I really like Nvidia. This company amazes me with what it can do. It blows my mind.

What many investors underestimate about Nvidia is its importance to technology. Nvidia is to technology what the fire hose is to a fire department.

Nvidia’s GPU tools are used as digital shovels for crypto miners.

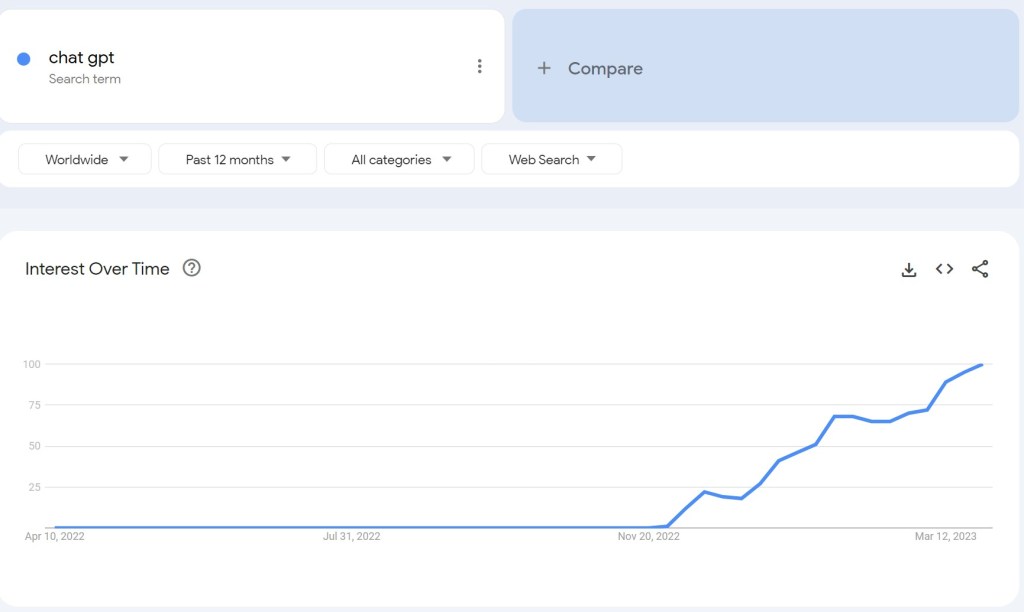

Nvidia’s A100 chips are now the engines used to train ChatGPT and other generative AI.

With any new technological advancements or innovations come new markets and revenue drivers. Whoever the winner in the space is, Nvidia will be there. The players’ names and buzzwords may change, but Nvidia will be there.

Self-driving cars

The Metaverse

Autonomous robots

That’s why you cannot just look at a balance sheet and value Nvidia properly. Their growth potential is nearly limitless. The free cash flow for Nvidia can double in a year. Nvidia’s technology is powering the next big thing you cannot forecast.

The big secret about Nvidia is that it will always be overvalued at any price. You invest in a company like Nvidia for 2028 and beyond. The company and what drives its revenue will likely be drastically different in the future. As an investor, if you do not like roller coasters, there are calmer rides to get on. Nvidia is a high-quality technology company, but its sector is volatile. AI is fast-moving. You cannot map it out in a DCF model. You aren’t valuing Starbucks or Visa. Artificial Intelligence Computing isn’t slow-moving or predictable.

When the stock price falls, you give them the benefit of the doubt, like if Stephen Curry were to go on a long cold shooting streak. The bounce back is inevitable. I am not saying to go out and buy the stock right now, but when you invest in Nvidia, you are investing in a best-in-class company.

Analysis of technological change requires imagination and the ability to quantify unknowable wonders. You will not find this in most financial market analyses. Just remember how often Chat GPT was discussed on Bloomberg or CNBC six months ago.

America will continue innovating based on four factors:

Moore’s law: the theory that the number of transistors you can fit on a microprocessor doubles every two years.

Koomey’s law: the theory that the energy efficiency in computing doubles every two years.

Kryder’s law: the theory that the amount of data you can fit in one inch of disk drive doubles every 13 months.

Shannon-Hartley theorem: As long as you can create channels with greater bandwidth, you can transmit information more clearly and faster. The more bandwidth, which is theoretically unlimited, the better.

Most of America’s tech industry revolves around these four rules. Eventually, when these wind-down, new advances will take place, driving innovation and efficiency further.

With Nvidia, I stress patience. The company was founded in 1993 and nearly went bankrupt in 1999. Owning the stock in the early 2000s may have felt like owning an overpriced gas-guzzling car.

But patience did pay for early investors. Owning $1,000 worth of Nvidia stock back then would be worth over $9,000,000 today. That’s why my investing philosophy consists of holding stocks for the long term and holding them for dear life. Long-term investing consists of holding stocks during bad times and when everyone says it is overvalued. This strategy awards patient laziness. The longer you hold, the bigger your reward.

The buy-and-hold strategy may lack intellectual sophistication, but it works. Wall Street tends to look only 14-28 months out. The average retail investor has an even shorter window. This short-view investing window will not net you 3,000% or more gains.

Salesforce iPod in 2004, and analysts said its P/E ratio was “too high.” The stock has increased more than 30 times in value since then.

People sold out of Google stock in 2009 because its valuation was “too rich.”

People sold out of Amazon in the 2000s because the stock was “too expensive.

If you want a company that optimizes growth, you look at Nvidia. Companies that favor growth are making riskier future bets that may or may not pay off, but when they do, and in a big way, they become the envy of Wall Street.

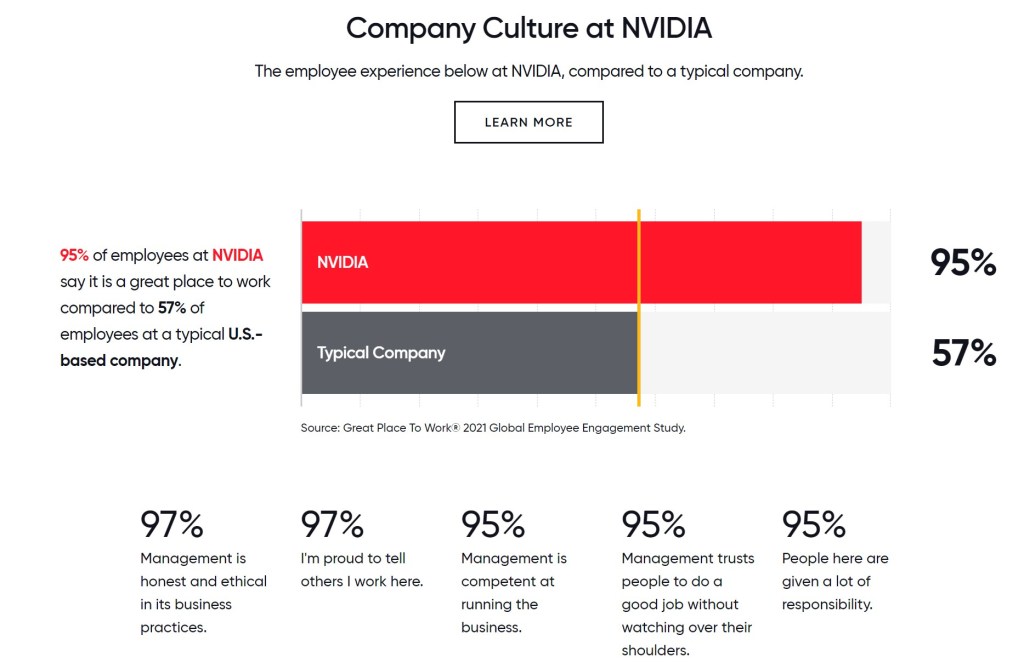

Lastly, I trust Nvidia because I trust Jensen Huang. As long as he is the CEO, I will hold the stock. Huang is an excellent CEO because he sells you on substance, not style and flash. Huang isn’t the best orator or salesman. He’s a hard-working guy who cares deeply for his company and employees.

Nivida is considered one of the best public companies in how they treat their employees, customers, and shareholders. Their employees are loyal, passionate, and dedicated. Huang preaches celebrating failure and intellectual honesty. Many tech companies take too little risk. You will be stuck in the mud if you fear taking risks. Many companies embrace risk, but many of those companies’ CEOS have a pie-in-the-sky mentality.

Jenseng demonstrates a great deal of emotional intelligence. He comes off as incredibly grounded yet relatable:

“I was a very good student and I was always focused and driven. But I was very introverted. I was incredibly shy. The one experience that pulled me out of my shell was waiting tables at Denny’s. I was horrified by the prospect of having to talk to people. You want customers to always be right, but customers can’t always be right. You have to find compromises for circumstances that are happening all the time and you have difficult situations. You have mistakes that you make; you have the mistakes that the kitchen makes. You can’t control the environment most of the time. And so you’re making the best of a state of chaos, which was a wonderful learning experience for me.“

I’m Prepared for Adversity. I Waited Tables.

A CEO like Huang is built for tough times. He understands how to navigate a company during turmoil and press the gas during a boom. I am confident he will lead Nvidia to a $1 trillion market cap as the growth story for Nvidia is still early. Buckle up and enjoy the ride up.