As an investor, I’ve had a love-hate relationship with Lemonade stock. I loaded up too heavily right after its 2020 IPO, only to regret not buying more aggressively when shares dipped into single digits. If you’re considering this name, approach it with caution—it’s a classic high-risk, high-reward bet. Lemonade remains a young company in its growth phase, far from maturity.

In hindsight, the stock’s wild ride in 2021 was fueled by meme-stock mania. It skyrocketed to $188.30 on January 12, 2021, despite the company having under one million policyholders and no auto insurance offering at the time. That bubble burst spectacularly, but beneath the surface, Lemonade’s fundamentals are showing real signs of improvement.

Back to the Drawing board:

The company has always excelled in technology, innovation, and customer acquisition. Profitability, however, has been its Achilles’ heel. I’d liken Lemonade to a highly touted high school baseball pitcher: a laser fastball and a nasty arsenal of pitches, but zero command on the mound. Without control, even the most talented arm flames out quickly; a great repertoire of pitches means nothing if you don’t know where the ball is going.

For a while, its business model reflected this wildness: impressive growth and customer attraction (the 103-mph fastball and filthy slider) were negated by sloppy underwriting (walks and hit-by-pitches). Critics often hammered the company’s high loss ratio as an unsustainable business model.

Think of Lemonade as a young Roy Halladay or Zack Greinke. Both were first-round draft picks who bombed early in their MLB careers, getting demoted to the minors amid mechanical issues and poor results. But they adapted, refined their approach, and emerged as Hall of Famers. Lemonade is on a similar trajectory.

Rebuilding the mechanics

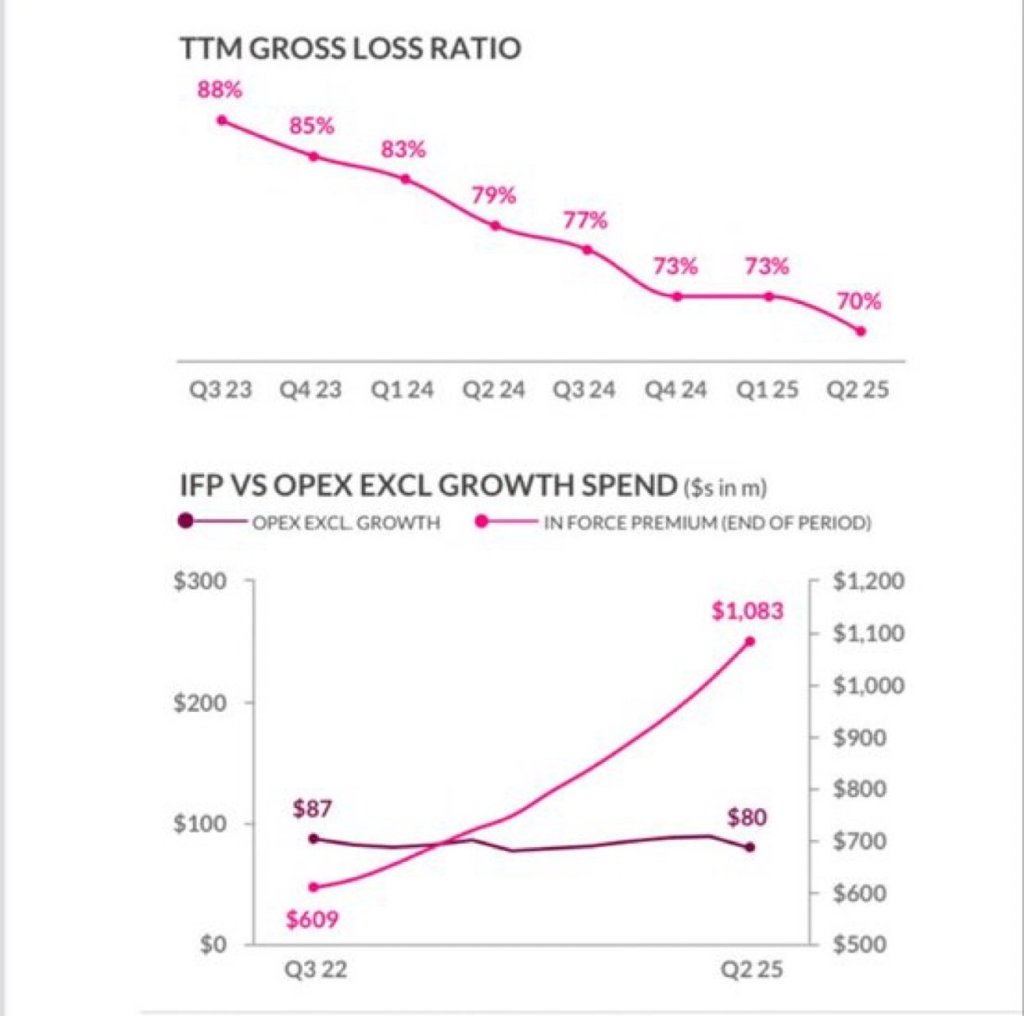

The data over the most recent quarters tells a story of Lemonade tackling its core risks head-on:

- Loss ratios are improving dramatically, signaling better risk management and a tighter command of its underwriting.

- It has slashed its quota-share reinsurance from ~55% to ~20%, meaning it now keeps more of the premium (and risk) in-house.

- After pulling back on its auto insurance rollout, underwriting discipline has strengthened, setting the stage for renewed expansion.

At its core, Lemonade’s business isn’t as complicated as it seems. It’s exceptional at drawing in new customers through its AI-driven, user-friendly platform. If it can continue tightening risk controls, revenue growth should accelerate while losses/expenses stabilize.

The Bull Case Ahead

Wall Street is sleeping on the roadmap ahead. I expect Lemonade to rev up its auto insurance product, expanding beyond the current nine states. New offerings like phone or travel insurance could further juice growth, pulling more users into the ecosystem and unlocking bundling discounts for multi-policy holders.

I’m not hyping this as a sure thing, but my optimism feels more grounded now: rooted in a business that appears primed for scalable profitability. That said, risks abound: Lemonade lacks a deep moat against competitors or economic headwinds, and plenty could still derail it, much like a pitcher blowing out their elbow on a single throw.

Analysts will likely pile in late, chasing momentum rather than leading the charge. I could be wrong, falling into the retail investor trap of being too early or clinging to a thesis that fizzles. Uncertainties remain, but Lemonade looks increasingly deserving of a small portfolio allocation. The bull case could spark explosive upside volatility, especially as AI evolves from infrastructure plays (like Nvidia or Google) to application-layer disruptors. Lemonade’s AI-powered insurance model positions it to capitalize on this shift, potentially delivering venture-like returns in the years ahead. While it’s no Palantir clone, the ride ahead could be like an epic roller coaster.