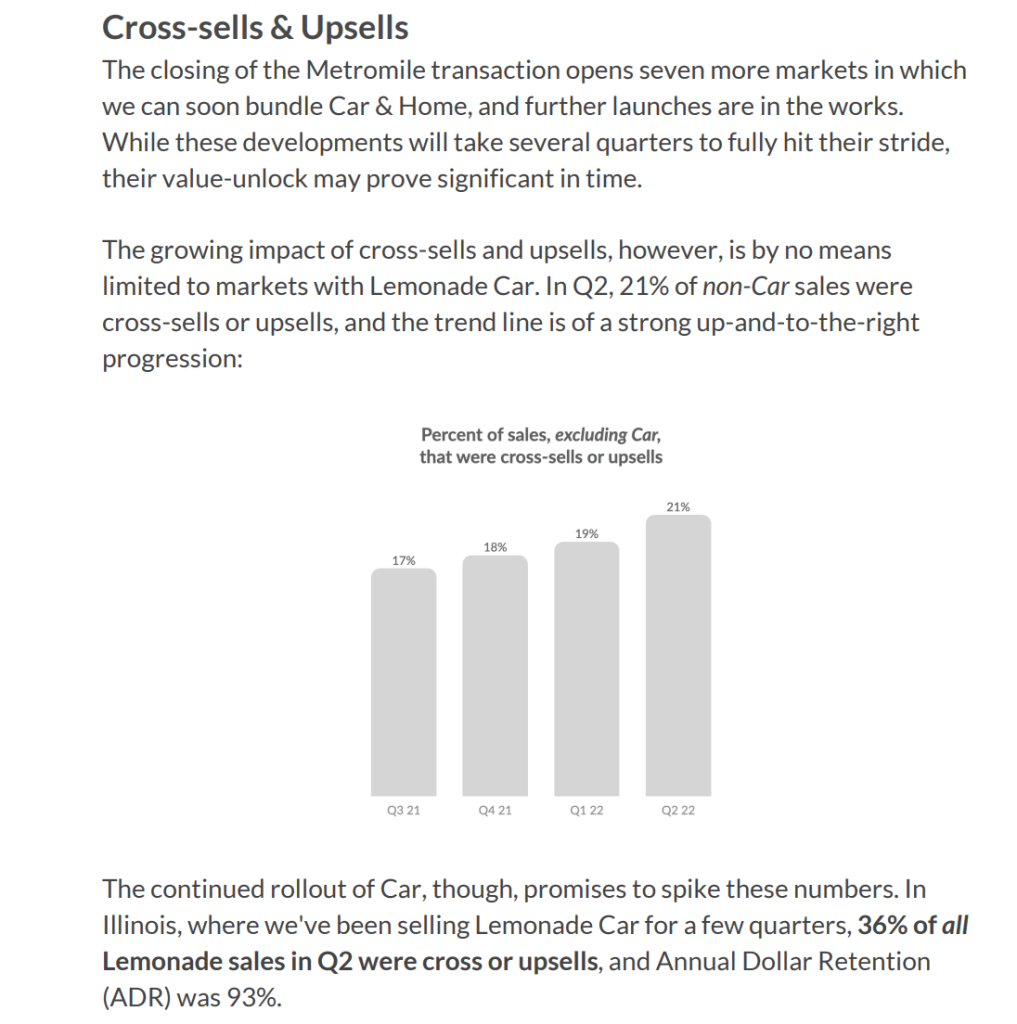

Lemonade just reported Q2 earnings, and the results were impressive. The critical piece I took from the earning call was their sales from cross and upselling:

What this means:

Cross-sells and upsells cost the company nothing. For example, Lemonade insurance is available in Florida for renters, pet, and term life insurance. When they eventually rollout homeowners, condos, and car insurance, they have current customers ready now in Florida to buy those products, just waiting for an e-mail or tweet.

Lemonade will still need to acquire new customers, which is unavoidably expensive, but the cross-selling from every new product rollout creates a pathway toward profitability:

The upshot is that even as we continue to launch new products in new

territories to new customers, we have turned a corner. We expect our losses

to peak this quarter (Q3), and to continue to shrink thereafter, charting a

clear path to profitability.

Increased cross-selling and upselling = increased profits without increasing spending.

Think of it like this: McDonald’s best-selling items are french fries, but who orders just fries? Typically people buy fries with a Big Mac, double cheeseburger, or coke. McDonald’s wouldn’t be as profitable if they just sold fries. Look at renters insurance as the fries for Lemonade.

Renters’ insurance alone won’t make Lemonade profitable or a big winner, but it does provide them with a lot of data for their AI to analyze and become more intelligent. It is also very likely if you need renters insurance, you will need pet, term life, or car insurance, at least one of those products. Customers with renters insurance typically need homeowner/condo insurance when they eventually buy a home.

Customers love Lemonade. They wouldn’t buy more products if they did not like the company. The market has several options for insurance products. For current customers to buy more products from Lemonade, show a loyal customer base and a sticky product ecosystem.

For a restaurant, you need to get customers inside the doors and hope the food, staff, and atmosphere do the rest and keep them coming back. Lemonade needs to follow that same path: Get customers into their product ecosystem and hope what separates them from other insurance companies keeps them as lifetime customers, owning several different policies.

The great news is that Lemonade has a lot of markets they have yet penetrated. The earning call presented fantastic information for the long-term picture. The company is derisking and growing at the same time. If they have all the products consumers need and want, I can one day see Lemonade as the one-stop shop for all things insurance. I will eagerly observe how this company grows in the next few years.