While it’s difficult to say whether Big Tech is past peak growth, investors should start thinking beyond 5-10 ticker symbols, no matter how incredible they are.

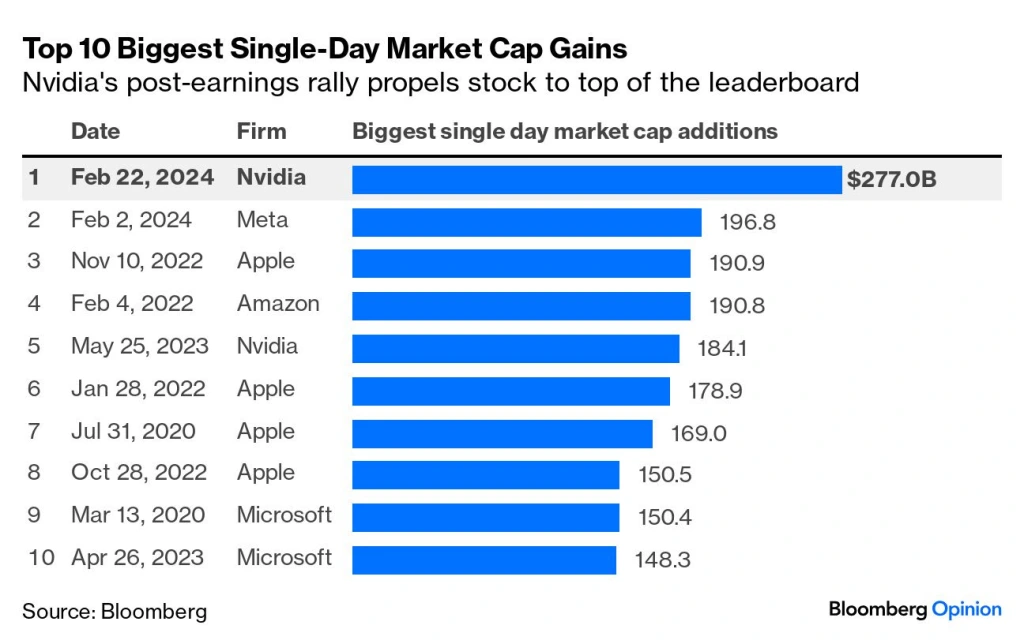

An obvious point needs to be made: If you have been investing for the past 10 years and have yet to own at least one of the big tech companies, you likely have been missing out. Any fund manager who has ignored these names has committed financial malpractice. The most significant single-day market cap gains in the past four years have come from Meta, Apple, Amazon, Nvidia, and Microsoft.

If you don’t own one of these names, you might ask yourself, “Why?”

These companies have a significant competitive advantage, allowing them to maintain their market share. They are well-positioned to benefit from several long-term trends, such as cloud computing and artificial intelligence.

It also helps that these companies can write blank checks to fight against regulatory scrutiny. They also can burn through a lot of cash on projects or initiatives that are unprofitable yet still maintain pristine balance sheets.

If you already own these names, there must be a compelling reason to sell them, and I don’t see any obvious red flags. These are companies you typically hold and don’t trade. However, strong evidence shows these names are no longer must-buys at any price.

- In 2022, Facebook’s user base stagnated for the first time.

- Apple’s revenue growth has been 5.5% from fiscal years ending in 2019 to 2023

- Digital advertising, which accounts for over 80% of Alphabet’s revenue, slowed down in 2022. While Google Cloud revenue is still growing, the growth rate has slowed compared to previous years. The same goes for Amazon Web Services (AWS).

Although these are not necessarily signs that these companies are in peril, they signal cracks in the foundation. These companies still have high expectations for future growth. Yet, there is clear evidence of saturation and slowing growth in their core markets.

Revenue growth has already slowed, and it will get more challenging for them to get bigger. Acquisitions are a costly way to grow, but with regulatory pressures, that is not likely a realistic option anymore.

Meta also authorized its first-ever dividend, joining Apple, Microsoft, and Nvidia. A dividend usually means transitioning from a volatile, high-growth company to a stable, slower-growing one. Anytime a company offers a dividend, it gives away value to become more widely held by large institutions like pensions and mutual funds. This is the trade-off a company makes when issuing a continuously growing dividend.

What’s happening is that these companies are maturing. They are more predictable and closer to the consensus, aligning closer within parity to the general market. The Magnificent 7 is no longer a group of companies that produces alpha; it is a risk management group. The days of these names creating outsized gains in your portfolio are likely over. These companies will succumb to the law of large numbers, even Nvidia.

Is this a bad thing? Not necessarily. However, the ability of these companies to grow in size in the next ten years will likely be slower than in the past ten years. Looking at these names for supercharged growth is the wrong mindset for an investor. It’s wrong on both a fundamental and a valuation viewpoint.

Probabilities, Probabilities, Probabilities

The secret is out. These are high-quality businesses, and much of the value has been priced. The more new money you add to these names, the higher you will have to pay and the lower your future return.

There is still a place for adding stable, high-quality businesses in your portfolio, but better strategies exist to build a portfolio that outperforms.

Valuation and Quality Matters

An investor aims to find undervalued assets and dislocations in the market. Undervalued in valuation and fundamentals. Investing is not always about zigging when everyone else is zagging. An investor should also buy and hold quality, even at a premium price. Not every move is a contrarian bet, but a well-rounded investor must be able to do both. Having flexibility in thinking but a structured discipline process. Investors that can do both of these things will likely rise above the median.

As an investor, you must think like a general manager of an NFL team. Not owning a company in the Magnificent Seven is the equivalent of trying to win a Super Bowl without a star quarterback or pass rusher. Teams need quality players, but cost and value matters.

Patrick Mahomes is the best quarterback in the NFL. You can call him the Nvidia of Quarterbacks. That doesn’t mean the Kanas City Chiefs should trade him for draft picks and sign a lesser quarterback to save money. It also doesn’t mean the Miami Dolphins or Chicago Bears should mortgage their future and take on Mahome’s salary by trading for him.

The one luxury of being an investor in your portfolio is that you are the GM and Owner. You can enact your vision and strategy without the fear of being fired. If you want to “win,” you must make good decisions and not think in such a pedestrian matter.

Expensive players come at a high price that can and will diminish when they can’t keep up with overhyped expectations. Continuously overpaying, even for quality players, is a losing strategy because teams will run out of cap space. You will get less bang for your buck and likely cannot field a well-rounded team. The Chiefs’ success largely depends on getting production from their core stars and signing and drafting overlooked players in free agency and in the draft.

Buying stocks based on the market’s direction is not an investing strategy but a gambling strategy. You are not investing in companies; you are betting, period. You are falling into the trap of the allure of the market: Chasing gains and buying based on superficialities. This is emotionally a draining investment strategy when the inevitable business cycle fluctuates.

- Nvidia was trading below 120 in October 2022. How many analysts had buy ratings on the company then?

- Meta was trading below 100 in November 2022. What was the mood and sentiment of the market back then?

Who was pounding the table to invest in these names?

Finding quality value

As a long-term investor, think about sleepers and good bargains. Will it work every time? Of course not, but this is a proven winning investing strategy.

Build core positions in high-quality companies and add to them when undervalued. It also requires pulling the trigger when the street sits on the sidelines. There is absolutely zero edge or creativity when you follow the consensus agreement.

Every investor should, at minimum, look at the company’s balance sheet they invest in. While a balance sheet is valuable for understanding a company’s financial health, it doesn’t capture everything.

Characteristics of a good company that goes beyond the numbers:

- Strong leadership: A clear and inspiring vision from ethical, transparent, and accountable leaders.

- Brand reputation: A robust and positive brand image that resonates with customers and stakeholders.

- Intellectual property: Valuable patents, trademarks, and other intellectual assets.

- Customer & Supplier Relationships: Strong and collaborative relationships with key customers and suppliers.

These characteristics are not found in a balance sheet or screener. It requires more unconventional research and abstract thinking. I still have certain investing principles. If a company has negative gross profits (Revenue minus cost of goods), It’s almost an automatic no-touch investment. When revenue cannot cover the basic expenses incurred to create a product or service, it’s like a diner paying $6 for raw materials to sell a $5 burger. Fundamentally, the business needs to be fixed and likely won’t scale. This may seem rudimentary, but money continues to be poured into Rivian, Lucid Motors, and many other unprofitable businesses.

My playbook? I will only add to specific names in the Magnificent Seven if they become significantly undervalued, which will eventually happen, but less often than before. These names are becoming in lock-step with the herd, which means less opportunity. I will not be shy about adding to these names when the herd and the street flood out of these names. This strategy is a lot easier said than done. Heavy buying is usually best when you don’t hear a company like Nvidia is a “must-buy” stock, even though it has been up almost 2,000% in the past five years. I am OK with holding these names and increasing my ownership through a dividend reinvestment plan but not adding to them at these levels with fresh money.

Good solid investing requires creativity and outside-of-the-box within a framework. Look at traditional metrics, but be willing to go against the grain.

Two examples of looking beyond the numbers:

WWE fans are dedicated and incredibly loyal. The amount fans spend on scripted sports entertainment is quite astonishing. The revenue growth since the company went public in 1999 has been consistent. You would think fans’ interest would drift towards another form of entertainment, but it hasn’t. Fans of the product in the 90s and 00s are still engaged and driving consumption today. Pro Wrestling still hooks newer and younger fans, even though the format hasn’t changed.

WWE fans are dedicated and incredibly loyal. The amount fans spend on scripted sports entertainment is quite astonishing. The revenue growth since the company went public in 1999 has been consistent. You would think fans’ interest would drift towards another form of entertainment, but it hasn’t. Fans of the product in the 90s and 00s are still engaged and driving consumption today. Pro Wrestling still hooks newer and younger fans, even though the format hasn’t changed. An entire book could be written about pro-wrestling fanaticism, but the popularity is likely to continue for a long time.

Taylor Swift: Her current “Eras Tour” has an average ticket price of $1,088.56. Compare that to Dua Lipa for her past Future Nostalgia Tour, the average ticket price was around $97, or Olivia Rodrigo’s Current Guts Tour, which falls between $117-$637.

Explaining why a fan would spend so much on a Taylor Swift ticket is based on a combination of the artist, music, physical presence, and live experience. Explaining Swift-fandom is a complex phenomenon beyond rational or conventional thinking. Life itself is not static, and you must look at investing similarly. Swift’s meteoric rise wasn’t an accident or purely based on luck. In a different life simulation model, Swift is likely to be successful, even under worse circumstances. That’s because her success is influenced by various personal factors, not just based on one or two songs. Good investing is a process, not just being lucky in 1 or 2 ticker symbols. Investors who can develop a framework for success will likely avoid the pitfalls that the majority fall into.