- Meta acquiring Oculus Rift VR in 2014 will eventually be the most profitable and vital acquisition for Mark Zuckerberg, by a lot.

- Republicans and Democrats have both scapegoated Meta to drive their political agendas.

- The Federal Trade Commission has followed the same ethos as Chinese regulators and is blocking every attempted acquisition Meta tries to make.

- As Warren Buffet said, “diversification is a protection against ignorance.” Zuckerberg doesn’t need to spread his bets around. He has a clear, singular vision to reshape Meta.

- Zuckerberg built Facebook in his dorm room at the age of 19-years old. The odds were against him then. Zuckerberg now has the experience and finances to build the metaverse and make Wall Street look clownish.

At 32, Fidel Castro led the Cuban Revolution and took over Cuba in 1959 until he retired in 2008. At the age of 38, Zuckerberg is conducting a massive undertaking to capture the heart and soul of the metaverse. The battle is already underway. Meta investors like Altimeter Capital CEO Brad Gerstner want Meta to cut back on their metaverse spending. Wall Street says it is draining Meta’s Capex and an unnecessary pet project.

Kevin O’Leary sold out of his Meta position.

Jim Cramer started crying.

Betting against Zuckerberg is Wall Street’s biggest mistake since it gave up on Tesla and Elon Musk.

Meta is on the right track; ignore the media, shareholders even their employees. Meta is at war to create an open metaverse ecosystem vs. Apple’s closed ecosystem. The time for comfort is over. The next few years will be uncomfortable. Employees treating Meta more like a playground instead of a workplace will likely need to update their resumes soon.

Meta needs to double down on the metaverse. It is time to embrace the chaos.

In business, there are no democratic solutions or proportional representation. Competition is cutthroat, especially in the technology sector. A new start-up company that wants even a 1% market share will need to fight for it, even if it is crushed by Amazon, Microsoft, Apple, and Google.

If Meta wants a meaningful share of the metaverse, it must spend aggressively, not passively, to avoid Apple and Google from catching up to them.

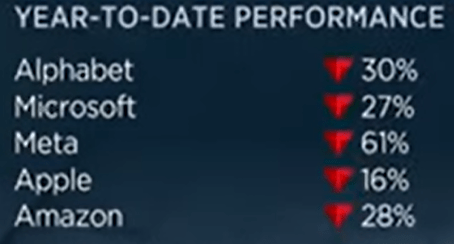

Meta has spent over $15 billion since last year on the metaverse. The losses will likely increase in 2023. Whether they spent $15 billion or only $1 billion, the stock price would have plunged anyway due to the deteriorating macro environment. Okay, maybe not 60% this year, but it still would have been down a lot. There is nothing Zuckerberg or the leadership at Meta could have done to avoid the stock plunge.

Look at Meta and its core advertising business similar to Amazon’s core e-commerce business. Meta is looking to create their own AWS. Amazon, without AWS, is a significantly less valuable company.

I am not saying that Meta should ignore or neglect its core business – Facebook and Instagram. Meta’s core businesses are safe for the next 3-5 years, but the days of being a high-growth company are over if they focus on their social media platforms.

Meta has been hampered by Apple Inc’s privacy changes to its iOS platform, allowing users to opt out of data tracking or Apple’s ATT framework. They are also experiencing fierce competition from TikTok. These headwinds aren’t going away.

Apple is very much like a mafia boss. They wield tremendous power, influence, and control with their app store. Apple, unfortunately, has created a hostile environment, pissing off companies like Meta, Snap, Epic Games, and Spotify with their 30% Apple Tax. Tim Cook holds tremendous political influence and control. Apple is the most owned stock by members of Congress. It is not surprising how the Federal Trade Commission seems more focused on stopping Amazon from acquiring iRobot or Meta from purchasing a startup VR fitness app. Where is the action to prevent Apple’s app store monopoly?

Privacy changes by Apple and competition from TikTok are sealing Meta’s fate to a slow death, just like what happened to Yahoo. That’s why the metaverse is essential. Zuckerberg is trying to create a growth engine where they control their destiny, not Apple.

What Gerstner and other Meta investors are getting wrong about Meta is based on two flawed arguments. They first argue that Meta should heavily focus on improving its core businesses. As a long-term investor, that is a terrible idea. Sure, beefing up Facebook, Instagram, and WhatsApp can help improve EPS margins and elevate the stock price in the short or medium term, but more is needed to address the long-term outlook.

Making incremental improvements to Facebook, Instagram, and WhatsApp is the equivalent of rearranging furniture and remodeling a house. The problem is the house of Facebook and Instagram itself is slowly sinking. Zuckerberg needs to pivot and build another home or universe in the metaverse. Making another world will require time, money, and, most importantly, vision.

The social media industry is no longer investor-friendly, and unpredictable Facebook needed Instagram in 2012, but the landscape is much more competitive now. TikTok is having its moment, but eventually, an even better platform (perhaps BeReal or Gas) will gain prominence, further deteriorating Meta’s market share. These headwinds are irreversible, and the sector is getting more toxic.

Does Zuckerberg need to be more of a caretaker and manage Meta until they get disrupted or lead them as the preeminent technology company of the world? The latter requires Meta to continue to pour money into the metaverse and focus on innovation rather than pleasing short-minded investors who want to make a healthy ROI over the next few years.

Investors’ second flawed argument is that the metaverse is an unknown pipedream and not guaranteed to drive revenue for Meta.

Meta seems to be making steady progress with Quest Pro and Horizon Worlds, but the current project is still crude. Palmer Luckey, the founder of Oculus, stated, “it is terrible today, but it could be amazing in the future. Zuckerberg will put the money in to do it. They’re in the best position of anyone to win in the long run.”

Of course, it looks a bit clunky and awkward, but the metaverse today is not the metaverse in 2032, and that metaverse will be different in 2042. We have seen plenty of examples of what happens when big companies enter emerging markets too late or unprepared.

Microsoft Zune 2006

Microsoft Kin 2010

Google+ 2011

Amazon’s fire phone 2014

RIP

My goal is not to own shares of Meta and sell them 10-20% higher in one or two years, like most investors. I want to own shares of Meta and sell them 2,000-3,000% higher in the next ten to twenty years.

If Zuckerberg starts listening to popular opinion, Meta will end up just like Yahoo, which didn’t have an alternative growth lever. Zuckerberg must maintain that founder’s vision, not just operating Meta but growing it exponentially.

It is laughable how Wall Street is betting against Zuckerberg again. All he did was create the number-one social media website in the world. Zuckerberg is a founder, not an operator like Tim Cook or Sundar Pichai. Founder-led companies are rare breeds because founders often see the company as an extension of their legacy, which motivates them to do what’s best in the long term. Meta has that edge, and Wall Street is laughably discounting it. Cook is not an innovator. Zuckerberg is. Zuckerberg is a builder, while Cook is a manager.

Meta needs to embrace its start-up roots and become disruptive again. People generally have trouble equating investments with exponential ideas. Wall Street fears uncertainty and embraces certainty, with the metaverse representing much uncertainty. Wall Street invests in the way they want the world to work rather than how it actually works.

Many seasoned Wall Street analysts are very good at analyzing events that have already happened. It’s easy to evaluate a quarterly result, as it is old news. People are terrible at predicting the future, and for some dumb reason, Wall Street thinks the future is easier to predict than in the past.

Morgan Housel wrote an excellent article about probabilities and numbers here:

“There are about eight billion people on this planet. So if an event has a 1-in-a-million chance of occurring every day, it should happen to 8,000 people a day, or 2.9 million times a year, and maybe a quarter of a billion times during your lifetime. Even a 1-in-a-billion event will become the fate of hundreds of thousands of people during your lifetime. And given the media’s desire to promote shocking headlines, you will hear their names and see their faces.

A 100-year event doesn’t mean it happens every 100 years. It means there’s about a 1% chance of it occurring on any given year. That seems low. But when there are hundreds of different independent 100-year events, what are the odds that one of them will occur in a given year?

When eight billion people interact, the odds of a fraudster, a genius, a terrorist, an idiot, a savant, an asshole, and a visionary moving the needle in a significant way on any given day is nearly guaranteed.“

When analysts say Meta has a 1% probability of succeeding in the metaverse, they are full of it. Technological growth is not linear and almost impossible to predict.

I encourage people to save and archive articles today, predicting the metaverse being nothing more than a fad.

Now go back in before 2007 and read articles about Apple’s phone:

“The Apple phone will be exclusive to one of the major networks in each territory and some customers will switch networks just to get it, but not as many as had been hoped.

As customers start to realise that the competition offers better functionality at a lower price, by negotiating a better subsidy, sales will stagnate. After a year a new version will be launched, but it will lack the innovation of the first and quickly vanish.

The only question remaining is if, when the iPod phone fails, it will take the iPod with it.“

Why the Apple phone will fail, and fail badly

“The problem here is that while Apple can play the fashion game as well as any company, there is no evidence that it can play it fast enough. These phones go in and out of style so fast that unless Apple has half a dozen variants in the pipeline, its phone, even if immediately successful, will be passé within 3 months.“

Apple should pull the plug on the iPhone

The people that said the iPhone would fail or that consumers would not pay $1,000 for a phone without a keyboard aren’t dumb. The problem is consumer behavior and technology are dynamic. The metaverse is still 3-5 years away. Seamless integration will happen when the software and technology are ready. After that, more advancements will stack on each other.

There will be a time when the metaverse will have widespread adoption. Those who think the metaverse is just a gaming market opportunity should see the bigger picture. The metaverse market is valued at $50-100 billion today and could be worth more than $5-10 trillion by 2030. Think of everything you do online – gaming, shopping, watching videos, zoom meetings, etc. If you make all those things into virtual reality, where the immersive experience is not just comparable but better than real life, that is what Meta is trying to capture, and Wall Street doesn’t understand.

Think about zoom meetings. They are convenient but lack a personal touch where you cannot make eye contact. I prefer face-to-face interactions, but they can be logistically challenging. If a business meeting in the metaverse can re-create those natural interpersonal dynamics without being there in person, that’s easily a market size of over ten trillion. You can apply that to dating, gaming, and classroom education; the possibilities are endless.

As Peter Thiel said: “the best startups might be considered slightly less extreme kinds of cults. The biggest difference is that cults tend to be fanatically wrong about something important. People at a successful startup are fanatically right about something those outside it have missed.”

The metaverse is a future revenue producer that can bring in more than Facebook, Instagram, and WhatsApp combined. For Meta to win the metaverse, Zuckerberg needs to lead maniacally. The way Steve Jobs led Apple to introduce the iPhone and Musk led Tesla to introduce the Roadster. Zealots tend to run highly successful founder-led companies, and Zuckerberg needs to embrace his inner Jobs and act more like a tyrannical dictator.

I advocate our government as a democracy; however, most workplaces do not operate like a democracy. Democratic leadership is not a successful model in high-growth tech companies. Jobs’ leadership at Apple was akin to Fidel Castro or Kim Jong Un than Barack Obama.

Going all-in on the metaverse instead of dipping their toes in the water is necessary for Meta to win. The Cuban Revolution could not have happened Fidel Castro had tried to negotiate peacefully with Cuban President Fulgencio Batista. By cutting back spending to the metaverse, Zuckerberg would admit defeat, and Meta would become the caretaker for legacy social media.

During Meta’s most recent conference call, Zuckerberg sounded like the voice of reason; passionate and confident. Wall Street analysts were the ones who appeared confused, providing dizzying lazy narratives on why Meta had it wrong.

The battle for the metaverse is happening right now, and companies like Apple and Meta are fighting for control. My advice for current investors of Meta, get out if you cannot handle the volatility. Put your money in more mature, stable companies like Alphabet or Apple, which operate more to the expectations of an investment management company. These companies are fine, but that strategy can lead to complacency and laziness. Meta’s approach is poised to capture a large share of the metaverse. A piecemeal approach toward the metaverse means less of a windfall for Alphabet and Apple.

Many people in the government and media desire Meta to fail and are openly rooting for it to happen. If Meta is harmful to society, why invest in it? I invest in how I believe the world works, not how it should work. It is also important to remember the stock price is not an accurate indicator of a company’s health, stability, and growth. Stock prices are based on perception, expectations, and sentiment, especially in the short term.

Zuckerberg is acting with great valor, while Wall Street is motivated by short-sided greed. Meta may fail; epically, however, my money is on a founder who will surpass Jobs, Bezos, and Musk as the greatest entrepreneur of our time.