FUD: Fear, Uncertainty, Doubt

“The biggest risk is not taking any risk. In a world that’s changing really quickly, the only strategy that is guaranteed to fail is not taking risks.”- Mark Zuckerberg

Often many of the decisions we make are based on fear. We may not like the decision, but we do it anyway out of fear. We work at companies we may not like for fear of not being able to support ourselves. We get married out of fear of being alone. For investing you would think more people would invest out of fear of not having enough money for retirement however the majority of Americans do not invest anything at all. A big reason for this is due to a fear of loss. This fear could be correlated to loss aversion, which is the tendency for humans to experience a loss with twice as much impact as an equivalent gain. This fear causes people to not invest at all or invest too conservatively to avoid the pain.

The media helps play on these fears as negative headlines tend to garner more attention than positive ones. How many times have you read the word “crash” in a headline when the stock market falls? A stock falling a few percentage points is technically not a crash, yet we see that word being used liberally regarding the financial market. These scare tactics are poisonous for novice investors or those starting on their investing journey.

The truth is stocks going down is quite normal and a sign of a healthy stock market/portfolio. They are inevitable and happen quite happen. Pain is something we cannot avoid in all aspects of life, especially regarding the market. When people say they don’t like volatility, they are saying they don’t like downward volatility. If you take volatility away from the market, you essentially have a savings account. Volatility provides the ability for your portfolio to beat inflation and get massive gains. One of the best analogies I can make to being an investor is to that of being a boxer. In boxing, it is inevitable for a boxer to get hit. Every boxer expects to be hit however they simply cannot stay on defense the entire fight. To win a boxer needs to take an offensive position and throw punches, even if that means an increased likelihood of being hit themselves. A boxer that takes no risk, will never win. A boxer that takes too much risk, might get knocked out. The key is to find some sort of balance

Great boxers and investors:

- Get hit and suffer losses, that is inevitable.

- Try to avoid getting knocked out

- Understand this is a long game. Boxing is 12 rounds. Not every fight will end in a round one TKO. Not every investment will be a 10x gain in one month.

- Make adjustments. Remember Mike Tyson’s famous quote: “Everybody has a plan until they get punched in the mouth.”

- Train, study, and prepare. It is said the fight is won long before the bell rings.

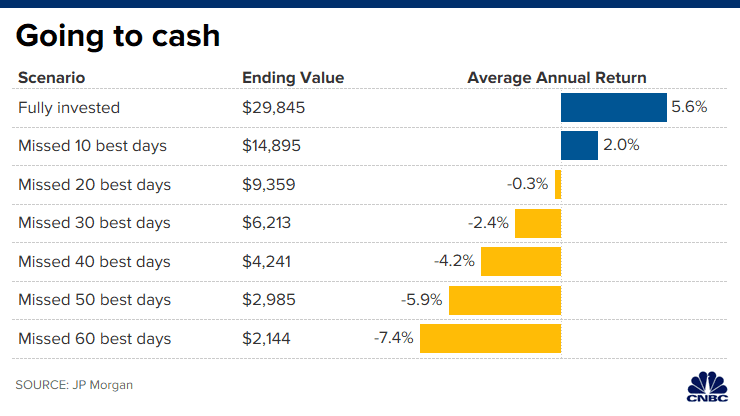

Staying in the market in the long term is important. We simply do not know when a stock will have its biggest upswing. It can happen right after a stock has its biggest downswing. Trying to avoid pain altogether is typically a losing strategy. When you pull out of the market simply to avoid short-term loss, you risk missing out on the best days. Not accepting risk is a big mental hurdle preventing many from investing. The stock market is impossible to predict accurately in the short term and trading in and out of stocks too frequently puts you in a trader’s mentality. Stats have shown the majority of day traders lose money.

Psychology plays a lot in investing and life in general. These barriers are a big reason why people stop or never invest. Here is some general advice that could help you as an investor.

- Evaluate companies based on what you project they will do in the future. Remember, no company beats on earnings every single quarter. Don’t be a prisoner of the moment.

- Understanding the price of the stock may not be the best indicator of how a company is performing or how it will perform in the future.

- Growth stocks like Tesla, Lemonade, Affirm are volatile by nature because they are valued on future potential earnings which are 3-5 years down the road, potentially longer.

- Earnings drive stock prices in the long run. How the company performs, not macroeconomic events or sentiment will determine the projection of the stock price.

- There is no exact formula or metric that will tell you where the stock is headed. Anyone can look up a company’s EBITDA or P/E Ratio. Investing is not a math equation.

My best response to comments rooted in FUD about investing.

I am not a financial expert, I don’t know which stocks to pick.

If stock picking was purely a science, wouldn’t the majority of mathematicians, accountants, and college professors all be millionaires? If you could predict stocks based solely on a formula or chart patterns, why are so many smart people wrong so many times?

The truth is stock picking is not purely a science, it is just as much an art. If you listen to some of the wealthiest investors, they all say something similar. One book I would highly recommend is One Up On Wall Street: How To Use What You Already Know To Make Money In The Market. It is a very quick read and although Peter Lynch wrote the book in 1989, the advice in the book is just as relevant today as when it was originally written.

Believe it or not, retail investors have a major advantage over Wall Street. The majority of retail investors live in the real world, they experience it. Wall Street is a bubble made up of mainly upper-class, older white males with an east-coast bias. Institutional investors have an advantage with transactional data however they have a very antiquated approach to interpreting that data. The advantage we have is in our imagination. We are a diverse group of people with different backgrounds and experiences.

90% of Wall Street is looking at the same data under a herd mentality doing the same thing. There is very little diversity or creativity involved. If you are looking for a fresh idea, the last place you would want to go to is a financial institution. Set up a meeting with a bank or Wealth Management Group and ask them a few questions. They typically provide the same investing approach. If you want creativity, go to an art studio, a music festival, or talk with a fashion blogger. You will probably get more relevant ideas that could spark your next great investment.

We all have unique perspectives, so utilize that in our investment philosophy. Identify change by making casual observations. Consume information to identify a change which could be anything – politics, consumer behavior, science, etc… Based on what you observe connect that to an investment opportunity. We are all experts in some sort of field. Some fields like chemistry, energy, or medicine require more knowledge to understand however things like brands, products, consumer behavior, pop culture, or entertainment are things that millennials and Gen Z are quite knowledgeable about.

If you are going to invest in something regarding social media, why would you listen to the segment of the population that never uses TikTok or Snapchat, or don’t even understand how these platforms work? Wouldn’t you want to listen to the people that use that platform daily?

Developing a quick thesis is not that hard. If you can come up with a few logical bullet points in owning a stock, you will likely hold it longer and know when to sell it when that thesis changes. Here is an example of how to develop reasoning to own a certain stock:

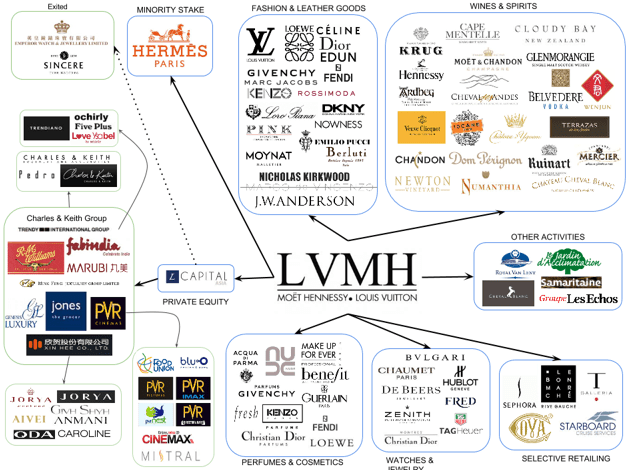

I know what Instagram is. I noticed a lot of luxury brand companies like Louis Vuitton on it. They have a big following. Instagram seems like a great platform for luxury brand companies to build awareness and gain customers. The site is a perfect environment to promote an aspirational lifestyle and luxury experiences.

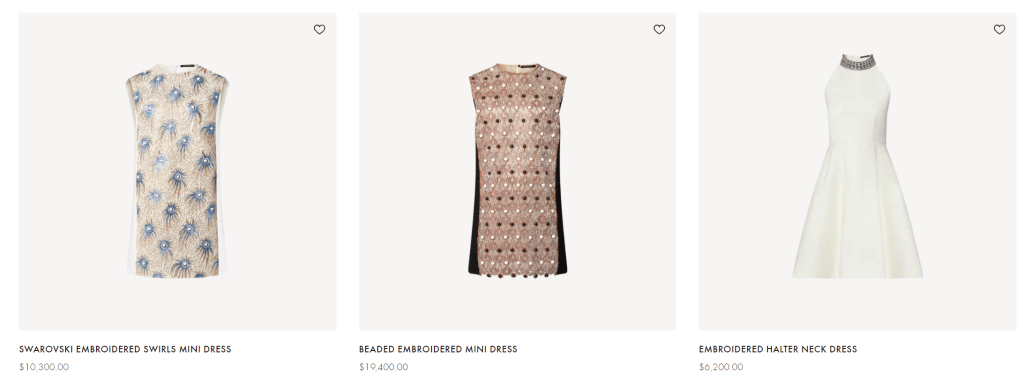

Luxury companies have already learned that Instagram is a driver of sales and have responded by dramatically increasing their social media presence and budget. Based on my research going on Instagram this is evident. When a consumer sees Louis Vuitton’s Instagram page, it’s just as influential as going to the store in person. Just in a day, a consumer can purchase a $2,000 dress, $1,000 top, and $800 hat all in a single purchase based on one Instagram post.

This is why I consider Apple, the Louis Vuitton of Electronics. One of the top five richest men in the world is Bernard Arnault, the head of Louis Vuitton who has no tech background. Consider the cost to make a Tesla or iPhone vs the cost make a handbag or dress. The margins are quite intriguing.

When I see some high-end fashion stores packed with customers I wonder “who is buying all these overpriced items?” Instagram is fueling these sales as multiple posts can create demand for buying multiple outfits and the luxury fashion brands that can best utilize social media will likely see higher revenue growth in the future.

Reasons to Invest in Louis Vuitton.

Reason 1: Pent-up demand from the pandemic. A lot of people have money to spend and a lot of that will go into luxury products.

Reason 2: Social Media platforms like Instagram are fueling the growth of Luxury Brand companies

Reason 3: Inflation proof: If you are already going to spend $5,000 on a Louis Vuitton handbag, is increasing the price to $5,500 going to deter you from buying it? When you decide on buying a handbag, you also need the matching outfit and accessories, which means more spending.

Reason 4: Louis Vuitton has a strong luxury brand name. Biggest fashion brand in the world outside of Nike, clearly number one in luxury fashion, not even close. Unless they do something to hurt their brand name like go into factory outlet malls, that won’t change soon.

FYI I have never invested in Louis Vuitton, but have considered it though. I have used this thesis/thought process to invest in companies like Stitch Fix, Revolve, and Coach. The biggest thing you should ask is why? It is one thing to understand that Louis Vuitton is the top brand name in luxury, but a good investor will understand why it is.

I work too hard. I won’t risk losing it all

If you are that risk-averse, you should most likely invest in low-cost index funds or put a small percentage of your net worth in individual stocks. Only put what you are willing to lose, but also be prepared on missing out on gains. When you are investing in an ETF or Index Fund you are mitigating your losses but also capping your gains.

An ETF can have hundreds if not thousands of stocks inside the fund. An Index Fund is typically designed to mimic the index or benchmark, not beat it. With lower risks comes lower rewards. Single stocks appear to carry more risks however some stocks are conglomerates. Companies like Tencent, Berkshire Hathaway, and Louis Vuitton can be considered well-diversified as they are multiple businesses under one parent company. Given how diverse one company can be, investing in multiple ETFs can be considered a cluttered investing strategy.

The stock market is a giant casino/Ponzi scheme. It is designed for me to lose money

When you think about that statement more in-depth, do you wonder how people lose all or near 100% of their wealth in stocks when in the long-term the stock market goes up? Did they engage in options trading, margins, shorting the market, or buying penny stocks? Ask and you might not get a clear answer. The problem with the Wall Street mentality is that they focus too much on quarter-to-quarter results. It’s as if once they get a decent gain, they already have their eyes on the sell button. Having this type of mentality puts you closer to a gambler rather than an investor. Why sell a stock you know likely will 10x 5-10 years later? If you view stocks as a get-rich-quick scheme then yes, it can feel like a casino. The shorter your investment strategy the more risk you are assuming. Psychology and emotions might take over and allow you to cut corners or do something stupid. We are all guilty of making make bad investments but again, the common theme of investing is that you have to be invested and assume risk to make money. That is the necessary risk to become wealthy.

There is too much risk in the market

If one could time the market accurately, you would likely have at minimum, a billion dollars. There is no such thing as a risk-free stock market.

The amount of risk you subject yourself to in the market is probably more based on your personal qualities rather than external factors. Good traits for investors are typically patience, use of common sense, open-mindedness, humility, a willingness to learn and admit mistakes. If you have ever watched an episode of Gordon Ramsay’s 24 Hours to Hell and Back or Bar Rescue, you see many owners stick with a failed business strategy (stubbornness/close-minded) and ignore good advice (lacking common sense) despite bleeding their business dry.

Stocks can be viewed as an educated gamble where the odds are tilted in your favor. When you engage in more short-term riskier activity, you are mimicking the gambling you see in a casino, which is more luck-based. Patience and time are some of the greatest edges an investor has but many don’t utilize them enough. It can erase big mistakes and turn a small amount of money into a fortune.

My best advice is that when you invest, you should have some sort of plan. Whatever you do, measure the survivability of your plan. The more risk, the less likely that plan is to survive. If one risk can wipe you out completely, it is probably not worth taking. Genius can be defined as seeing opportunities so obvious they go unnoticed by 99% of others. The best investment you make is more likely to come from something you wear or eat every day rather than a company working on advanced genomic testing or hydrogen fueling stations. Allocate your risk accordingly but remember to take risks.

Good

LikeLike

Thanks!

LikeLike