Having insurance is one of the best ways to preserve your wealth. Another way to say this is that insurance protects your downside risk and makes it less likely for you to go into financial ruin.

Did you know that medical bills cause over 62% of all bankruptcies? Health insurance isn’t a cure-all solution since it doesn’t cover all medical expenses. Still, it would be reckless today to voluntarily opt out of health insurance.

Being young and healthy is not a smart reason to opt-out of insurance. The risk of paying the total cost of a health emergency is the equivalent of being trapped in a building with a bomb in it. The explosion will hurt you.

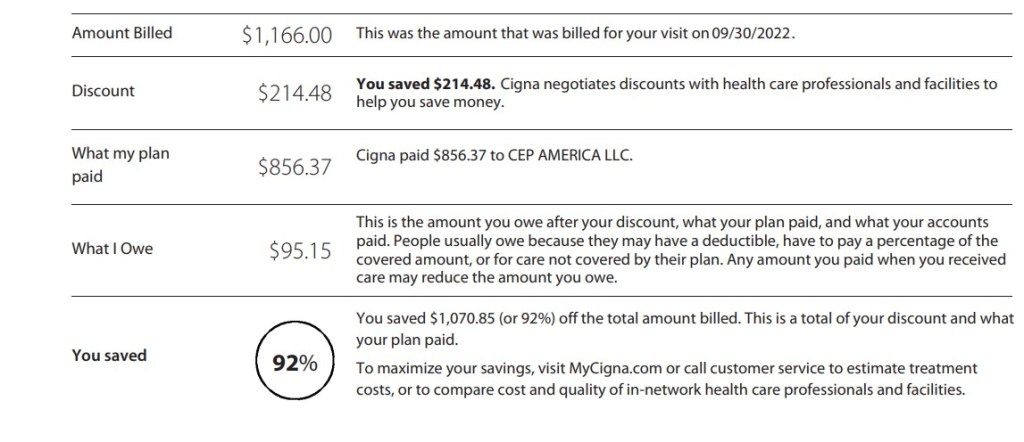

A few months ago, I had chest pains, which could have been a precursor for a heart attack. Luckily, I went to the emergency room, and all my tests returned back as normal. I never found out why I suffered chest pains, but I was still billed $5,716 for a few tests. Insane right? No treatment or diagnosis, just a few bills to find out I didn’t have a heart attack.

Put yourself in my shoes. I am relatively healthy, with no serious medical history or preexisting conditions. Do you avoid a trip to the ER and hope the pain goes away but risk suffering from a heart attack in your home?

I was lucky and considered myself fortunate to have insurance. Is it worth saving $100-200 monthly in premiums but risking paying medical expenses at full cost? No investment or opportunity is worth the uninsured risk. Multiple medical bills can create an avalanche effect, wipe out your net worth, or bury you in debt. Remember, unpaid medical debt doesn’t go away or expire.

Get Health Insurance! Being uninsured is not worth the risk!

- The amount you would save in a decade by not paying premiums ($200 monthly) with no health insurance: $24,000

- The average cost of a hospital stay for one day is $2,873

Main takeaway: Many Americans are doing okay financially but are entirely unprepared to absorb a major financial shock. A cataclysmic health crisis, even a mini one, can crumble your net worth. Staying at a hospital for over a month without insurance will cost you easily over six figures.

I agree that health insurance in the United States is broken and unfair however people have to best navigate through this rigged system with intelligent financial decisions. Just complaining about the system and hoping the government will fix it isn’t a viable solution. Health insurance is one (but not the only) way of not becoming another American healthcare system victim.

If getting good health insurance requires working a part-time or full-time job you hate, so be it. Educate yourself and take prudent steps before soliciting donations on GoFundMe becomes your only option. Ignoring the issue isn’t going to resolve the issue. Crying foul on how rigged the system isn’t a viable solution either; take steps to protect yourself.

Another valuable insurance is renters or home insurance. Many landlords and banks require insurance, but it isn’t required by law like car insurance. Ironically about the same percentage of people who file for bankruptcy from medical bills is about the same percentage of renters that do not have renters insurance.

Many think paying $10-15 a month in renters insurance is a waste of money, even at that low cost. I used to think this way until I was recently robbed.

The robbers took nearly all of my belongings. Luckily I was not injured or required any medical attention. My insurance through Lemonade reimbursed me for my phone, laptop, and glasses. Getting those funds wired from Lemonade provided a great sigh of relief. They made me realize how paying for renters insurance was worth every penny.

Please consider getting renters, pets, car, home, or life insurance through Lemonade here. My experience with the claims agent, Jose, was pleasant, and the process was smooth. Once I provided a copy of the police report, Lemonade immediately wired the funds to my bank account. I couldn’t have received better service from any other insurance company, and I am thankful for being a policyholder through Lemaonde.

Think of insurance as a safeguard for yourself. You do not typically profit from insurance, but it keeps you whole or restores what you lost. I write a lot about how investing can create financial freedom, but with wealth building, you need to start with a strong base or foundation. Insurance is necessary to protect that foundation and can prevent it from collapsing. Investing can create wealth, but insurance can protect it. Insurance will act as a safety net even if you have a small net worth. If you voluntarily opt out of insurance or are thinking about it. I strongly advise you to reconsider. In risk management, not having insurance is one of the riskier decisions you can make.

This is an excellent post! It’s a great reminder of the importance of insurance and how it can help protect us from financial ruin. It’s also a great example of how even small investments in insurance can pay off in the long run. Thanks for sharing!

LikeLiked by 1 person

Thank you.

LikeLiked by 2 people