“If you are working on something that you really care about, you don’t have to be pushed. The vision pulls you.”

Steve Jobs

Many of the best companies are born during tough times. It feels like we are in a macroeconomic depression.

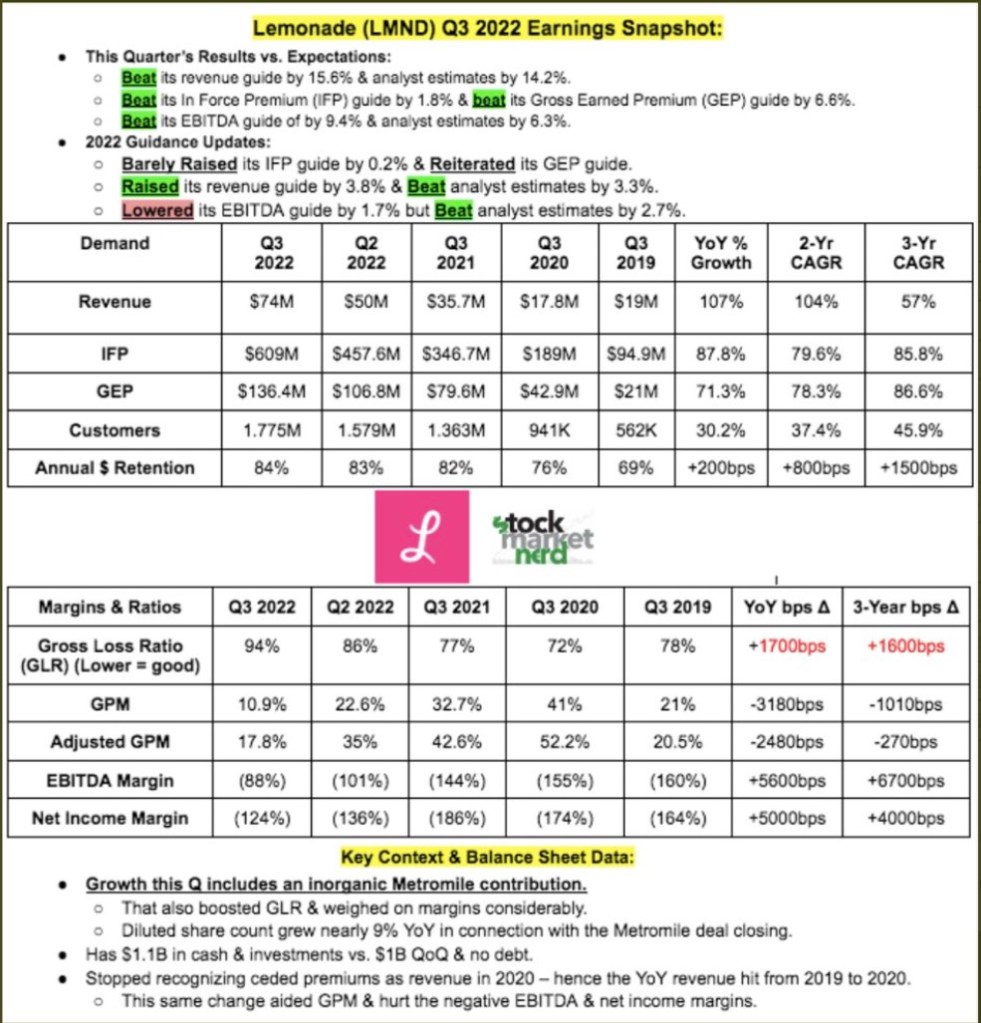

For Lemonade investors, you have to be comfortable being uncomfortable. Currently unprofitable and not forecast to become profitable over the next three years.

That is not new.

The stock will suffer because there isn’t a short-time pathway toward profitability. In a market like today, unprofitable companies get punished, especially with the ongoing inflationary pressure.

I’m highly confident that at some point in the future — it might be six months or three years — we’re going to look back at some point over the next few months, and we’ll say, ‘that was a phenomenal time to buy Lemonade.’

Every investment opportunity has risks. You have to assess if the risk is worth the reward. Sometimes the risks are either exaggerated or hidden. Some companies can overcome risk, while others can’t. An investment in Lemonade is worthwhile for the potential reward. I could see this being the start of something big.

The good news:

The story is simple. Lemonade will either realize the economies of scale or not. To achieve this, they must continue to grow. The good news is customer growth is scaling nicely.

Where Lemonade shines brightest: Gateway policies

Lemonade is among the leaders among all insurance companies in acquiring first-time buyers of renters insurance, especially if they are under 35 years old. The growth in pet insurance is also impressive.

The growth rate for these gateway policies is very positive, but renters and pet insurance are just appetizers for Lemonade’s growth. These businesses are niche, and customer churn is high.

Renters and pet insurance have to be looked at the same as the rice and asparagus of insurance policies. Nobody eats rice or asparagus by itself, but when eaten with steak, chicken, or mac and cheese, it creates a perfect synergy. Lemonade renters and pet insurance policyholders will bundle more policies together as they become available. If they need term insurance, it is available. Lemonade has a 300k waitlist for Lemonade car without advertising. Most of those on that waitlist are in the Lemonade ecosystem.

Customer growth has been consistent and steady. I expect that to continue as they enter more markets. When Lemonade grows with more 2-4-product policyholders, you will see the flywheel spin.

Evolution of a policyholder at lemonade:

$60 a year: Renters Insurance

$600 a year: Renters, Car, Pet Insurance

$6,000 a year: Home, Car, Pet, Term

The bad news:

I fully expect loss ratios to fluctuate in the short term. Lemonade is an insurance company that isn’t profitable. Not what you want to hear, but they are a newer company. I don’t hold it against them, just as I don’t hold it against SoFi or Block for being unprofitable banks. It is about the future forecast.

That being said, any catastrophic natural disaster like Hurricane Ian will have a more crippling effect on Lemonade’s balance sheet than a more stable insurance company. A rise in claims will hurt any insurance company’s bottom-line results, but for Lemonade, the cut will be felt deeper since they are still trying to diversify their business book.

Lemonade home and car are low frequency-high severity products. When paying out claims for home and car, the payouts can be crippling. It creates a double-edged sword. The juicy TAM and profits are in car and home insurance, but so are the expenses and payouts.

The question remaining:

How to determine if Lemonade will be a big-time winner: If their technology – LTV models, leveraging AI and machine learning can lead in the long run to better underwriting results.

A natural event like Hurricane Ian can push insurance companies to the brink of bankruptcy. How Lemonade navigates through this in the future will determine if they succeed.

From Q3: Total Customers: 1,775,824. Premium per customer: $343. As the customer count grows and more products become available, the premium per customer should steadily increase. As this happens, the LTV Models and AI provide better predictive data, leading to better underwriting. The result is providing more desirable customers with less expensive premium costs and riskier customers with more expensive premium costs.

That is it. Lemonade’s stock will likely go sideways in short to medium term. It may even go down significantly. It might take several quarters for Lemonade to hit its stride fully, but the groundwork now will be unlocked and prove significant in time.

Expenses may continue to grow, but if Lemonade can gain exponential customer growth, that will be the key to unlocking a network effect. If Lemonade gets a network effect, revenue growth will far exceed expenses.

I could never see myself selling Lemonade stock anytime soon because the potential reward is so big. The company could 10x, twice, and still have a small share of the overall insurance market.

Lantern Consciousness and First Principles Thinking

Many investors are looking at Lemonade as a big loser, which is fine. The stock is not for everyone. I would argue that narrowly focusing on just a few key metrics can create blind spots and tunnel vision in investing.

Consider the difference between spotlight and lantern consciousness. Spotlight consciousness illuminates a single focal point of attention. This is how most adults think. Lantern consciousness illuminates a broader point of attention. This is how most children think.

Spotlight consciousness is fantastic. Drugs like caffeine and certain medications enhance it better. The problem with spotlight consciousness is that it may not be helpful for long-term investors.

Projecting a company’s stock price in 5-10 years is silly, focusing on the balance sheet or discounted cash flow model. Lantern consciousness in investing can provide an advantage because it doesn’t lead toward a predictable tract. Financial measures and formulas don’t help see where a stock will go long-term, as too many variables can change. Figures can be interpreted differently based on preconceived notions and biases. If a few prominent analysts make a prediction, it shapes everyone else’s perception, leading to a herd mentality. Humans generally want a feeling of belonging, so popular opinions often become the “right” opinion.

What is needed is a more philosophical viewpoint or first principles thinking. This is why investing is hard. Humans desire to belong, and investing requires you to go against the popular decision. When utilizing lantern consciousness and first principles thinking, it allows you to peel the onion and gain a more introspective viewpoint:

In layman’s terms, first principles thinking is basically the practice of actively questioning every assumption you think you ‘know’ about a given problem or scenario — and then creating new knowledge and solutions from scratch. Almost like a newborn baby.

On the flip side, reasoning by analogy is building knowledge and solving problems based on prior assumptions, beliefs and widely held ‘best practices’ approved by majority of people.

People who reason by analogy tend to make bad decisions, even if they’re smart.

Elon Musks’ “3-Step” First Principles Thinking: How to Think and Solve Difficult Problems Like a Genius

Lemonade can be a big winner because they have a culture and model wholly divorced from how legacy insurers operate. Could they fail? Obviously, but what if they succeed? Something improbable is improbable until it isn’t. The insurance market is incredibly inefficient and outdated. A lot of it needs to make more sense to the consumer. Why do male drivers pay higher insurance than female drivers? Simple because of their gender? Why do older drivers pay less than younger drivers? Simply because of their age?

Calculating premiums based on how groups of people within a demographic behave is outdated and unfair. Lemonade addresses many of these inefficiencies because they utilize technology to create a more efficient business model, and if they succeed, the stock has no real ceiling. Again, they can go bankrupt, but from where they were in 2015 to now, the company has made meaningful progress and is still in the early innings of growth.