Revolve’s venture into brick-and-mortar retail with its first Aspen, Colorado store was not just a success, but a triumph. The initial pop-up store in December was a mere glimpse of the potential, and the decision to sign a multi-year lease was a resounding testament to Revolve’s ability to exceed its own expectations.

Why does this matter? Revolve, a digital-first business that has been diligently building its brand and e-commerce model, has made a strategic shift. Despite previous comments from earnings calls suggesting no serious plans for retail, Revolve has now embraced the potential of the physical retail space.

But the results were too good to ignore. It wasn’t so much that they sought retail, but demand called, and Revolve answered the call.

Aspen is just the beginning. With a robust digital marketing apparatus already in place, and the success of its first brick-and-mortar store, Revolve is poised for further expansion. This is a pivotal moment for Revolve, as it can now potentially translate its digital brand into a network of physical stores, paving the way for future growth.

This has the potential to increase an already impressive high average order value from the benefits of in-person shopping: impulse buyers from being able to feel and touch the merchandise. The Aspen store has also been a source of bringing in new customers, which is Revolve’s advantage and opportunity.

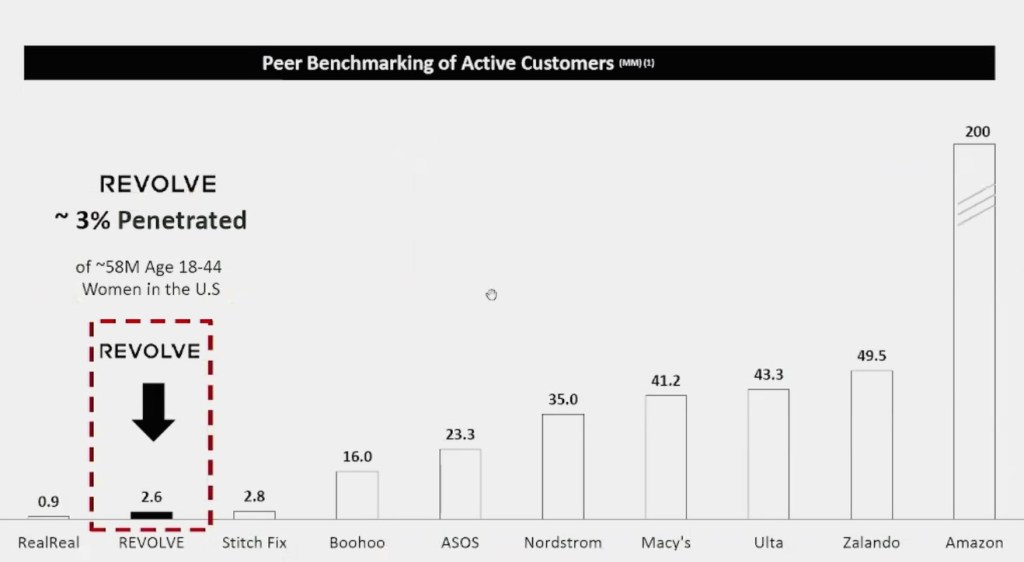

Advantage: Revolve’s customer base is mostly Millennial and Gen Z females. Roughly 60-70% of Macy’s and Nordstrom’s customers are Gen X and Boomers. I am not optimistic about legacy department stores. They have a problematic long-term business outlook. Macy’s is investing heavily in Bloomingdale’s and Bluemercury, but their brand name has declined significantly in the past decade. Nordstrom is doing a better job attracting young customers due to its off-price retail chain, Nordstrom Rack, but focusing on deals and discounts is a race to the bottom, and they will likely lose to Amazon, Walmart, and Target. I never understood Nordstrom’s business model because the off-price division does not complement the flagship stores. A “luxury” brand shouldn’t target consumers on a budget and vice versa.

Opportunity: Macy and Nordstrom need help mightily attracting Gen Z customers. It’s dire. Both companies will likely not show any year-over-year sales growth. Macy and Norstrom will eventually go private and leave the public market soon. It’s not a matter of if but when. These businesses may be able to restructure by going private, but it will likely take a very long time. Going private would also make raising capital difficult and cause a potential departure from key employees. Once the move happens, the capital and employees will likely shift towards a company like Revolve.

Is the Aspen store a signal for immediate retail expansion? I hope not. The focus should remain on building the digital platform and live events—Coachella, The Super Bowl, Cannes, etc. Physical retail should only complement the existing business unless the data overwhelmingly suggests otherwise. Much work is needed to build the brand through product/category expansion and international growth, which is more cost-effective through social media and pop-up events.

It would be premature for Revolve to make an aggressive retail push like Aritizia (3-5 new stores annually by FY27). They also don’t need it. Revolve has a much bigger online presence than other digitally native brands like Figs, Warby Parker, or Allbirds.

As a shareholder, I advise Revolve management to focus on curation rather than expansion. Identify 3-5 unique locations to create a highly personal and immersive experience. The stores should be bright and feature natural wood fixtures, making them engaging places to shop.

Aspen works because it is an affluent city that blends luxury, charm, and scenic beauty. However, a store like Aspen is not scalable to a nationwide rollout. The ambiance is more subtle than in bigger cities like Las Vegas or Miami. It offers lesser-known brands in the high-end category to stand out more to a wealthy clientele.

I have identified some markets for Revolve to explore that can create a potential Aspen effect:

Park City, Utah

Nantucket, Massachusetts

Jackson Hole, Wyoming

Charleston, South Carolina

Carmel-by-the-Sea, California

Key West, Florida

Santa Fe, New Mexico

Entering smaller but highly profitable markets is a strategic move that makes perfect sense. Revolve, armed with ample marketing data, is poised to make prudent decisions and identify a few Aspen-like markets. The goal is to create a small footprint of high-ROI stores that offer a curated collection of luxury fashion brands—a blend of art, immersion, and boutique feel. The key is a luxurious bespoke experience, catering to the target audience’s preference for experiences over value or deal-hunting.

There is still plenty of room to grow. Despite a challenging macroeconomic picture for luxury retail, I haven’t sold any shares. I am confident in the business’s fundamentals and see a long-term pathway for growth and overperformance.