As a proud shareholder of Nvidia since 2016 and a continued buyer of the stock in 2021 and January 2023, the results of the quarter one earnings call were phenomenal but not a surprise.

Nvidia guided for second-quarter revenue of $11 billion, plus or minus 2%; the chip maker has never before reported quarterly revenue higher than $8.29 billion, which it hit in the fiscal first quarter a year ago. Analysts on average were expecting $7.17 billion, according to FactSet, a gain from the $6.7 billion in sales Nvidia put up in the fiscal second quarter last year.

The experts expected Q2 revenue to guide $7.17 billion but now expect $11 billion. The numbers Nvidia reported are truly breathtaking but, once again, not surprising because, as shareholders of Nvidia know, the company is a powerhouse.

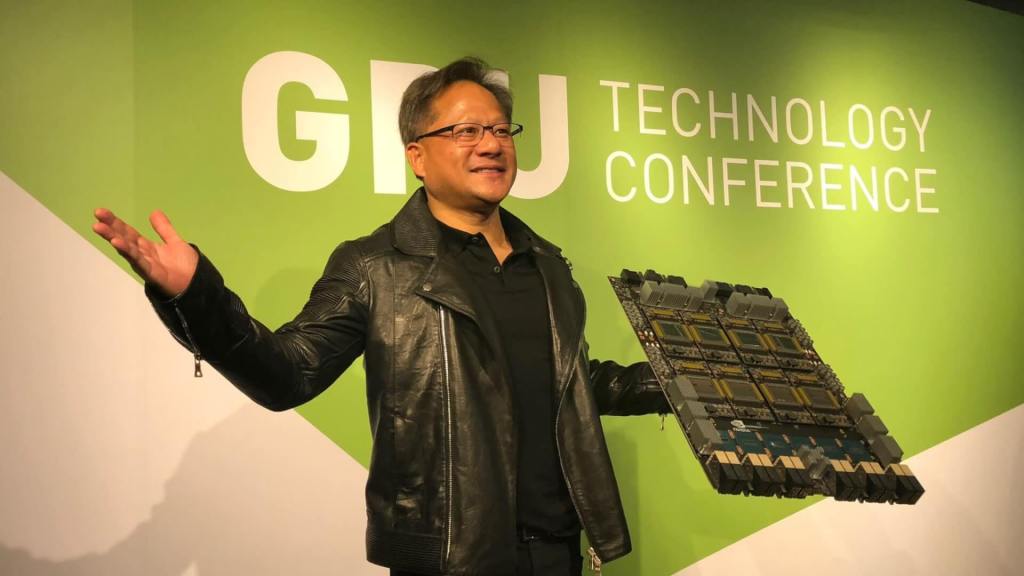

Nvidia is a fundamentally solid growth company. The media has covered this company’s who, what, where, when, and why in-depth over the past 7 years. Jim Cramer re-named his dog Nvidia in 2017. The CEO, Jensen Huang, was on the cover of Time Magazine in 2021. The stock isn’t some private investment that only a few insiders knew about.

The qualitative aspects of the company were terrific back 7 years ago. Understanding that Nvidia is equivalent to the Pat Mahomes of high-growth tech companies requires little due diligence. Buying the stock was a no-brainer, easy investment.

The fundamentals of Nvidia didn’t get worse; they have gotten better. What does change is sentiment, which is almost guaranteed to change dramatically. Negative sentiment is what helped drive the stock down to 108.13 in October.

Here is what investors can learn from Nvidia.

For most investors, you should buy and hold a stock like this. You don’t trade in and out of it, you don’t short it, you don’t use leverage. Just buy the stock and hold it.

It’s a simple strategy, but one many fail to actually execute. Of course, it’s painful during downturns, but it pays off without the stress of constantly getting in and out of the market.

The Power of Simplicity:

A grilled cheese sandwich is absolutely delicious, one of the most perfect yet straightforward things you can cook when made correctly. Too often, when I make a grilled cheese sandwich, the bread is cooked unevenly, and the cheese isn’t oozy enough.

Long-term investing is like a great grilled cheese sandwich. You buy and hold, simple as that. You hold during the tough times. You hold during the good times. Make it more complicated than that, and that’s where investing becomes stressful and more like a game of roulette. Your portfolio starts looking like burnt toast.

Investing isn’t a battle of intellect or having specialized knowledge. It’s mainly about being patient during euphoric and gloomy times. Let’s revisit Apple. Many investors had the vision to buy Apple stock. Many investors had the foresight to buy the stock when they were not the robust profit machine they are now. Those who made the most gains did not necessarily have a higher IQ or were great traders who got in at the right time; they bought the stock, sat on their hands, and held it for a long time.

The problem with investing is that perhaps our human nature makes us think we must be active in our portfolio. The paradox of investing, which does not apply to everyday life, is that more activity in your portfolio does not equate to better performance. Warren Buffett isn’t necessarily a more intelligent person than Carl Ichan or George Soros, yet his net worth is roughly nine times larger than Ichan and Soros combined! Buffett sat on stocks for decades, and Ichan, although still successful, took a different route that could have been more profitable.

The honest truth is that long-term fundamental investing is something most people universally agree is a solid strategy but never can do. Much like eating vegetables or exercising, the Warren Buffet strategy for most people is the best way to invest, but only a few people do it, which will likely remain the same in the future. The story is played out the same way every time. Investors who start consistently make bets that the market will crash, make ill-time short bets, or sit on the sidelines for an extended period underperform and lose money.

Many investors become fearful and panic, unable to hold stocks through even the whisper of a recession. In the stock market, you will also see a lot of arrogant investors who care more about their egos than making money. Both the scared and pretentious investors have the same problem: A lack of calm and patience when holding equities.

The buy-and-hold strategy lacks much sophistication and complexity, but….. it works. This strategy is the best and easiest way to capture the growth of Nvidia, a company with insanely high ratings on Glassdoor and a visionary CEO up there with Bill Gates and Jeff Bezos. Nvidia is about as perfect high-growth company you can find. Nearly unlimited demand, met by astronomical growth numbers. I will continue holding the stock like I have don

Vision to see great opportunities: Not being blinded by market timing or predicting a bear market.

Courage to buy into great opportunities: Be courageous, not fearful or arrogant.

Patience to hold them: The hardest and rarest of the three.

It takes vision, imagination, and a forward-looking lens into what a business can achieve and how big it can get. Don’t look at investing as a black box but as a reductionist art form. From ChatGPT: “Reductionist art refers to an artistic approach or style that emphasizes simplicity, minimalism, and the reduction of visual elements to their essential forms. It involves distilling or paring down the subject matter or visual elements to their most basic or fundamental components, often eliminating unnecessary details and complexities.”

Investors that can boil things down to the essentials and avoid the noise win.