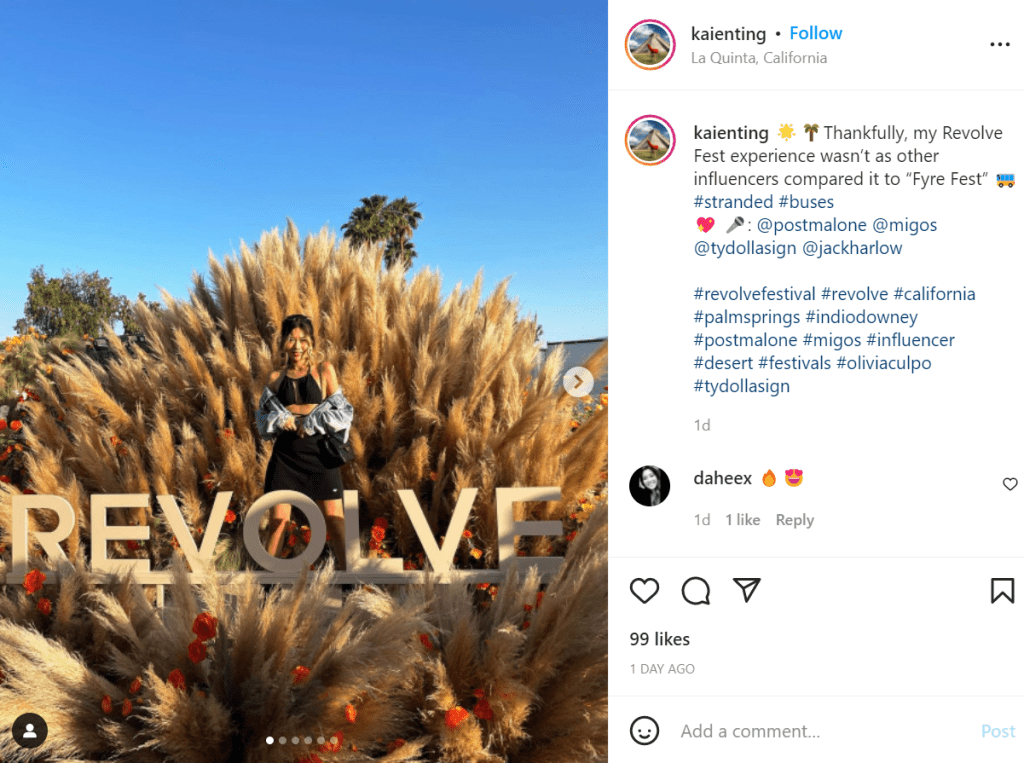

The media ran with the story of Revolve Festival being compared to Fyre Festival 2.0. In the short term, it does not help the company’s brand; however, the story has died down and has minimal impact on its intrinsic value.

I am an investor in Revolve. Group. I have never bought anything on their website and am nothing close to a social media influencer. I do not even have a Tiktok account. Revolve Festival’s negative attention ma worried me as an investor; however, the story is sensationalized as a non-story disguised as a major headline.

Frye Festival was a fraudulent festival. It was a con in the Bahamas where people spent between $1,000 and $12,000 on tickets for a fake event. The organizer of the event is now in prison.

The Revolve Festival is an actual invite-only event that was launched in 2015. People had to wait in long lines for shuttle buses and were stuck in the heat with no food or water. Those that attended the festival had a great time, but the negative criticism is mainly from those that waited and never got in.

I do not mean to point out the obvious, but any major event with high demand will see long wait times. The people that get preferential treatment are the super influencers and A-List Celebrities.

I am reminded of the song “That’s Life,” which Frank Sinatra made famous in 1966.

Revolve made a logistical error in inviting too many influencers for an exclusive invite-only event. They could have done better, but the headlines sound like a complete overreaction to what actually happened. Micro-influencers are complaining that they were treated like commoners.

Being a non-expert on this subject matter, I looked for experts’ opinions on the subject matter. From blogger Elise Purdon:

Revolve Fest has become one of the biggest and most important networking opportunities for influencers, especially smaller ones, every year, and many are dying to get in to advance their careers. Some of their reactions were likely driven by career anxiety of missing the festival and thus a huge opportunity, rather than being sweaty and bored. “The real problem is that Revolve has such a power over the industry that people are willing to fight and shove and stand all day in the desert to try and get on a bus to get into this thing where they aren’t even getting paid to create free advertising,” she said. (Many influencers receive store credit in exchange for posting about the invite-only event, according to reports).

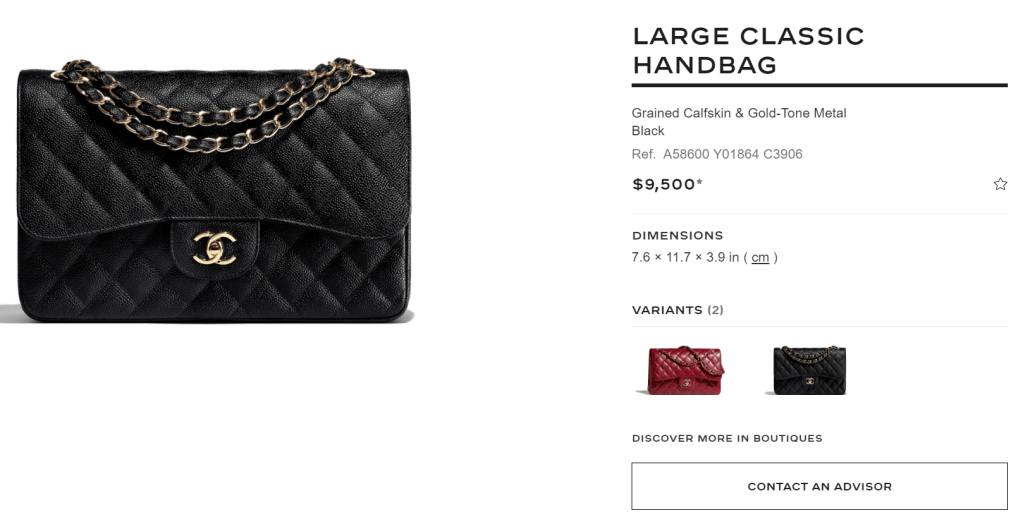

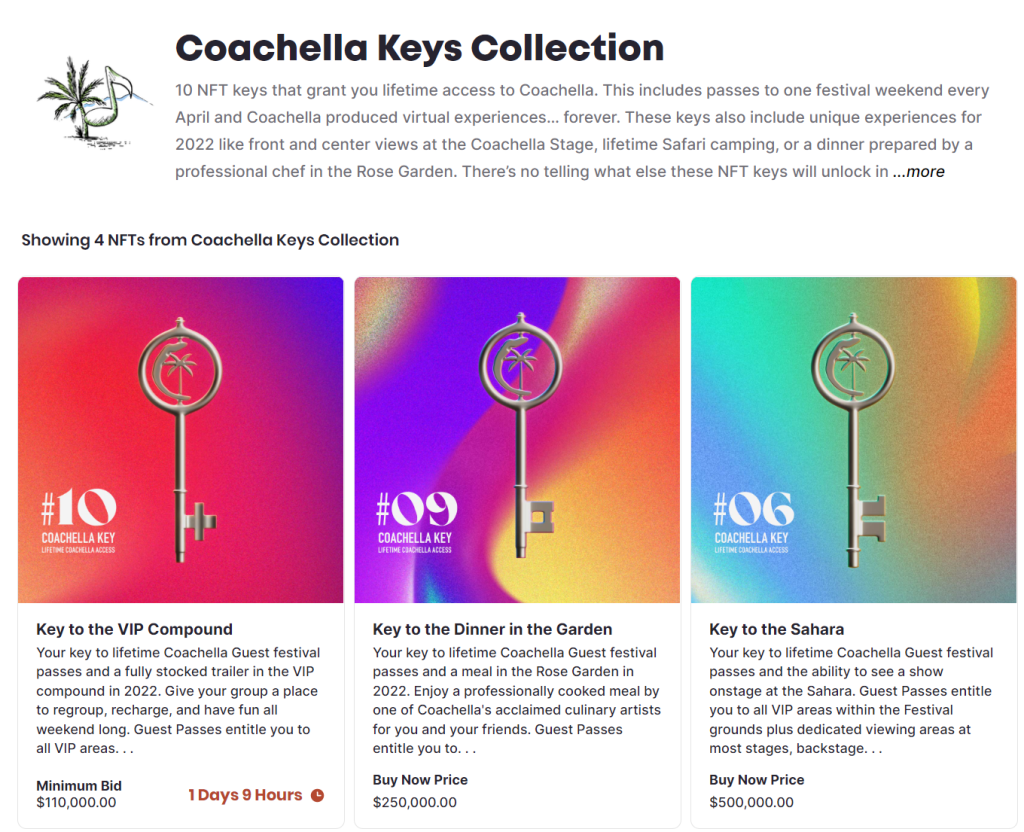

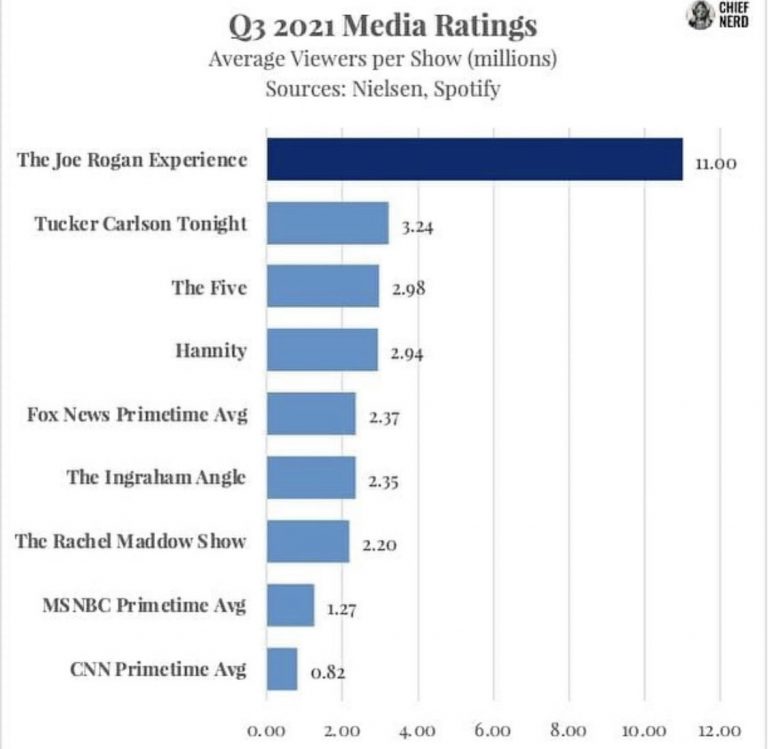

Revolve Festival is the creme de la creme event for influencer marketing, explaining the crazy demand they get. The festival has become more prominent than the actual festival, Coachella. They get more likes and impressions than H&M, Coachella’s official partner. Revolve has been running circles around global brands that bring in billions every year. The influencers complaining are likely the same people that would pay $10,000 or more to attend this festival if they could be treated like Kim Kardashian or Kendall Jenner.

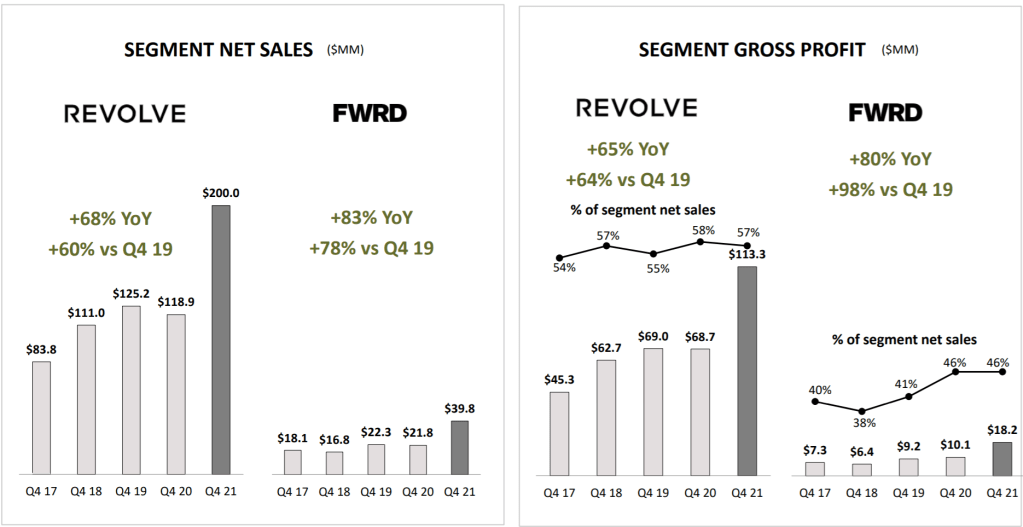

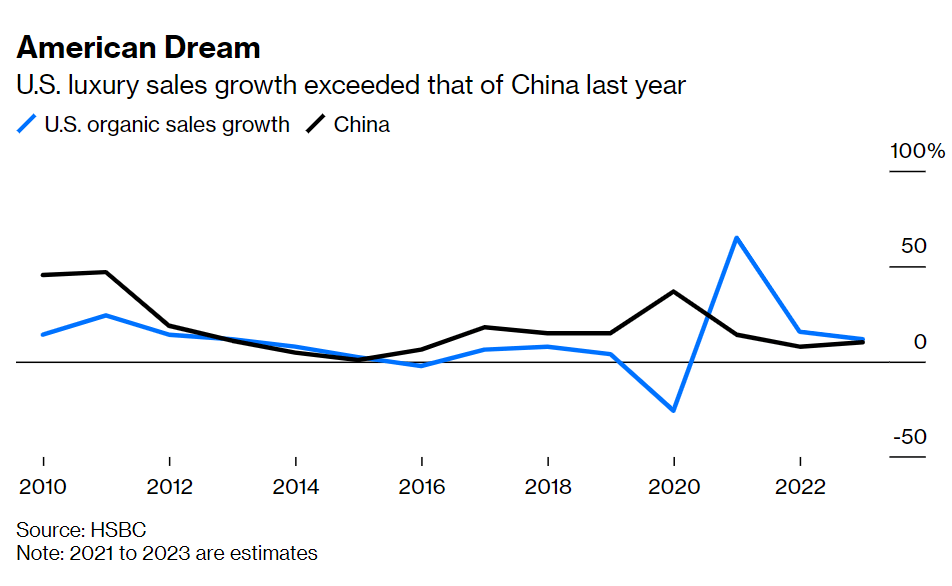

Revolve Festival is a signal of Revolve entering the slope of its growth S-Curve. Revolve is as much of a clothing company as Tesla is a car company. They have an army of social media influencers who will get bigger and stronger. The company is multiplying, and the overall sector is expanding as well. For an investor, that’s what you want to see.

I respect social media influencers because it takes tremendous talent and hard work to amass millions of followers. They are hungry entrepreneurs trying to build their careers. Influencers are the lifeblood of Revolve and are necessary for their future growth. I compare the importance of influencers similar to software engineers for companies like Google, Meta, Tencent, etc. Tech companies need talented software engineers to grow their companies. They get paid a lot because there is such a low supply of them on the job market. The best influencers actually make as much money as the best software engineers, which, you can argue, makes them more valuable.

The negative headlines will likely die down. Disgruntled engineers leave tech companies every day, so Revolve can’t please all their influencers. There is no call for a boycott or cancel Revolve Festival because this story is a non-story. This will do nothing to stop the demand for events like this. Revolve understands the value of influencers and provides them attractive compensation packages. They are one of the few companies that pay influencers like tech companies pay software engineers. Until companies like Macy’s and Nordstrom adopt this model, Revolve will continue to take their lunches as they have been doing for the past 5 years. The cost of paying influencers will be significantly higher in the future. Revolve is paying discounted rates for influencer marketing, leading to stellar revenue growth. By the time traditional retailers react and Revolve groups lose their moat, they could be a mega fashion conglomerate. The growth train has started, and it will be hard to stop.