and the S&P 500 Index for the past 30 years (through 2021).

This is one of the best charts to display whenever someone asks if you should sell your entire investment portfolio.

Even the best investors get caught up in market timing or news headline gyrations. The simple fact is a person that invested $1,000,000 30 years ago in the S&P 500 and just held would have a portfolio of over $2 million. The average equity fund investor has vastly underperformed, with a portfolio almost 2/3 lower.

Success in investing is more behavioral than it is intellectual. This is the #1 rule of investing. You must have the discipline, self-control, and commitment to a longer-term plan to succeed in investing. What you invest in does not matter if you lack these behavioral traits. You will likely underperform the market. As Warren Buffett put it: “The stock market is a device which transfers money from the impatient to the patient.”

The depressing fact is that the average investor does not have the mental and emotional strength to ride out downward market cycles. The proof is in the numbers.

Human behavior is not going to change anytime soon. If more people had self-discipline and patience, the world would not need financial advisors, fitness trainers, life coaches, etc.

Here are a few assumptions I have made about investing. I don’t think I will change my mind on these, but you never know:

You will likely underperform the market if you lack emotional stability or patience. The questions of what individual stocks or indexes you invest in are irrelevant until you correct your behavior. The good news is that you do not need an MBA from Harvard to be a great investor. The bad news: human behavior is learned throughout a person’s lifetime. Learning good behavior or unlearning bad behavioral decisions is much more complex than learning how to read a company balance sheet.

If you have the right temperament, you shouldn’t invest in indexes. It is a waste of your abilities. People do not build wealth by seeking the average return of the market. The one negative aspect of indexes that does not get enough attention is that you are not learning about valuations or actual investing.

Investing in fixed-income assets like I Bonds is bad for most people. Investing in something like I Bonds is terrible if you have a long-term horizon. $10,000 in I Bonds will likely return you about $750 in profit after taxes. $750 is not life-changing money. This profit is equivalent to doing a side hustle, which doesn’t require holding $10,000. When people run toward fixed-income assets, it is typically a sign of a scared investor. The lost opportunity cost of tieing your money in something like this for a decade or longer is massive. Those with a high net worth aren’t giving I Bonds the time of day. Putting your first $10,000 in I Bonds is bad for beginning investors trying to build their wealth because this isn’t a wealth-building activity.

Do not worry about hedging. Buy-and-hold investors should not even consider hedging. Until you have a sizeable portfolio in the seven figures, be laser-focused on growing it. Stop copying institutional investors and hedge funds. The games they play differ entirely from what most retail investors should do.

The Stock market is not a giant casino. And investing in stocks is not equivalent to buying lottery tickets. Comparing the two will likely lead beginners not to invest altogether. There is a fundamental difference between betting $10,000 on one spin of roulette vs. investing $10,000 in a company like Alphabet, which has a market cap of over $1 Trillion.

Starting your own business is hard. From LendingTree: “18.4% of private sector businesses in the U.S. fail within the first year. After five years, 49.7% have faltered, while after 10 years, 65.5% of businesses have failed. I admire those who want to start their own business because it is tough to do so. From an ROI standpoint, I would instead invest in public companies led by some of the most innovative people in the world rather than use my capital and build a company from scratch. If everyone had this mindset, we would have far fewer entrepreneurs worldwide. It also goes against the ingenuity of American ideals and prosperity. I find it peculiar that many business owners are admired as go-getters and entrepreneurs, yet stock-pickers are labeled risk-seeking gamblers. Based on statistics, entrepreneurs who start a business from scratch have worse odds of getting a higher ROI than long-term investors.

Watching CNBC can be toxic for your health. You can include all financial news channels. Most financial experts say it is impossible to predict short-term movements in the stock market, yet CNBC brings on people who make predictions on the stock market and the economy in the short term. Much news/data is delayed or irrelevant to your investment portfolio and strategy. Often you are better off holding and doing nothing instead of reacting to every earning report or news headline. My advice is to focus more on the history of financial markets and events and less on forecasts.

Great investing is a lonely journey. Having conviction is difficult when everyone – the media, family, friends, neighbors, and random people on the internet says what you are doing is wrong. Imagine being an investor in Tesla. For years you had investment managers predicting Tesla going bankrupt or the company being a giant scam. Even despite the epic performance of the company, the same critics do not say they were wrong; they just say Tesla investors got lucky. It is important to remain optimistic in the long view. You can save like a pessimist and be worried in the short term but remain optimistic in the long term.