Searches for the term ‘recession’ have spiked in June and July on Google Trends. More and more “experts” are calling for a recession; some say even a great depression. So many things are going wrong in the world:

- Inflation

- War in Ukraine

- Gas prices

- Tech Stocks are down 50-90%, and it could keep going down further

- Cryptocurrencies are down big, and exchanges are collapsing

- Supply Chain issues

Did I miss anything? Despite all the uncertainty, I am still investing. Life is full of uncertainty, but this is nothing new. Is life more uncertain now than it was when the United States invaded Iraq or during the Cuban missile crisis? What about when Japan attacked Pearl Harbor? I do not know but consider the four most dangerous words in investing: “This time is different.“

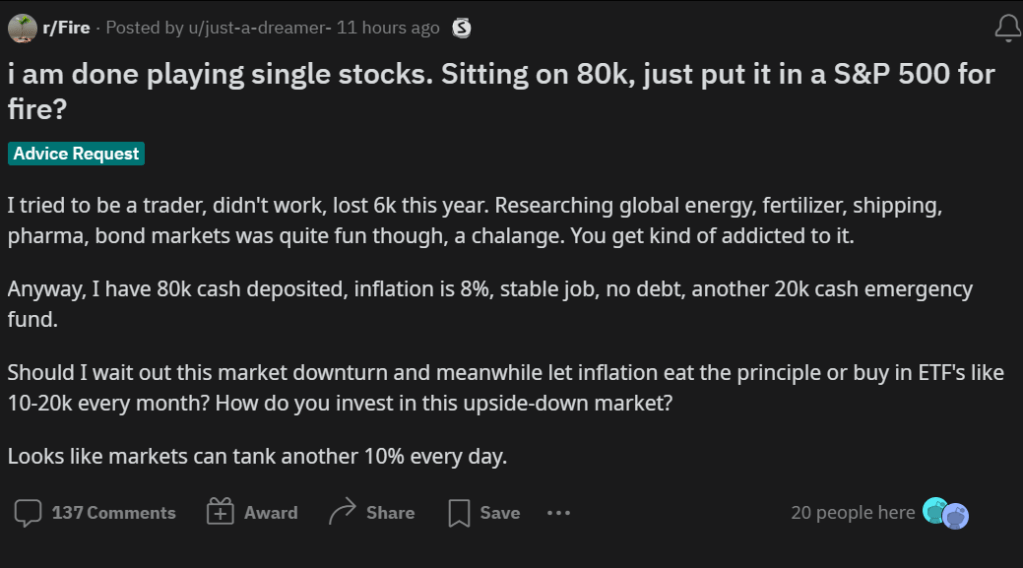

If your net worth has fallen 30% or more because you own stocks Like Netflix or Zoom, I feel for you. Are we at the bottom? I don’t know. Stock prices can continue to fall.

It sucks buying individual stocks for the right reasons (profitability, free cash flow, revenue growth), yet the price goes down…… a lot.

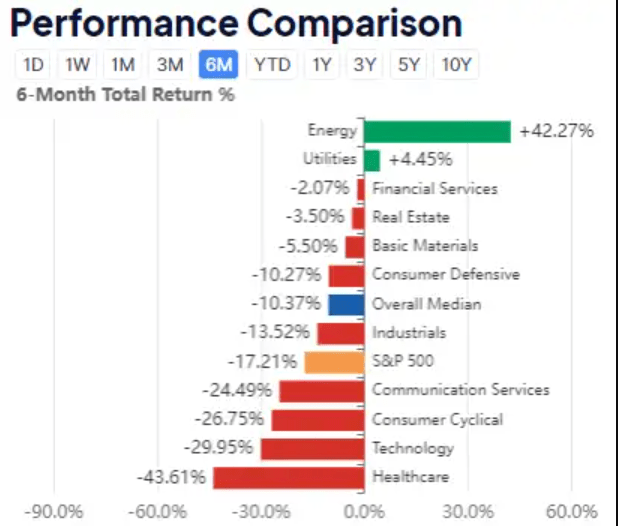

As an investor, not much has gone right. The majority of investors have seen their portfolio kneecapped in 2022. You are probably in the red unless you invested in certain energy stocks or the energy sector.

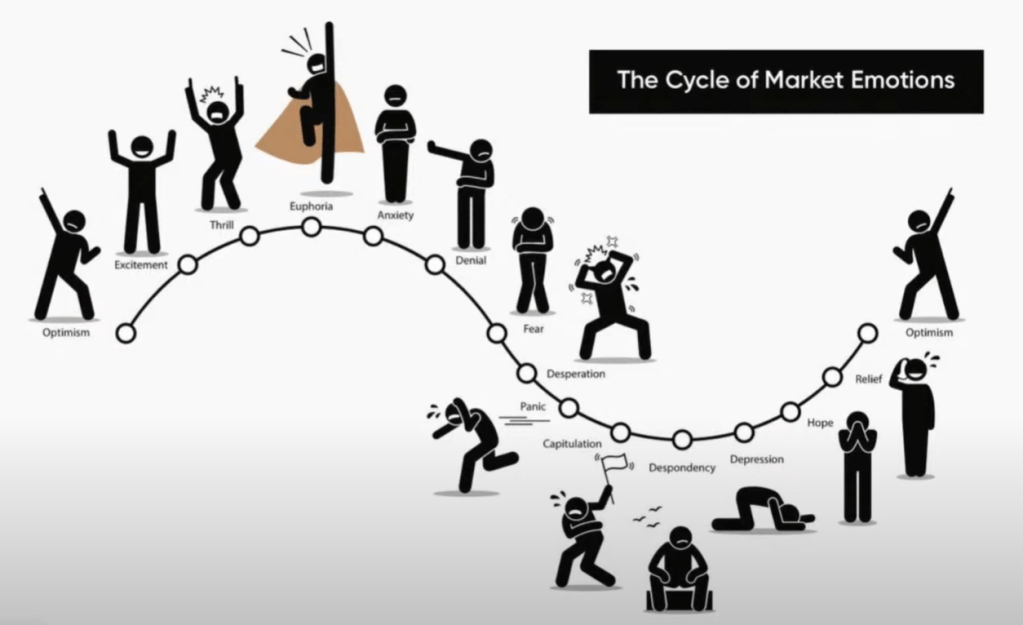

As a new investor, you may have concluded investing is a game of regulating and maintaining your emotions. You are right. For long-term investors, you have to remain optimistic about the economy. It’s easy to be pessimistic, but from a long horizon, the market has punished investors/non-investors who are overly bearish on the economy.

Market corrections and even recessions are regularly occurring events. Even asset bubbles are normal. Nobel laureate economist Robert Shiller, who is also predicting a recession, said:

One problem with the word bubble is that it creates a mental picture of an expanding soap bubble, which is destined to pop suddenly and irrevocably. But speculative bubbles are not so easily ended; indeed, they may deflate somewhat, as the story changes, and then reflate.

Speculative bubbles don’t just pop – they may deflate and reflate

Successful investing is mainly psychological:

The stock market is a game of psychology. In the long run, stocks generally going up doesn’t prevent many investors from panic selling. People, in general, are victims of the external environment around them. Since the sentiment is that the economy is going into recession, it makes sense to sell everything and avoid further losses, right?

- Financial advisors generally advise against investing in individual stocks, yet financial news channels dedicate large segments of their reporting to individual stocks.

- No matter how intelligent and well-informed people are, that doesn’t make them more patient, less greedy, or level-headed during times of panic.

- Nearly every investor, even good ones, suffers from recency bias. It is incredible how much different the sentiment changed just one year ago!

The Milgram experiment showed that almost two-thirds of people would kill someone with electricity if an authority figure told them to do so. The Stanford Prison Experiment showed rather disturbing results. In a less extreme example, many people know how unhealthy it is to drink alcohol. A recent study revealed zero health benefits for young adults who drink alcohol.

If you understand the general rules of investing, anyone can be successful. Investing is not like basketball; if you want to be as good as Stephen Curry, you need particular abilities and talent. Investing is much more a game of chance and probabilities. Those that succeed are not the most intelligent people. Successful investors are those that understand the rules of the game. They have patience and impulse control.

I have said this before, and I will likely repeat this but investing is difficult mainly for the reasons above. I have read behavioral financial studies showing that stocks going down can cause you physical pain. Long-term investing is challenging because human psychology works against us. Being knowledgeable about the risks of alcohol doesn’t change how it makes you feel when you drink an alcoholic beverage. Knowing the ins and outs of a company and its financials may not prepare you for what you will feel when the stock price falls 50%.

Luck and happenstance play a significant role in investing:

No matter how smart you are. No matter how much research you do, chance plays a big factor in investing. Whether you invest in single stocks or indexes, your portfolio performance is based on many external events beyond your control.

- Apple nearly went bankrupt in 1997. They were 90 days from bankruptcy until Microsoft made a $150 investment in Apple. Since 1997, the stock has appreciated over 90,000%

- Yahoo turned down $1 million to buy Google in 1998. In 2002 Yahoo turned down $5 billion to buy Google. Yahoo only wanted to pay $3 billion.

- Yahoo offered to buy Facebook for $1 billion, which Mark Zuckerberg declined.

We can play the “What If” game forever; however, even the best investors cannot deny that luck plays a major factor in their success.

Why I invest in individual stocks:

Many financial advisors advise against investing in individual stocks. They say investing in a few stocks is riskier than an index or mutual fund that tracks the stock market.

Being a former financial advisor myself, I can tell from experience that most financial advisors err on protecting your wealth rather than growing your wealth.

There is fundamentally nothing wrong with investing in index or mutual funds, however;

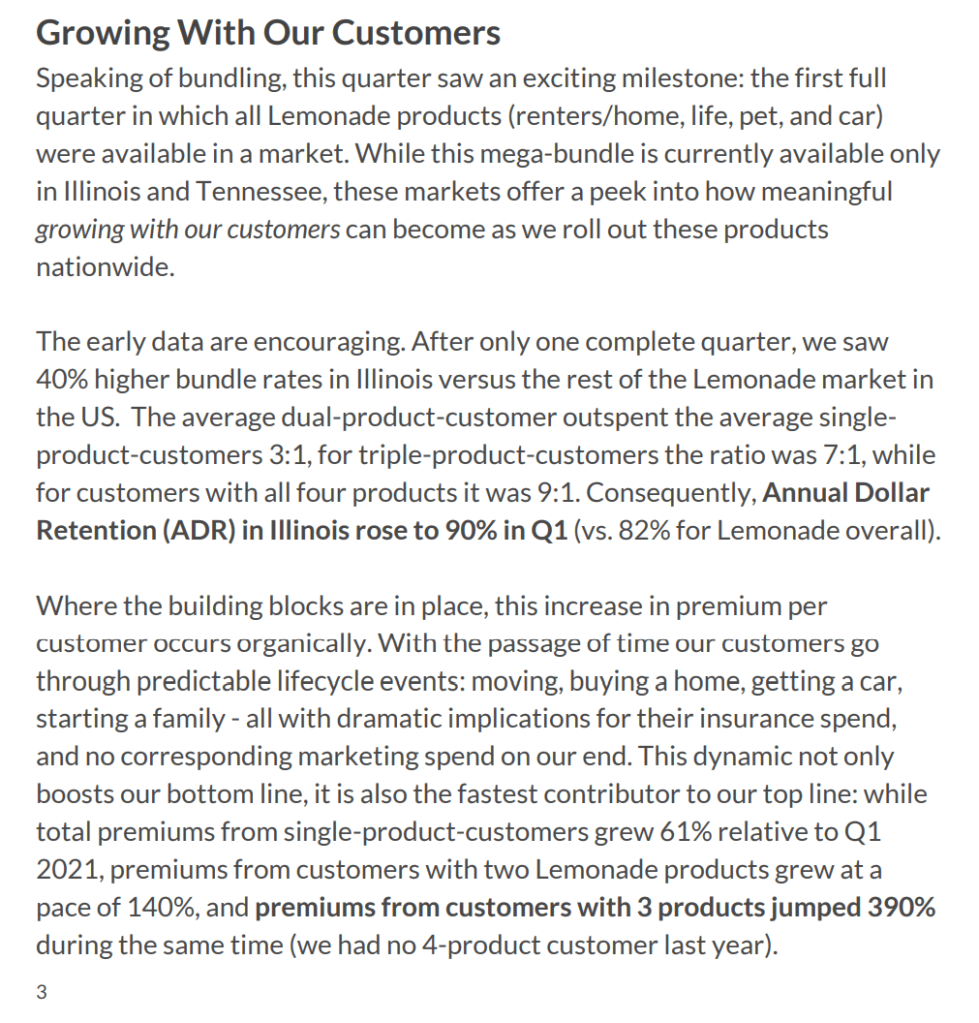

- You are guaranteed average/mediocre gains. There are no outsized gains.

- Passive index investing is essentially dumb money or investing on autopilot. There is no analysis of the fundamentals or valuations of companies.

- Safety in this type of investing is a myth. The S&P is down over 20%. The Nasdaq is down over 30% this year. There is no guarantee the indexes will rebound.

- Meta, Amazon. Apple, Netflix, and Alphabet make up about 19% of the S&P 500. Investing in an index that mirrors or follows the S&P is heavily weighted in just five companies.

My point is the majority of passive funds are overcrowded with money flowing toward the same stocks. It is dumb money. Although there is some safety in following the herd, and easier to mentally digest for the average investor, it locks you into mediocre returns.

Do not just look at numbers:

The art of investing comes from the idea that you have to value things that do not yet exist. The irony is that it is impossible to predict the future, but successful investors must make educated guesses. I try to ignore predicting stock prices but predict emerging social trends or technological advancements.

That’s why it is important to invest in “garbage” companies. To overperform the overall market, you have to take actual risks and speculate. The stock market is fluid; there are no guarantees that current stalwarts or trends will stay the same in the next decade.

When you look at the stocks most widely held by ETFs like Apple or Microsoft, they already returned outsized gains and are most likely overvalued. There is a prominent place for these types of stocks in your portfolio as you can look at them like a ballast; however, owning just these companies is not enough to be a solid investor.

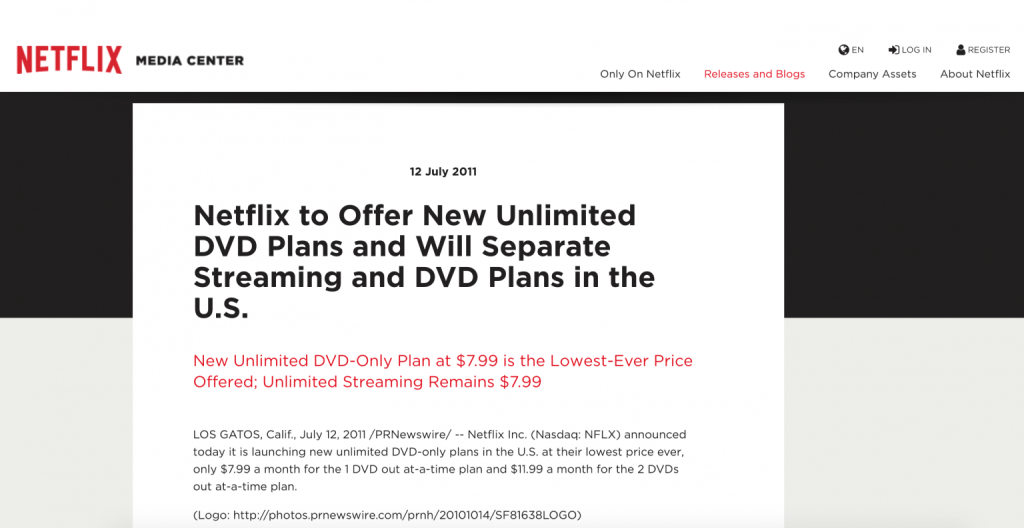

- Bellwether companies can decline and fall.

- Garbage companies can emerge and become the next Tesla or Apple.

- Since they are unprofitable, they can be oversold and undervalued.

- Outsized gains are created while holding unprofitable companies transforming into profitable companies.

- All it takes is a few winners to offset the losses of stocks that underperform a diversified index.

Soley looking at numbers or accounting metrics to value a stock is silly. It would be like a baseball scout evaluating players based on statistics and not watching games in person. Imagine dating people solely based on their net worth, credit score, or income. A considerable amount of subjective analysis is involved in life, including evaluating the value of companies.

Importance of being an optimist in the long-term:

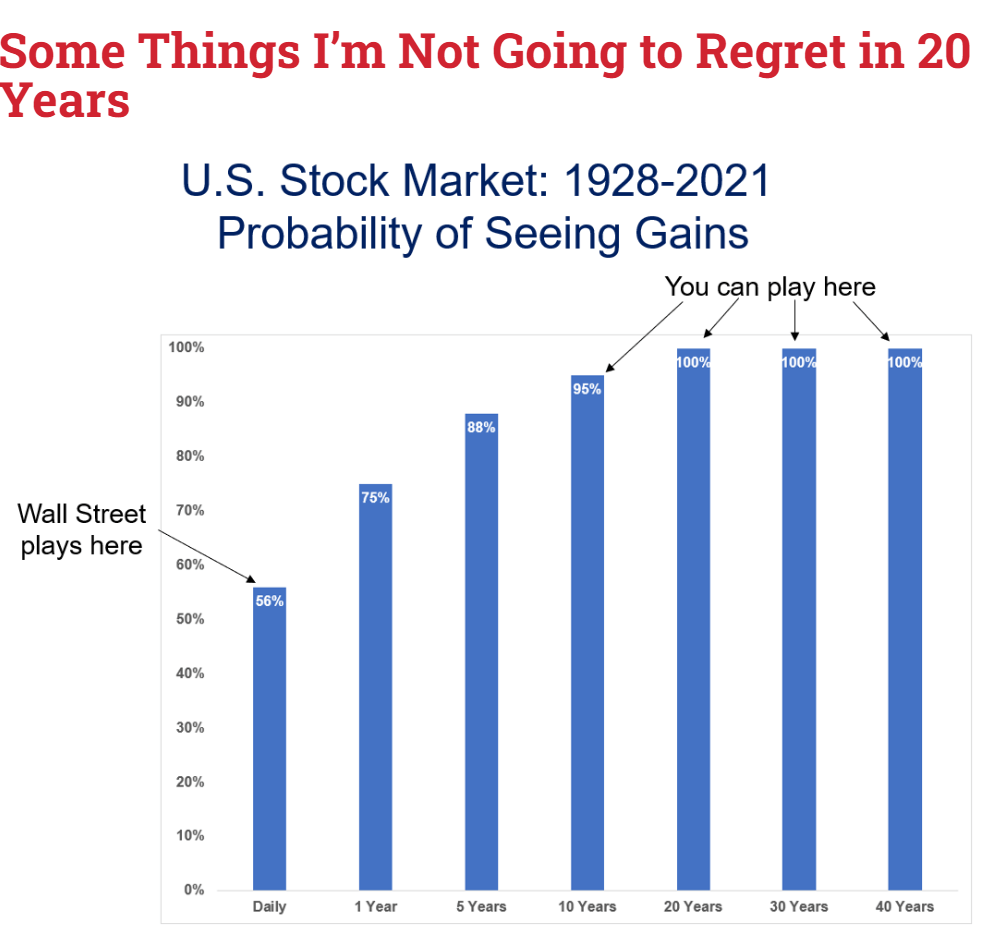

If you hear someone say the stock market will not produce any meaningful gains in the next decade or we will enter a global recession, remember the odds are not in their favor.

I cannot guarantee that the stock market will go up in the long term but based on history, it is a strong probability.

In our society, optimistic views have been considered naive or doe-eyed. Pessimistic views have been viewed as intelligent or enlightening.

Famous psychologist Rollo May wrote in his book Love and Will that “depression is the inability to construct a future.” If you are sad or panicked due to what is happening with the financial markets, it would probably make you more likely to have trouble seeing what the world will look like in 2026 or 2027. The key is sticking with a plan and not deviating from it.

Anytime in our history during times of despair or destruction, it has created opportunities for a rebound and urgent problem-solving.

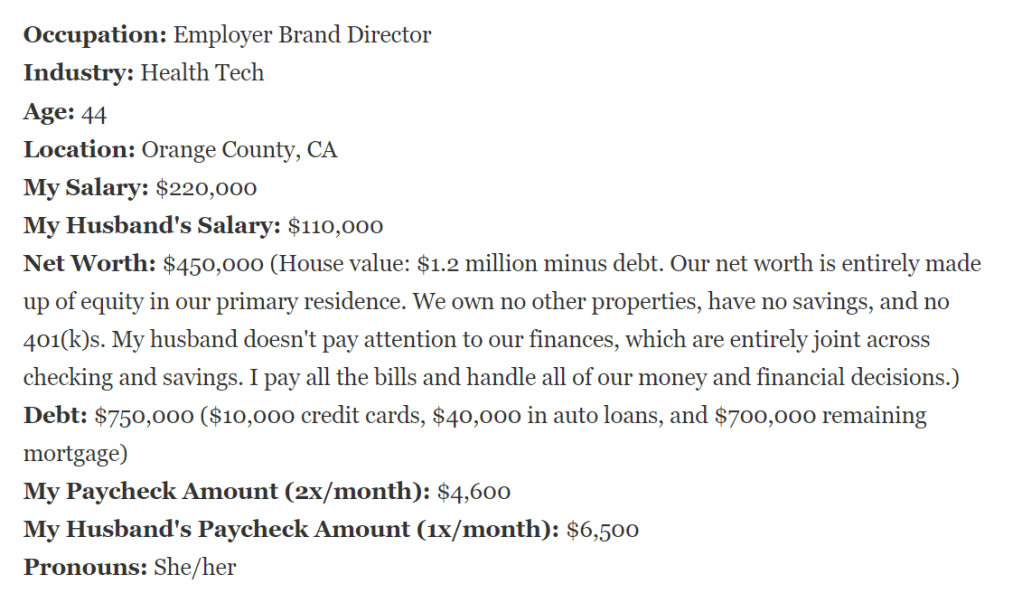

Many people are poor at saving money and spend on frivolous things:

From CNBC: Of those earning $250,000 or more, 30% live paycheck to paycheck.

From The New York Times: A recent study by Fidelity Investments found that 45 percent of people aged 18 to 35 “don’t see a point in saving until things return to normal.” In that same age group, 55 percent said they have put retirement planning on hold.

If you are living paycheck to paycheck on a 250k salary or spending $3,000 a week on single bagel app deliveries, you shouldn’t be thinking about investing.

Famous American feminist Gloria Steinem said, “the first problem for all of us, men and women, is not to learn, but to unlearn.” Consistently overspending is a recipe for disaster. Getting on a budget will require people to unlearn years or even a lifetime of bad habits.

I am investing. Many disagree with me; however, investing seems prudent vs. buying a car above its MSRP price or going on an overpriced vacation that will likely be more stressful due to global labor shortages.

Closing thoughts: Have a plan and stay optimistic.

Long-term investors,

Day Traders,

Professional Poker Players,

Sure it seems we speak different languages; however, whatever category you fit in, if you want to be successful, you need a plan and stick with it.

Most importantly, the best investing advice I can provide is to STAY OPTIMISTIC.

There is no evidence to suggest that our economy or humanity has peaked. It may seem naive to be optimistic, but it will pay off in the long run. Today is the best time to be alive in the history of humanity.

“Humanity can address a lot of the suffering that occurs in the world and make things a lot better. I think a lot of times people are quite sort of negative about the present and about the future, but really if you are a student of history, when else would you really want to be alive?” – Elon Musk

“The world is getting better, even if it doesn’t always feel that way.” – Bill Gates

“I’ll repeat what I’ve both said in the past and expect to say in future years: Babies born in America today are the luckiest crop in history.” – Warren Buffett