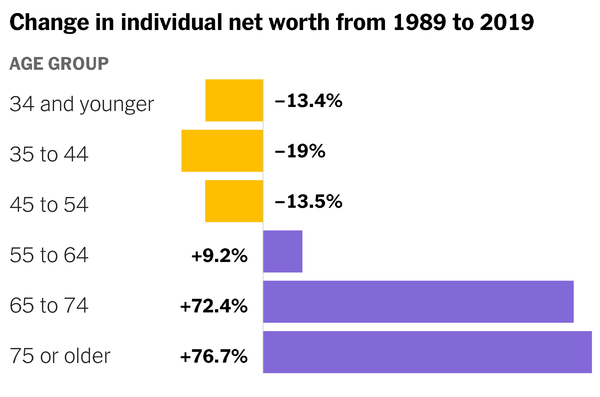

The economy is uncertain. Inflation is raging on. Americans under 54 have less money than adults three decades ago. The journey to wealth-building is challenging; however, investing is one of the greatest equalizers in skyrocketing your net worth. It is accessible to nearly everyone. Not everyone has the time, skillset, or education to become a neurosurgeon. Not everyone can become a senior manager at a Fortune 500 company. Anyone can invest, and the need to do is more important than ever.

For people to get ahead, they cannot keep their cash in inflation-losing savings accounts, CDs, or I Bonds. If you have a finite amount of discretionary funds to grow wealth, why put it in vehicles that cannot beat inflation?

A certain amount of risk is needed to get an edge. Even index investing is not enough.

I look at investing as owning a productive asset or a piece of a business. I specifically look at the underlying assertion of the productivity of that business, the return on cash based on cash flows coming out over time, and the general fundamentals around it. Over time I pull money out of my investments and hopefully get more out of them than I originally put in when I bought them.

Fewer people today look at investing like this. The average investor today holds a stock for about 5.5 months. In the 1950s, the average investor held onto their shares for nearly a decade.

Today more people look at investing as paying x amount for x asset and look to sell it to someone else for y. Many people treat their stocks more like collectibles or poker chips than shares of an actual company.

There is absolutely nothing wrong with this mindset; however, it is clear that this is not long-term investing, which is one of the best pathways to becoming wealthy. I look at my managing my portfolio as operating a business. Typically, business owners do not start a business and make day-to-day decisions to sell it for a profit six months later.

Here is where I would allocate $100,000 today under the heavy influence of long-termism. The average holding period is 5-10 years, probably longer if the company’s fundamentals remain favorable.

$10,000

Revolve Group Inc

Industry: E-commerce/Fashion Retail

Risk: Medium

Holding Period: 5-10 years

Do I already own it? Yes

An alternative company to consider: Lululemon Athletica

In the e-commerce industry, you will have trouble finding a cash flow-positive growing company with no long-term debt. Revolve Group managed through the pandemic and will likely weather a recession better than its competitors. Revolve caters to a higher-income segment, which is less affected by inflation. They will survive while many of their debt-burdened peers will crater, clearing away the competition.

Why am I so bullish on Revolve? They can operate nimbly compared to a larger department store chain like Macy’s or Nordstrom. Traditional apparel retail struggled before the pandemic, so it is no surprise they would have trouble as the economy turned. Revolve has no physical retail presence with a business model that can be modeled globally. They can grow quickly and more efficiently with a concentration on technology, data, and social media influencers.

Revolve advertises where consumers spend most of their time on Tik Tok and Instagram. This digital-first approach strengthens their brand name and allows them to connect with Millennial and Gen Z consumers. Most big-chain apparel retailers spend significant money on traditional media advertisements – magazines, TV, radio, and billboards. In the All-in Podcast, David Friedberg said, “if you don’t naturally have content creation in your blood, you have to go buy a content business, or you are going to die. In the future, all advertising and marketing get replaced by content creation.” Revolve will continue to eat Macy’s and Nordstrom’s lunch while growing its massive social media following, leading to partnerships and collaborations with emerging designers.

More companies will utilize influencer marketing and copy Revolve’s advertising strategy; however, it takes decades, if not more, to develop a luxury brand. The balancing act from being a cool, aspirational lifestyle brand to being affordable to mass consumers is tricky. Revolve knows its core demographic: college-educated women with an income of around $100,000. They target that specific demographic instead of value-oriented customers. By elevating the brand, you can raise prices. Most mid-tier luxury brands like Nordstrom or Macy’s have failed to elevate their brand over the past decade. I believe Revolve is on the path to becoming a valuable luxury brand. The fear of a recession will not cause me to sell my shares; I will likely buy more.

$10,000

MercadoLibre, Inc.

Industry: Multinational Technology/Shipping/Financial

Risk: Medium

Holding Period: 5-10 years

Do I already own it? Yes

An alternative company to consider: Amazon

MercardoLibre, in a simplistic explanation, is the Amazon of Latin America. Mercado libre, envios, crédito, shops, pago, and publicidad means a lot of industries and growth opportunities.

MercadoLibre is a rare company because of the many positive catalysts; investing in the stock is a no-brainer. The more important question is, why would I pick them over Amazon? There is no right or wrong answer; however, MercadoLibre is building a profitable moat. The total addressable market is enormous, and MercadoLibre is creating an impenetrable business apparatus in Latin America. They have a regional/first-mover advantage, giving them an edge over Amazon and Sea Limited.

The stock to buy and hold forever. One of the biggest knocks on single-stock investing is the risk of investing in one company. MercardoLibre is, in reality, six different businesses in multiple countries, all under one parent company.

Barring a leadership change or extreme political volatility in Latin American countries, this is one stock I am not selling.

$10,000

Roblox

Industry: Online gaming/Metaverse

Risk: Medium-to-High

Holding Period: 10 years

Do I already own it? No

An alternative company to consider: Unity Software

Question: Do you think the Metaverse will be massively popular and profitable in the future? If the answer is no, there is no reason to invest in Roblox or other Metaverse companies.

Roblox is widely popular, with a robust number of daily active users. My question for the CEO David Baszucki is whether he wants to prioritize monetizing its users or building a high-quality immersive metaverse-like experience.

Roblox is in its beginning stages of growth, so focusing on monetization would likely be destructive for its long-term growth projection. Roblox is a popular game for younger children that offers a crude metaverse experience. For the stock to be a major winner, Roblox needs to attract an older audience and build a genuinely immersive metaverse-like experience. We are still 3-7 years away from the software, hardware, and technology ready to bring the Metaverse to life. Until that time, Roblox cannot fully monetize its users. Baszucki should focus on tinkering and building the most enjoyable gaming platform.

I was considering buying the stock in the 20-25 price range, so I will be patient and sit on the sidelines temporarily. Given the stock price volatility, it will eventually enter an attractive buy category. Investors that want Roblox to focus on profitability and monetization now are too impatient, and I question their reasons for buying the stock. It would be like Netflix trying to monetize on an amusement park still under construction.

What attracts me to Roblox as an investment is that the environment they have built is very kid friendly and safe. More of their revenue goes towards infrastructure, trust & safety, research, & development. Since their core demographic is minors, it is essential to fund trust & safety to preserve a strong brand name and create a network effect.

Roblox’s technology and brand name are too valuable for the company to go belly-up. At the right price, there is a safety of margin. Worst-case, Roblox struggles and gets sold to a company like Disney, Meta, Microsoft, or Netflix, which creates a long-term floor price of around 10-30. Disney would probably overpay for Roblox right now if they were for sale. The upside for a company like Roblox is very high, creating an attractive risk-reward profile.

$10,000

Meta

Industry: Multinational Technology/Metaverse

Risk: Medium

Holding Period: 10 years

Do I already own it? Yes

An alternative company to consider: Apple

Meta is a wildly profitable business that is stable by most financial metrics. They have no long-term debt. Revenue, net income, and free cash flow are the best for any company worldwide.

For Meta to be considered an actual growth technology company, it must take one step back to take a giant leap forward. Spending on its Reality Labs business will be a money-losing endeavor in the billions for the foreseeable future. The market for the Metaverse is niche at the moment but may be worth over $3-10 trillion by 2030. Losing money now on the Metaverse is necessary for Meta’s future growth.

Going all in on the Metaverse may seem risky; however, it is a risk worth taking for Meta and Mark Zuckerberg:

- They have the cash to burn: Would Meta be better off just keeping their hoard of money or spending it on R&D to find its next growth driver?

- They have the people: Billions of people already use a platform owned by Meta. It would be logistically easier for people with Facebook, and Instagram accounts to go on Horizon Worlds rather than a brand-new platform. Think of it like this: If you are eating at a restaurant and finish the main course but want dessert, would you walk a few blocks away to a different restaurant or order from the menu from where you just finished your meal?

- Myspace and Yahoo: The social networking landscape will change, and Meta has to be prepared for Facebook and Instagram to become less popular. Millennials do not hang out in the same space that Gen X did. Gen Z prefers using TikTok as their networking app of choice. Gen Alpha will likely hang out in a different space from Gen Z. Behavior and preferences change over time.

- Move away from Apple’s thumb: Apple’s ATT framework costs billions of dollars annually in lost ad revenue for Meta. Apple iOS dominates the U.S. market. Meta will not create a competitor to the iPhone, but the Metaverse is a new space where Apple doesn’t have complete control.

Mark Zuckerberg is a ruthless operator. Just because he isn’t likable has nothing to do with the company’s fundamentals. Meta can responsibly fund the Metaverse without going into debt. This gives them a significant advantage over less profitable companies. If the Metaverse becomes a true extension of the internet, the space will have multiple winners, likely including Meta.

The Metaverse is a big opportunity, and already you hear a lot of people in denial about how big it will be. This is another critical aspect of investing: having an open mind. You won’t make money with ideological thinking. Yes, people did say once the internet was a fad, the iPhone wouldn’t get a big market share, and Netflix was overvalued… back in 2003! I am taking advantage of the Metaverse as an investment before the sector soars more than 1,000%.

$10,000

Nvidia

Industry: Multinational Technology

Risk: Medium

Holding Period: 10 years

Do I already own it? Yes

An alternative company to consider: Tesla

If you invest in technology, Nvidia is a must-own company. Nvidia is the most important technology company in the world – not Apple, Tesla, Google, or Microsoft.

- AI infrastructure chips and platforms.

- ORIN Robotics processor: Nearly every company working on AVs uses Nvidia technology.

- NVIDIA Omniverse: The ability to create 3D worlds.

From Evercore ISI analyst C.J. Muse:

“Advancements across in vehicle technologies, data center capabilities, connectivity, and AI/simulation (Omniverse) are enabling a transformation in the automotive industry today, leading to an estimated $2 trillion opportunity from the monetization of car services over the coming decade (largely led by Autonomous Driving and/or Mobility-as-a-Service).”

Nvidia is the most important tech company on planet

Jim Breyer, founder and CEO of Breyer Capital on Nvidia: “they are so far ahead of everyone else in building semiconductor infrastructure for AI and quantum. They are so far ahead of anyone in China or Europe.”

The company is more than about chips. Nvidia is shaping nearly every innovative technology. Any significant pullbacks in the stock should be bought immediately. Nvidia has become the unquestioned leader in innovative AI technology leapfrogging over the competition. It is the best in class in its sector, with one of the top-performing CEOs in Jensen Huang. It will be negligent not to own this stock if you are an investor in technology.

When I began investing, I specifically looked at the best of the best. Invest in the highest quality companies in growing sectors with solid management. This investing style doesn’t always produce astronomical gains as best-of-breed type stocks are typically overvalued; however, this strategy usually wins in the long term.

$10,000

ATAI Life Sciences

Industry: Biopharmaceutical/Psychedelics

Risk: High

Holding Period: 10 years

Do I already own it? Yes

An alternative company to consider: Compass Pathway

Clinical-stage biopharmaceutical companies are not everyone’s cup of tea. Owning these stocks is not for the faint of heart. Atai has a drug called PCN-101/R-Ketamine in its pipeline, a potential game changer for treatment-resistant depression. Imagine a drug that:

- Provides rapid antidepressant effects

- Able to be taken at home and not at the doctor’s office

- Limited dissociative (psychedelic) side effects

A non-psychedelic, rapidly acting antidepressant that reduces depressive symptoms within an hour of administration can last up to seven days. PCN-101 is currently in Phase II of clinical trials, but early results are promising. Atai is Compass Pathways’ biggest shareholder, meaning any breakthrough with psilocybin therapy and trials benefits Atai shareholders.

Atai Life Sciences is backed by billionaires Peter Thiel and Christian Angermayer. I look at Atai more as an incubator and holder of several clinical-stage pharmaceutical companies. The approach is more decentralized and can pay off if the FDA gives these drugs the green light. I am not blind to the risk associated with early-stage biotech companies. That’s why I have my hands in MindMed (LSD focused), Compass Pathway (Psilocybin focused), Atai (r-Ketamine focused), and Field Trip (Ketamine Therapy focused). I am confident at least one of these companies has a blockbuster drug in its pipeline.

Here is a good discussion on Psychedelics from Luke Lango, a senior technology analyst at InvestorPlace. He argued that for Pyschedlics to take off as their category of medicine, they need mainstream consumer destigmatization (which is happening right now) and sound data/science.

The science and data have always been sound for Psychedelics, and global decriminalization in more countries and cities comes with more mainstream destigmatization.

I expect explosive growth in the Psychedelic drugs market. The current market size is around $490 million. By 2030 that market size could reach $4-10 billion. Like with the Metaverse, there will be several winners in this space. I want to warn investors in this space though you need to be extremely patient. I have, at minimum, a 5-8 year investing horizon on psychedelics as an investment.

$10,000

Alphabet

Industry: Multinational Technology

Risk: Low

Holding Period: 10 years

Do I already own it? Yes

An alternative company to consider: Microsoft

Alphabet is a highly well-run and financially stable company. The stock will not likely 10X in the next ten years however, I view them as a ballast to provide stability to my portfolio. I also consider Alphabet as my savings account. In terms of safety, you will not find a safer technology company that provides a consistent growth rate. Alphabet is a cash cow with a clean balance sheet.

Nearly everyone knows how profitable the core businesses for Alphabet are: Google Cloud, YouTube, Traffic Acquisition Costs, and digital advertising. The reason to own this stock is that Alphabet’s Other Bets are paying off. Q1 revenue from Other Bets more than doubled by $440 million from the year prior. I could see these subsidiary divisions of Alphabets eventually driving revenue growth in the long term.

By 2030 Waymo could own the lion’s share global self-driving market, a potential trillion-dollar industry. Alphabet’s drone service Wing delivered 100k packages in 2021. It took around three years to complete 100k deliveries. Six months later, they doubled that to 200k packages in just six months. The great thing about being an investor of Alphabet is that you get these potential growth engines without fearing the company going bankrupt.

Investing in this company is an easy decision. It would be like bunting against the shift in baseball. I am forgoing a double or home run; however, the probability of getting on base is extremely high.

$10,000

Lemonade

Industry: Insurance

Risk: High

Holding Period: 10 years

Do I already own it? Yes

An alternative company to consider: SoFi

I love everything about Lemonade, except that it is not financially profitable. There is the risk of investing in early-stage companies. I am betting that leadership will execute and have a pathway toward profitability.

Lemonade is a full-stack digital insurance company powered by AI, behavioral economics, and driven by social good. Like Revolve, since they are primarily digital, they have a business that can expand quickly. A lot of potential investors with Lemonade look at the U.S market but forget they are available in France, Germany, and The Netherlands. The United Kingdom is likely coming soon, which will be a significant market for Lemonade.

What makes Lemonade so enticing is its secret sauce: Proprietary technology that collects about 100x more data points per customer:

Having this real-time data and predictive modeling—and being a multi-product, multi-market, multi-channel business—means that we can pivot and shift priorities quite quickly. So in Q2, we dramatically slowed our California homeowners business in several locales, while accelerating our Pet business across most states.

The systems we have in place both capture the data needed to train our neural networks, and are built to act on their outputs in real time. Each new policyholder brings fresh data into the model, making its predictions better and sharper. We’re not aware of any other insurer who has these capabilities. And it’s not something that an old-fashioned company could simply adopt and adapt; these tools and techniques are difficult to graft onto a company that wasn’t built with them as a core design principle.

Listening to LTV6

Lemonade is a speculative play because there is no actual proof their technology is superior. Even if it is, there is no guarantee of profitability. Insurance is a very complicated business with a lot of regulation.

Lemonade is a high-risk, high-reward play, but I think it is a smart play. Lemonade’s direct-to-consumer growth has been impressive, but it will need to create more strategic partnerships, like the one they have with SoFi. Companies adding Lemonade Pet or Term Life insurance in their benefits package to offer employees can create user growth in a less costly but more efficient manner. Lemonade has a unique ethos and mission. If they can find like-minded companies to partner with, this can fortify Lemonade’s book of business.

For example, seventy percent of U.S. households own a pet. Lemonade can continue to target individual pet owners. Still, I think there is ample opportunity to partner with ecological-friendly pet companies that can directly offer pet insurance to their employees via their benefits packages.

$10,000

The Honest Company

Industry: Consumer Goods

Risk: Low

Holding Period: 3-5 years

Do I already own it? Yes

An alternative company to consider: e.l.f. Beauty

There is a lot to like about Honest:

- Great brand name

- Mission-based company with a story

- Halo effect of Jessica Alba

- The macro trend is headed toward all-natural, organic, hypoallergenic plant-based products

- Continuously rolling out new products

- Partnerships with Costco, Target, Ulta Beauty, Walmart, etc.

The company is a buy right now, considering the IPO stock price was $16 a share. Honest has a massive opportunity ahead of them. Only 2% of their revenue comes outside the United States, yet 75% of Jessica Alba’s Instagram followers are international. Honest is a growing business with growth in its core products: Diapers & Wipes and Skin & Personal Care.

One problem I see is that investors who primarily focus on SaaS or high-tech growth companies try to evaluate companies in different industries similarly. Nike doesn’t have a $167 billion market cap because of their technology. You can look at Monster Beverage and Chipotle the same way. An investment or business model doesn’t have to be super complicated or even innovative to be a winner.

Honest has a strong brand, a great story, a loyal customer base, and a rockstar pitchwoman. Even with a lot of competition, Honest is still growing, and I would be shocked if they weren’t profitable by next year. Honest is in a competitive space but does well in a recessionary environment. Most importantly, Honest has strong brand awareness yet less than 6% market share in each key category. The stock is too cheap and ignores any growth expected in the future.

$10,000

Cardano

Industry: Cryptocurrency

Risk: High

Holding Period: 10-15 years

Do I already own it? Yes

An alternative company to consider: Ethereum

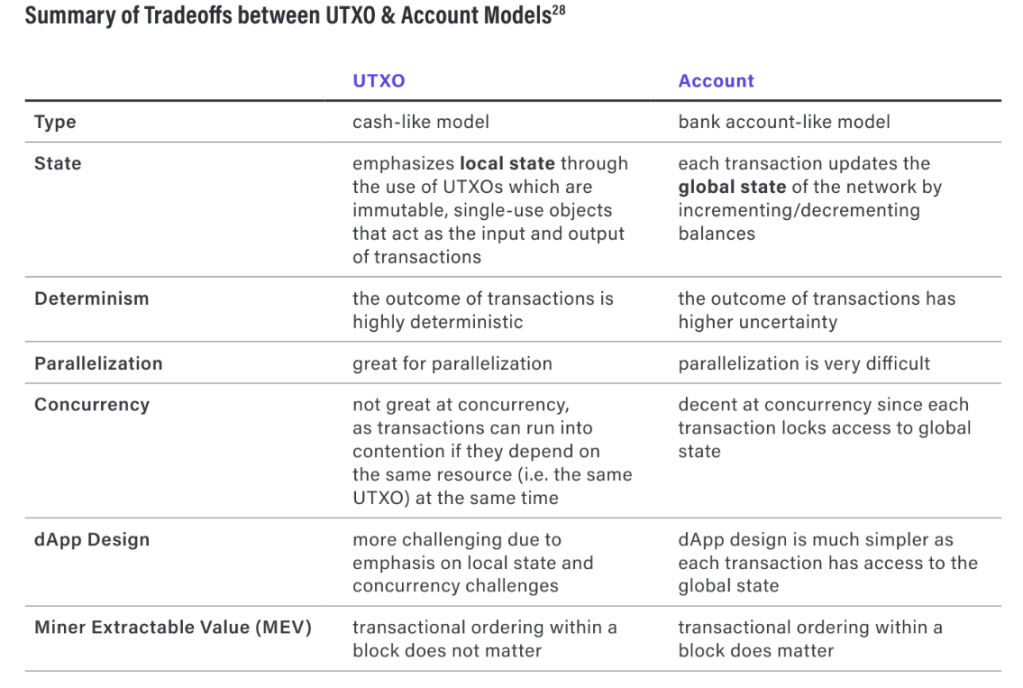

I am intrigued by Cardano because they utilize the UTxO model, compared to the accounts model used by Ethereum.

UTxO explained:

The UTxO model is the unspent balance of a previous transaction, which can be spent in the future.

UTxO chains do not have accounts; instead, coins are stored as a list of UTxOs, and transactions are created by consuming existing UTxOs and producing new ones in their place.

The balance is the sum of UTxOs controlled by a wallet. UTxOs are similar to cash in that they use “change”, and are indivisible (UTxOs are used in full), i.e. if you have to pay $50 and you have a $100 bill (UTxO), you must hand it over in full and receive change in a $50 bill (new UTxO).

Accounting Models in Blockchain: UTxO, eUTxO and Account Models

Look at Cardano as the ability to make crypto transactions without needing to connect to the internet, a cash-based system. This is a significant opportunity in the unbanked market, particularly in Africa and South America.

Cardano is an attractive investment for long-term investors because they sacrifice faster development rollouts to favor higher quality development in their projects. They want to get it right the first time, which is an Apple-like approach. Cardano checks the boxes of a durable cryptocurrency:

- Scalability: Both technical and social

- Security: Founded on peer-reviewed research

- Sustainability: Cardano’s energy use is just 0.01% of Bitcoin

While Cardano slowly rolls out, it can correct the mistakes of other projects that are released too quickly and fail. You have a slow-and-steady roadmap, however, one that is durable and has a long-lasting infrastructure.

The data shows that Cardano’s daily transaction volume is higher than Ethereum but transacting on Cardano is significantly cheaper than transacting on Ethereum. Cardano is a more ecological and efficient cryptocurrency. By the next decade, this will matter. The problems of cryptocurrency today will differ from those in 2030-2035.

I do not believe I am fully knowledgeable enough to speak about specifics regarding cryptocurrency, but there is too much to like about Cardano and its projects to ignore. Kraken released a research report on Cardano in February 2022 piqued my interest.

With Cardano or any other investment, I always ask is if the company or project solving a problem. Are they improving on an existing solution and making it more efficient? With Cardano, the answer is an empathetic yes. Take Baia’s Winery, a small family winery in Georgia (the country, not the state). Baia’s Wine utilizes Cardano’s Blockchain system for authenticity, which creates transparency in its supply chain and fights off counterfeits.

In conclusion, remember the importance of diversity. No matter how optimistic or knowledgeable you are about a specific investment, you don’t know the outcome.

Anybody that says they do is probably full of it. This is the unavoidable risk of investing; however, that does not mean you should avoid investing. Making 10-20 investments and getting just five to six right can pay off 100-fold. I believe at least five of these assets I discussed will outperform the market, and possibly one or two could be a potential 100-bagger.