How to look at Revolve’s earnings:

Look at 2019 as the last “normal” business year.

2020 and 2021, due to mainly the pandemic, were not standard years and must be considered anomalies. Those numbers might be a glimpse into the long-term future but not something you can expect in the next few years. 2022 although a lousy year with rising interest rates and the Ukraine conflict, should be considered a typical business year.

For a company like Revolve, compare their numbers from 2022 to 2019 instead of the last two years. 2022 was a bad year for the economy, whereas 2019 was a good year. If the crucial numbers like revenue, sales, active customers, and average order value in 2022 are better than in 2019, that’s a strong sign the company is doing well. If the opposite is true, that could be a sign the company is going in the wrong direction.

That’s how I look at growth companies. Revolve for 2022 had almost doubled the number of active customers, total orders placed, and net sales from where they were in 2019. With nearly twice the number of orders, the average order value has increased, a sign of a strong brand.

Bottom line: The 2022 numbers for Revolve are above the 2019 trendline.

Not everything is rosy. Some of the numbers are pretty bad. Macroeconomic issues hurt Revolve as they are not immune to inflation or rising gas prices.

When prices increase, consumers decrease their spending on non-essential items like apparel. There is no question Revolve will suffer, but I predict it will weather the storm of an economic slowdown better than its competitors. Before the pandemic, companies like Nordstrom, Macy’s, and H&M struggled. These high-end department stores have a laundry list of problems. Take Nordstrom, for example. They offer nearly a 4% annual dividend yield, which siphons funds to shareholders. This only makes sense if the business is healthy. This type of dividend for a struggling business is the equivalent of an unhealthy person donating blood. The old guard has a bunch of debt, stores, and employees. Revolve has none of these financial obligations, where its profits go straight towards fortifying its brand and investing in its logistics.

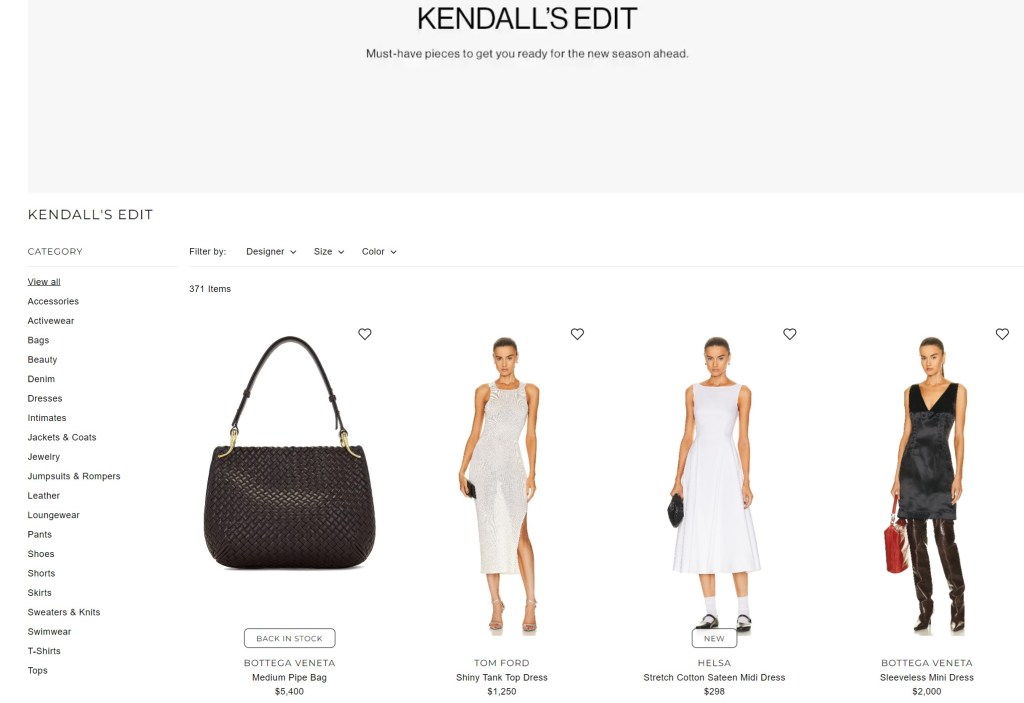

Strong Brand leads to Customer Loyalty + Consistent demand/Profitability

Revolve will emerge as a big-time winner and an industry leader when the economy improves. Like a high-end jewelry brand, Revolve will have consistent profitability, pricing power, and margins. The stock will be a hero based on the brand alone. If they continue to improve their digital infrastructure, it will allow them to create a deeper connection with their loyal customers and eventually create a cost advantage. If Revolve can replicate the Nike playbook, the stock will 10x relatively quickly. The stock remains a solid long-term hold.