If you haven’t heard, Coupang is the “Amazon of South Korea.” In many ways, it is out Amazoning Amazon by offering overnight deliveries. If you order something like fresh lobster or a birthday cake before midnight, it will likely show up at your door in the morning or sooner. Think of Coupang like Amazon and Uber Eats having a baby.

When evaluating an e-commerce company, I first want to see if they have a moat. Does the company have a robust end-to-end network, well-developed fulfillment infrastructure, and the technology to integrate it all together?

The high costs of logistics investments are massive in building a moat. As we have seen with Amazon, Alibaba, and Mercadolibre, once you have a moat, you have a safety buffer or a de-risked business.

- A 5-10 year head start over competitors as building an end-to-end logistics network from scratch is expensive.

- A strong logistic network can lead to lower costs, a strong brand name, and a network effect.

- Ability to leverage customers from the core retail business to sell them other products and services.

For the reasons above, Coupang has a moat and is Amazon-proofing its business from the company it copied.

Look at Amazon. To compete with Amazon and pull Prime Subscribers away, you must offer a service or experience significantly better than what is already available. You can only do this with a fulfillment infrastructure and a controlled in-house fleet. Amazon also has a home-field advantage as they know the region of North America better than a company based overseas. Laying down the groundwork to build a logistics network is too capital-intensive for even a large company to commit, making Amazon’s moat likely safe.

Mercardolibre has a moat in Latin America. Amazon has the resources and capabilities to take market share away from Mercadolibre, but that would not likely happen. The largest e-commerce markets in Latin America are Mexico and Brazil. Mexico and Brazil are not among the world’s top ten largest e-commerce markets. Amazon is amazing, but even they have to curb spending. Pouring money competing against a worthy competitor in Mercadolibre would move resources away towards more profitable regions like Germany, UK, Japan, and India.

Look at a fulfillment network similar to a foundation towards a home. Coupang has invested $4.69 billion over the past 12 years in establishing an in-house logistics network. With the home base covered, it gives Coupang the map to expand into Japan, Taiwan, and possibly other markets in Southeast Asia.

Coupang has a similar market cap to Sea Limited, another e-commerce company in Southeast Asia. I prefer Coupang as an investment mainly due to its more substantial foundational base. Sea Limited has already retreated from France and the majority of Latin America. For them, expansion was too much, too quickly. They will likely have to re-invest to fortify their core operations to fend off competition from Coupang and Lazada (funded by Alibaba). This will be more costly now than they had this been done years ago instead of expanding in outside markets. Coupang can take on more risk, while Sea Limited will need to be more cautious.

I don’t see a strong moat for Sea Limited. I am not saying Sea Limited is a lousy investment. However, they are something other than a true e-commerce play, more of a gaming play with Garena, their gaming platform.

Coupang is a good investment due to its strong core logistic apparatus, which gives them the blueprint to capture markets overseas instead of retreating like Sea Limited. They will not overtake Amazon in market cap or even come close. However, analysts are also vastly underestimating the South Korean market.

South Korea is the crown jewel of eCommerce. By 2025 South Korea will likely be the third-largest eCommerce market in the world, behind only China and The United States. That is impressive for a country the size of Indiana. It is a small country that packs a massive punch. Having a dominant market share of South Korea, which has a high gross domestic product per capita, is more significant than having a dominant market share of 3-7 smaller countries in Southeast Asia.

The average Korean worker worked 1,915 hours last year, the fifth-longest among 38 OECD (The Organisation for Economic Co-operation and Development) member countries. Koreans have very little leisure time and will pay a premium for convenience. There is still a lot of juice to squeeze from South Korea. Coupang already launched Coupang financial and Coupang Travel recently. It will be exciting to see if their business can expand into something like Travelocity or a bank. The stock is undervalued just for the growth in South Korea alone.

Suppose Coupang continues to dominate South Korea and finds new regional markets with high urbanization, population density, and a well-developed digital infrastructure. In that case, the stock will be a big-time winner.

I am also making a bet on Bom Kim, the CEO. For an immigrant CEO, Kim is very Jeff Bezo-esk. I am an investor who puts a lot of weight on the company’s leadership. Strong leaders with savvy and grit can flip the script and make the improbable probable. Leadership is not something you can typically spot on a balance sheet or 10-K, but for a growing startup, it matters.

Kim has the rare trait of someone with a long-term vision but is not afraid to pivot in response to unpredictable market conditions. With Bezos and Jack Ma no longer running their empires, Kim has a chance to cement himself as the next great founder-led tech CEO.

Coupang investor checklist:

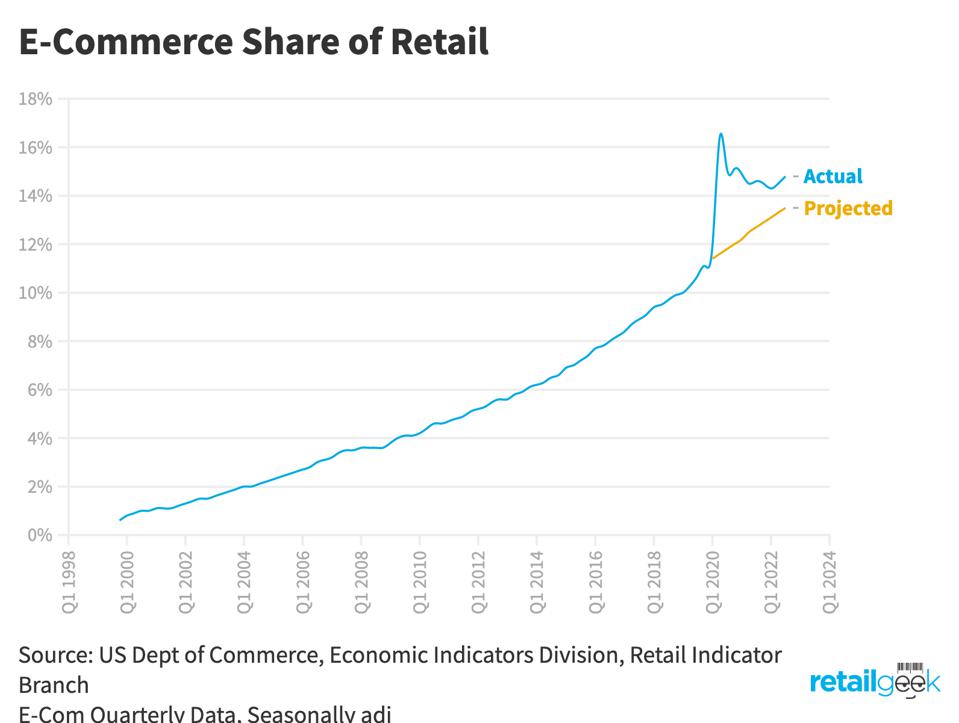

- The overall growth of eCommerce revenue continues to grow.

- Coupang is in the best market for eCommerce sales outside of China and the United States.

- Founder-led CEO with the characteristics of a visionary has a ton of skin in the game.

- It diversifies its business model by entering new industries that complement its core operations.

- Expanding overseas will be costly but could be what boosts this stock to an astronomical valuation.

- Well-known investors like Bill Gates, Stanley Druckenmiller, and Bill Ackman have been backers of Coupang. These investors wouldn’t have taken such a significant position if they didn’t do a lot of due diligence.